It's coming from inside the building

Free shipping, the horror; cable is still dying; no more raises; r u feeling liquid, punk? asymmetric downside of tightening; don't buy a car, yet; and It's Coming from Inside the Building

This is a Tuesday Random Walk, but I’m not gonna lie, it’s a bit like a Friday Random Walk, but I’m still going to pretend it’s a Tuesday one. Lucky for you, both kinds are amazing.

First, the shorties (sorta):

The Horror (of free shipping)

Cable is still dying and the networks too (also, Netflix is undefeated)

No more raises and other good news;

Are you feeling liquid, punk?

The asymmetric downside of tightening or why there is no white knight for distressed firms

Don’t buy a car, yet

Then, the longy (that’s actually pretty short):

It’s coming from inside the building, or the mystery of who’s lending Treasury all that money anyways

That’s it. The doom runs deep in this one, but I don’t make the data, I just find it. Have fun and be safe out there. Also, this:

Scatterplots

The horror (of free shipping)

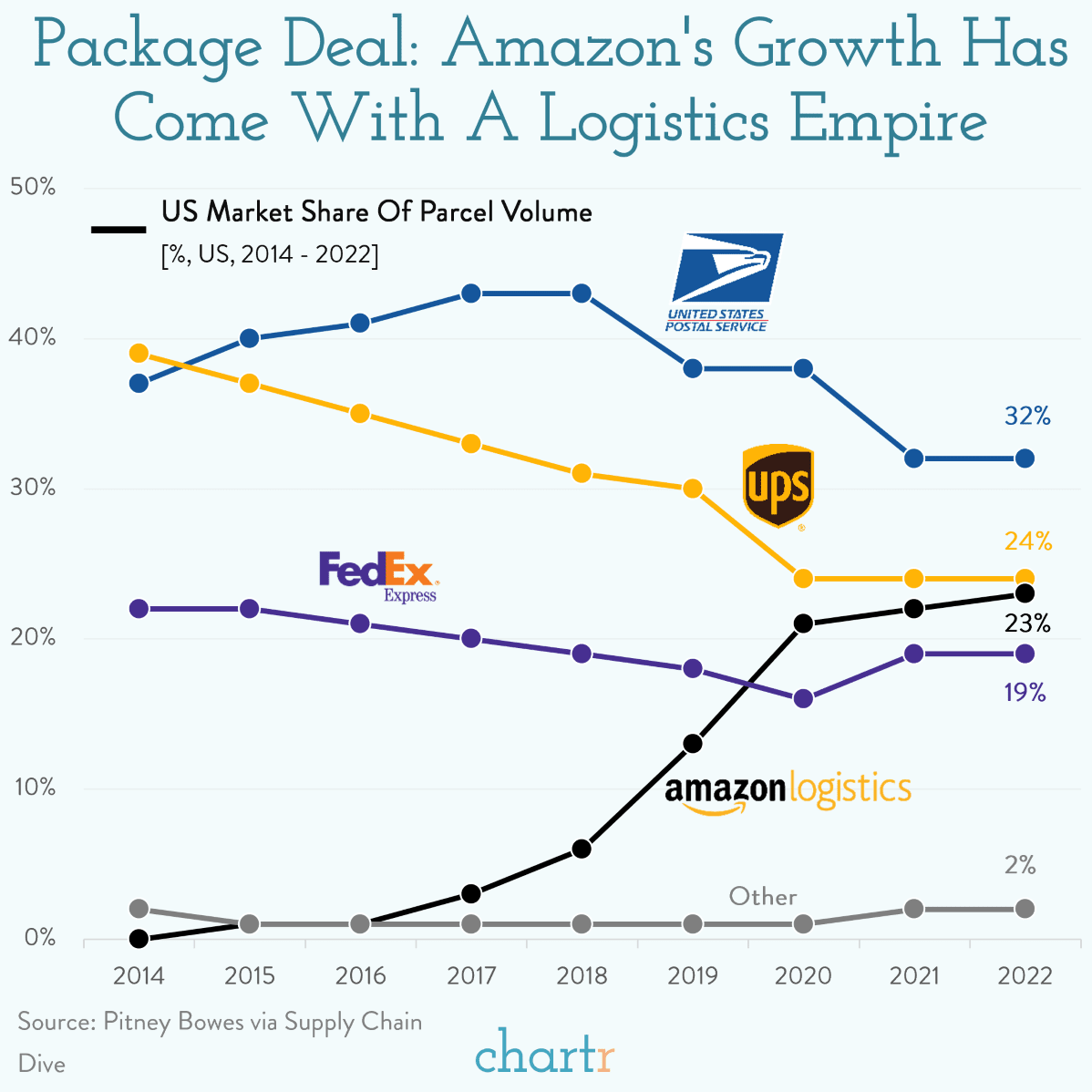

Linda Khan’s latest shakedown is to get mad at Amazon for getting customers hooked on free shipping. It’s funny, because while neither she nor the FTC does much to get me anything in any fashion, let alone a timely and free one, Amazon’s investment (and growth) as a shipper-of-stuff, is incredible to behold:

Khan’s band of “nice ecommerce company you got here . . . would be a shame if you had some ‘regulatory’ trouble” is especially mad that Amazon (supposedly) made it hard to unsubscribe.1 But, how does one unsubscribe from the FTC, I wonder? I feel like I’ve been forced to buy “consumer protection” that I don’t really want. Is there a number I can call?

Cable is dying (reprise)

Another unstoppable monopoly is mysteriously stopping. It’s not just cable, it’s the networks too:

Netflix NFLX 0.00%↑ doesn’t even appear on the bar in 2013. By 2022, however, it’s the only one of the four to show an increase in profits. Incredible.

Speaking of which, is Google really going to be the successor to cable? YouTube is coming for live sports:

Eh. There’s a big difference between replays and livestreams, so this doesn’t tell me much. Still, for all the things Google should have been better at but wasn’t (e.g. AI, payments, social), it continues to surprise with the things it is good at, but shouldn’t be (e.g. content). Predictions are hard.

No more raises

Brace yourself, RW is switching to macro.

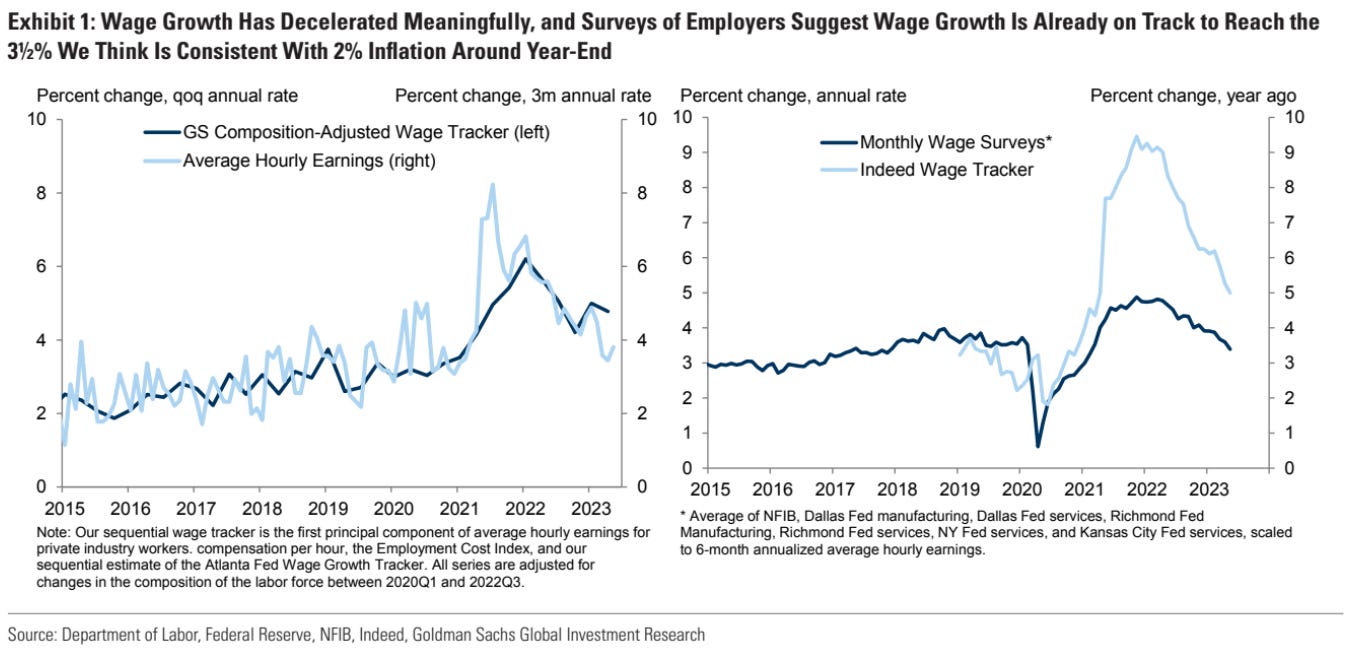

Goldman Sachs sees wage growth moderating to prepandemic levels:

That’s a good thing, insofar as ~2% inflation is now within reach, without substantial unemployment. Of course, it also means that we’re poorer than we were before because prices rose higher than wages, so consumption will have to taper, right? Our “excess savings” won’t last forever:2

In other news, sometimes it takes a while for certain price increases to filter back to the consumer. Take auto-repairs, the price of which has been buoyed by labor shortages, as well as the high cost of new cars (prompting drivers to hold onto the older cars for longer). Insurance companies bore the brunt of that run-up most directly, and while it takes a bit of time, eventually those costs filter back to the consumer, in the form of higher premiums:

Not out of this yet, no sir.

Just so no one thinks RW selects only for doom, the WSJ thinks that the price of imported stuff, at least, will continue to get lower and lower:

Yes, well, that is good, but goods were never really the problem (once the stimmies ran their course).

Are you feeling liquid, punk?

In contrast to the BofA small business data (from last week), the Dallas Fed survey indicates that loan volume has dropped precipitously:

The survey results somewhat suspiciously converge right around ~-27% (except for residential), which is a little odd considering there is more perceived difference when it comes to credit standards and terms:

Yes, ok, we get the message: no one has any interest in commercial real estate.

Meanwhile, the Fed’s War on Inflation regained its lead on the Fed’s War on Deflation, leading to a net contraction in liquidity (for now), at least:

Money is getting tighter again, but that’s all part of at least one of the plans.

For firms in distress, there is no white knight

On the subject of illiquidity and tightening, researchers at the New York Fed claim that the “share of distressed firms is higher now than during most previous tightening episodes since the 1970s”:3

Alright, so there’s at least some data that the rate squeeze is actually putting the *cough* squeeze on some businesses (even if it hasn’t really shown up in employment numbers or even bankruptcies (all that much).) It also bears mentioning, however, that having a high share of distressed firms, isn’t necessarily terrible, like most of the 90s for example.

Anyways, that’s not really the interesting part.