Latest from AI 'Bubble or Not?'

Hey, there's revenue...but it's very concentrated, and it's not enough...yeah, but those guys over there figured it out

Big hedge fund joins Team Bubble

Revenue concentration risk, and one big spender

AI can do better than Goethe—Palantir knows

More data centers coming to town

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. AI ‘Bubble or Not’

On the ‘AI Bubble or Not?’ front, there’s a new entrant on Team Bubble: Elliott Management.

The $70B AUM hedge fund/asset manager told its LPs:

Many of AI’s supposed uses are “never going to be cost-efficient, are never going to actually work right, will take up too much energy, or will prove to be untrustworthy,” it said.

. . . and therefore the hyperscalers won’t keep throwing all this money at Nvidia for long.

Look, in the near term, it’s almost certainly true that experimenting with AI is going to be a lossmaker. That’s how experimenting works . . . you play around until you begin to make some breakthroughs, often slowly, slowly, and then quickly-all-at-once.

How long Big Tech, its investors, and really Big Tech’s clients (who are spending lots of money to deliver actionable use cases), are willing to lose money on tinkering is basically unknowable, but that’s why keeping eyes on actual revenue-generating use-cases is so important.

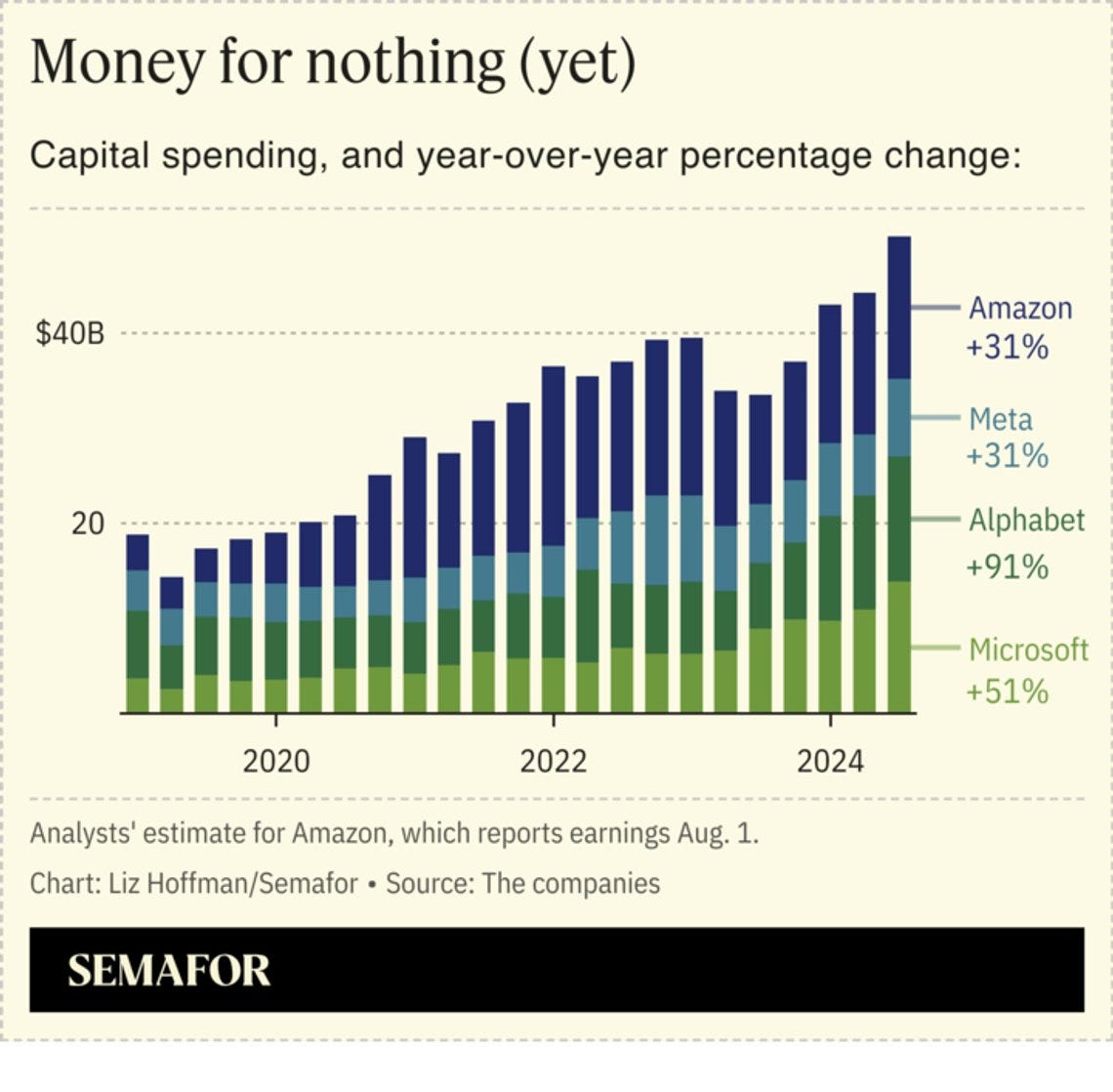

As a reminder, Big Tech is spending a lot of money:

Massive capex will need to generate returns, eventually.1

And but for AI capex, there really isn’t that much else. AI is the capital cycle now.

But, it’s also true that Zuck and Sundar are both on-record saying the risk of not-spending is higher than the risk of over-spending, so they know what they’re doing.

Also, they’ve been down similar paths before.

Revenue concentration or TikTok does what now?

The other thing to worry about is that AI-related revenues are pretty concentrated right now amongst a few big spenders. That being the case, even if one or two decides to throw up their hands, it could have some pretty sizable effects.

For example, consider this concentration risk for Microsoft/OpenAI.

Almost 25% of AI revenue was (apparently) coming from a single customer: TikTok

TikTok, for instance, was paying nearly $20 million per month to buy OpenAI’s models through Microsoft as of March, according to someone who saw internal financial documents about it. That was close to 25% of the total revenue Microsoft was generating from the business, when it was on pace to generate $1 billion annually, or $83 million per month, this person said.

It’s no great insight, but if TikTok is 25% of your revenue, then you need to be looking for other sources of revenue.

The notion that TikTok won’t use and/or develop some native LLM at some point seems almost impossible to believe. That’s probably why they’re spending all that money in the first place (and one can only imagine the internal discussions at Microsoft around managing that risk).

The Information also put together a nice graphic of ChatGPT power-users, which again highlights how much of revenue is “tinkering” related: