Making your own tailwinds

KKR on crowding out private borrowing; the importance of profits; household and corporate leverage are low, but . . .; public market liquidity as a share of gdp

Publishing note: Random Walk is going to experiment with a different publishing cadence over the next few weeks (more details forthcoming). I will endeavor to trade some frequency for depth, at least some of the time.

gov’t borrowing crowding out private borrowers

making your own tailwinds or why profits is the sole factor that matters

KKR on household and corporate leverage

where did all the liquidity go?

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. Making your own tailwinds

Random Walk has written previously about government borrowing “crowding out” private borrowing.

The basic gist of it is that as Uncle Sam’s borrowing needs grow (and the Fed otherwise tries to tamp down on expansion), then it leaves less cash leftover for the private sector.

It’s related to Uncle Sam’s Gain is Finance Bro’s Pain or Schrodinger’s Cat of Interest Rate Uncertainty. It’s hard to imagine a universe where capital flows are accommodating to both the Federal Government and Finance Bros at the same time (without runaway inflation).1 We can choose only one.

It’s also why rising rates caused less damage to the private sector than everyone (including Random Walk) was expecting: when rates went up, no one had any debt because of all the free money, and everyone learned to live without debt (bc Uncle Sam was the only one who could “afford” it). Higher rates didn’t hurt that much (except for asset prices) because there wasn’t actually that much leverage in the private sector.2

There must be profits, because leverage is already spoken-for

It’s also also related to the newish-theme of Earnings Uber Alles, and Doing More With Less. If there are no more secular tailwinds to ride, like population growth and/or free money, then you gotta make your own damn tailwinds, i.e. real productivity gains.

And that’s hard. And investors know it.

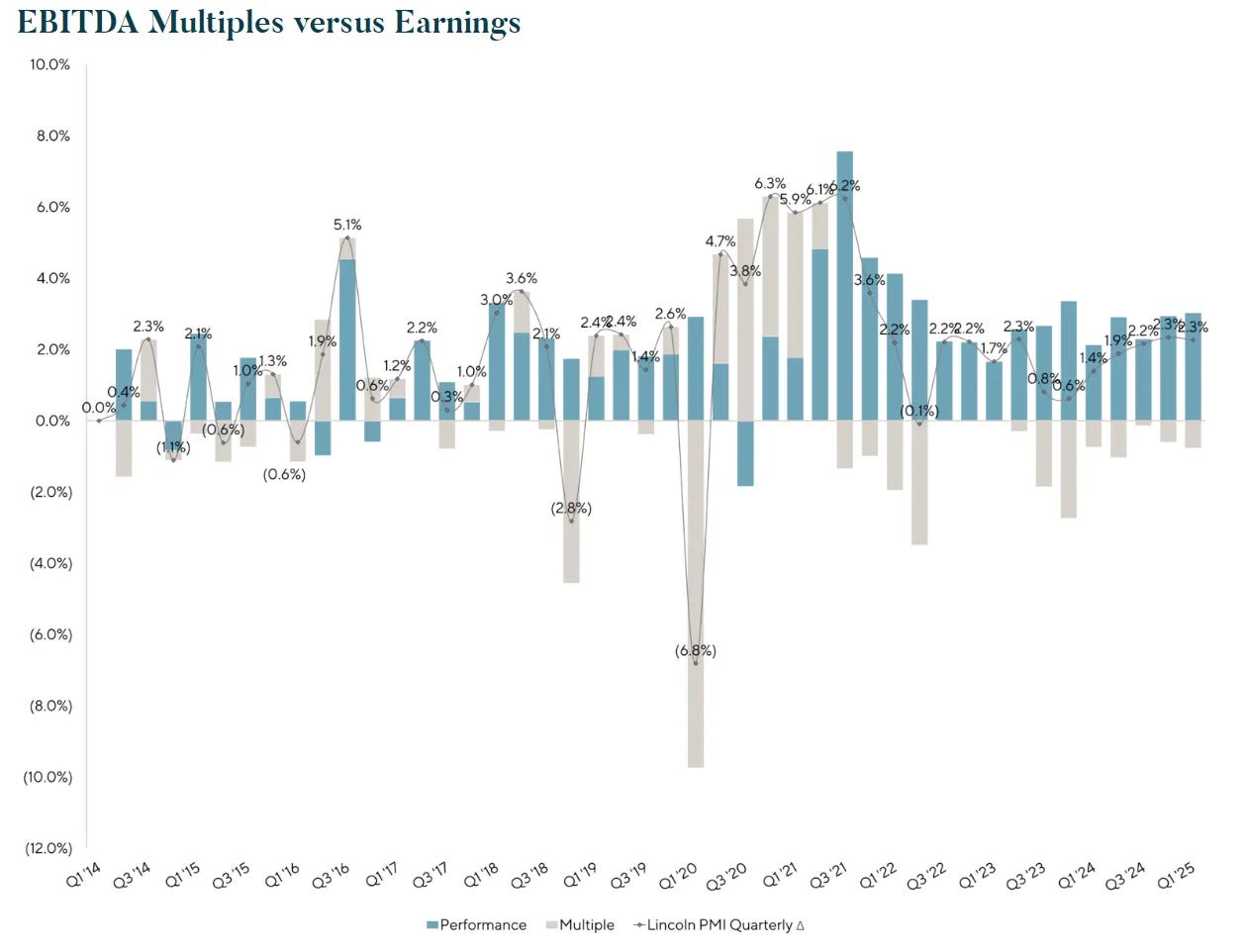

For example, this from Lincoln International, on the factor driving valuation increases in their private co index:

It’s earnings-growth doing all the appreciation work, while multiples have contracted.

Profits are the name of the game. There must be profits. No cheap leverage or multiple expansion to do your lifting for you.

But, that’s not really the main event.

The main event is that I found these two charts (in an otherwise lengthy, but thoughtful KKR report) illustrative and on-point, re. crowding out.