Misery is supposed to love company, so why can't we get along?

5 great datas on maps, renewables, smashing the debt ceiling, JPM says we're fine, and leggings + lipstick. Plus, OMG China how are we not besties?!

Welcome to all the new subscribers. Just remember that you are smart enough, you are curious enough, and doggone it, people like you. This is the Random Walk way.

Actually, no, this is the Random Walk way:

First, 5 datas to make the ladies swoon:

Maps on maps on maps;

Wind & Solar

Smashing the debt ceiling (part deux)

JPM says we’re FINE

Of leggings and lipstick

Then, the words without the pictures:

OMG China! We’ve got so much (misery) in common! We should be friends! (Or “Why Peter Turchin gets 0 points from me.”)

Please read and enjoy. Leave comments. Tell your friends. Obey.

Scatterplots

Maps on maps on maps

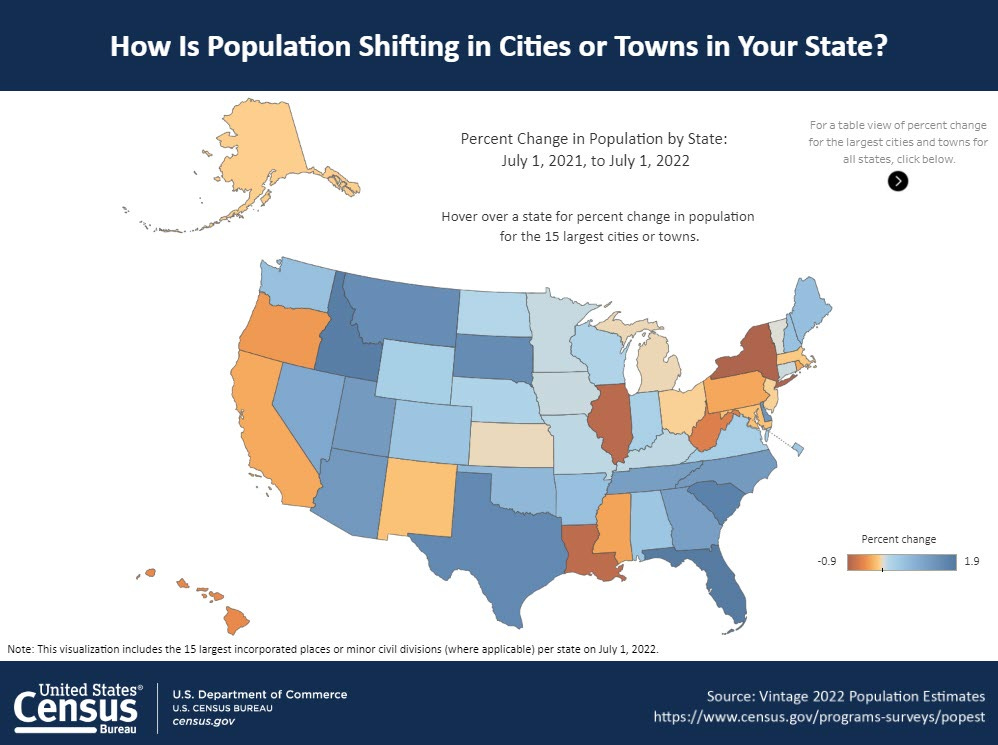

The census published its updated migration map, so Random Walk will publish all the maps, starting with that one:

Coming and going. Survey says people are still moving to and from the same places they did before, albeit with slightly less enthusiasm than in 2021:1

Coming and going, metro-areas edition:

Clearly much of the movement wasn’t out-state, so much as out-city-to-nearby-suburb—i.e. big reds, surrounded by little greens. The sunbelt, on the other hand, really stands out as a sea of green.2

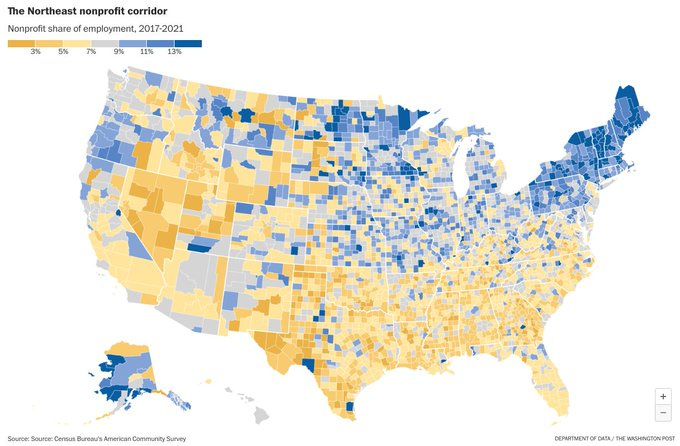

NFP Corridor. “Not-for-profits” apparently hate the warm weather:

Outside of northeast Minnesota (and seriously, what’s happening up there?), it sure seems like the longer you’ve been profiting, the more

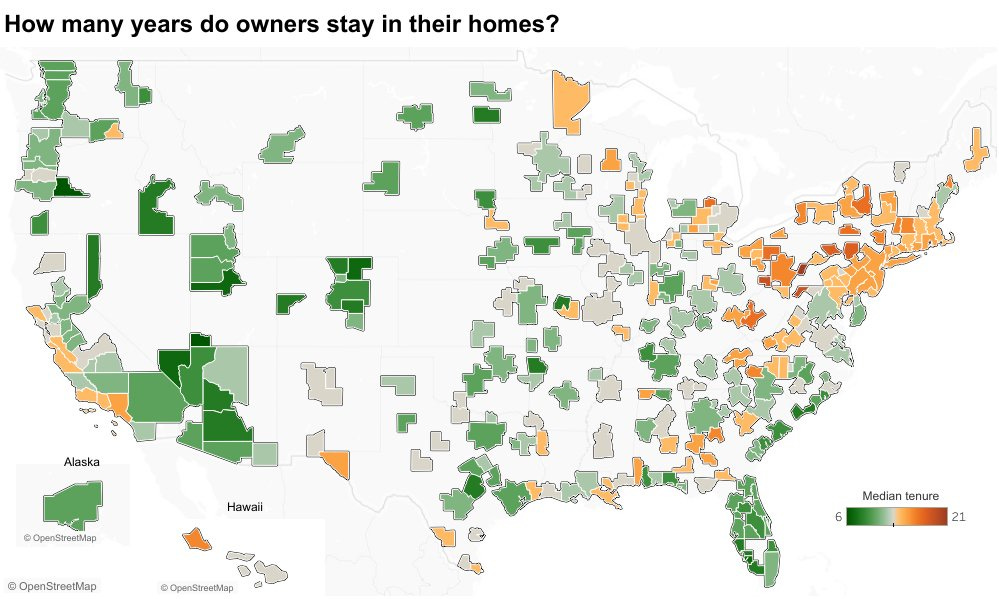

government-subsidized-featherbedding-and-networking-eventsnot-profiting you get. In all events, the geographic concentration of the NFP world is not in your imagination.3 Everyone really does work in Minnesota.Stay right there: The more NFPs you have, the longer you stay in your home because that’s how causation works—looking at you again NE Minnesota:

The places with the longest tenured homeowners are also the places with the most out-migration, which sure sounds like a housing shortage (my recent skepticism, notwithstanding).

Home prices. declining from peaks:

Declines off pandemic peaks is mostly a story of astronomically fast growth tapering a bit (e.g. Arizona, Florida), but parts of the left coast just look grim.

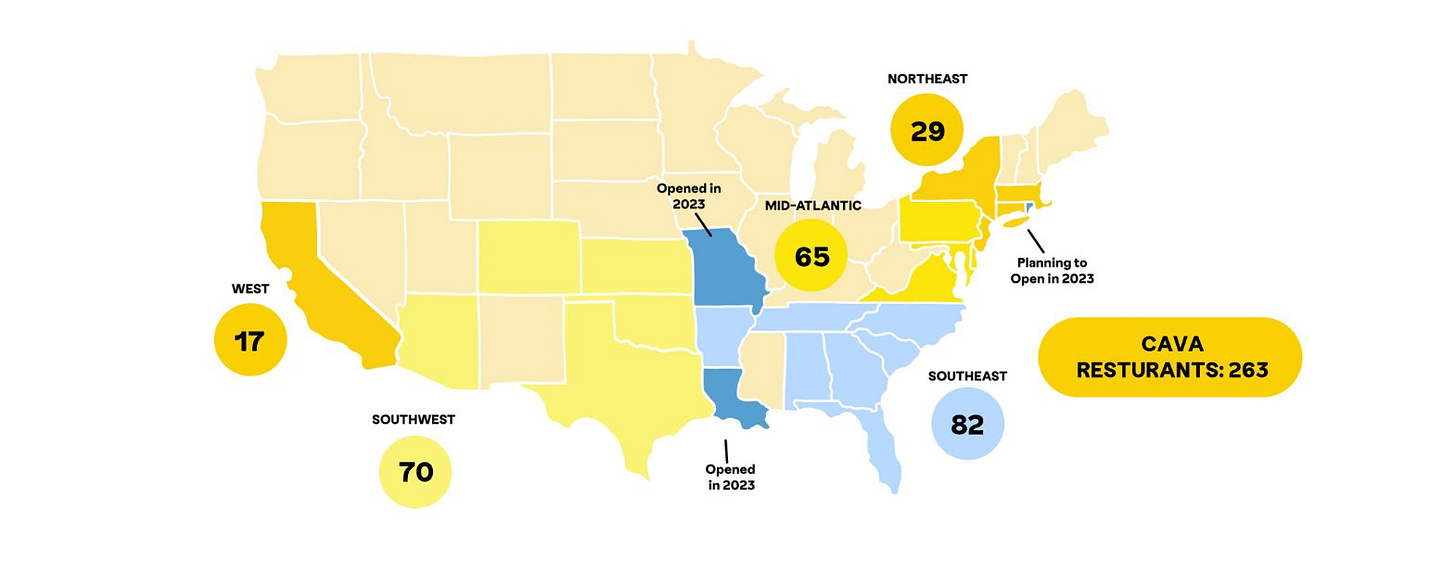

Cava locations. Go where the mouths are:

…and now, of course, the question is can Cava grow where the mouths aren’t?

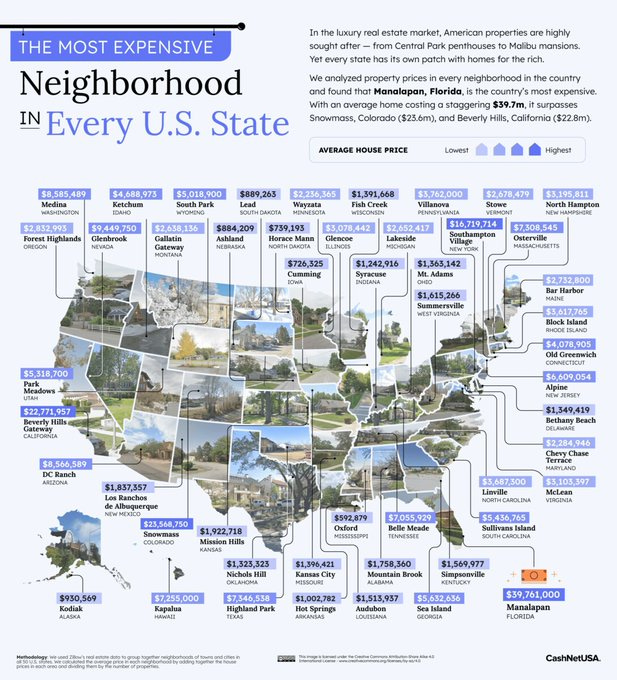

Most expensive neighborhood in every state:

Horace Mann died decades before Idaho was even a state, and yet he still gets the ritziest neighborhood in Boise named after him. Some people really do have it all.

RW thinks there are some broader inferences one can draw about these maps, taken as a whole (and indeed, I frequently try to draw them). This is Scatterplots, however, and attention spans are expected to be short.

Wind and Solar

The share of electricity generated by wind and solar are reaching record highs in parts of Europe:

Random Walk hasn’t checked, but I do wonder how much of this observation is driven by less energy consumption overall.

Going Broke Smashing the Debt Ceiling (part deux)

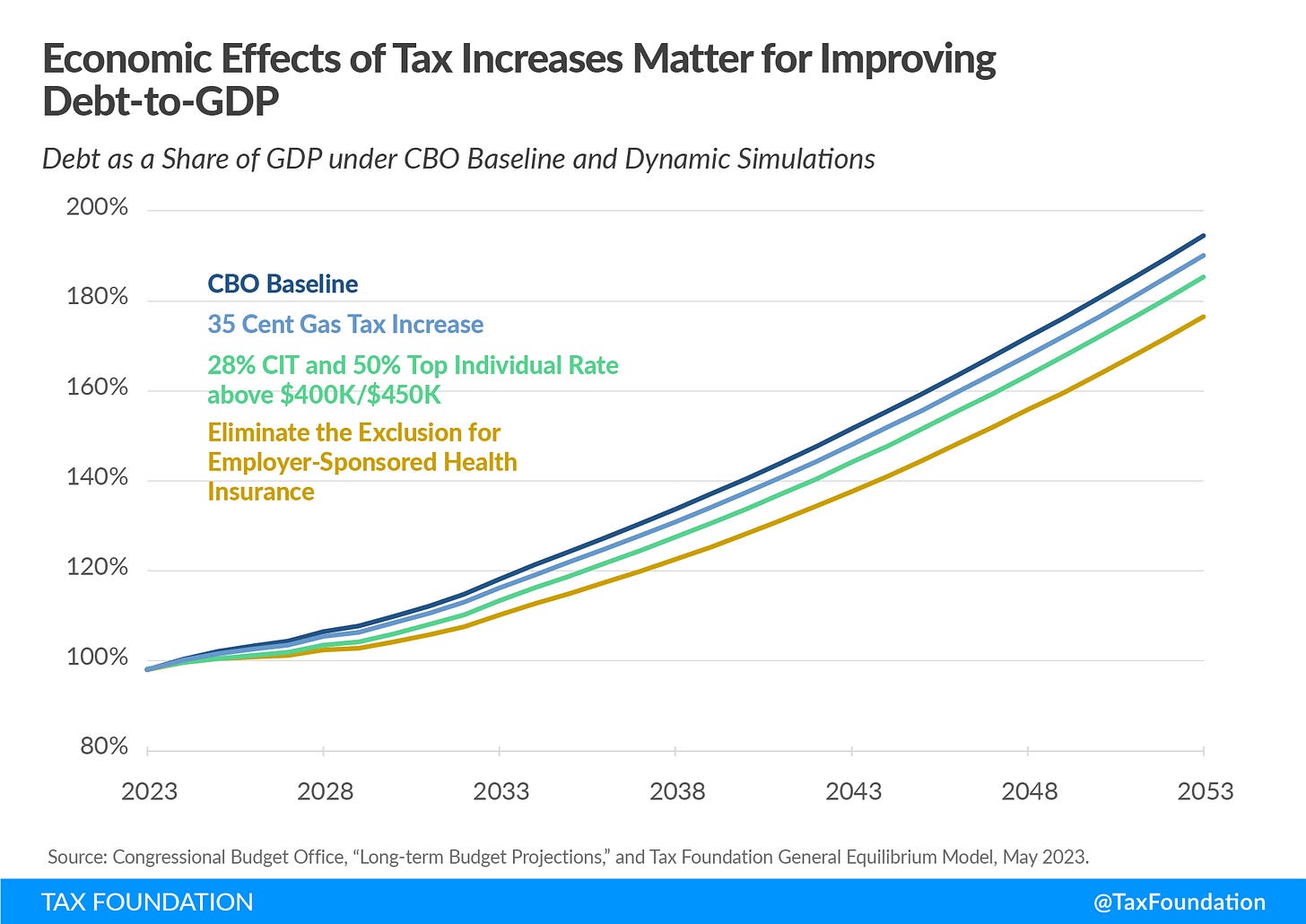

The more we spend beyond our revenues, the more we borrow, which means the more we spend (to pay for our borrowing). Unless making interest payments is somehow going to drive revenues (and how could it?), then this gap just gets wider and wider:

It’s a vicious cycle, where the worse it gets, the worse it gets (which is probably why they call it a vicious cycle). As a reminder, raising taxes isn’t going to help all that much:

Politics has a corrosive effect on data, so there’s reason to be skeptical, but RW is unaware of any math where the future looks very different. The deficit is growing and it’s rapidly becoming the thing that grows the deficit.

The simple phrase for this is: living beyond our means.

“Borrowing more to pay for our borrowing” doesn’t make sense, no matter who is doing it (and no, calling it the “risk free rate” doesn’t actually make it risk free). Would you lend to someone like that? Not willingly, that’s for sure. There are of course other ways to raise revenue, but that’s probably not a great outcome either. Something has to give, but it could take a while, of course, especially when we keep making it a future-someone’s problem.

JPM says everything is FINE

JP Morgan, which is happily buying all the banks, wants you to know that everything is just fine. Consumers have:

more cash than before;

more breathing room than before;

more income than before (but actually not really, unless you’re in the lowest income bands)4

All true, and reasons to be optimistic, that even if asset prices fall, people can still make ends meet (even if there will surely be knock-on effects from asset prices falling).

Also, notice (again) the pressure coming from the top down. A perma-labor shortage and premium to service and trade workers pushes low-end wages up (albeit a cost everyone bears), while a capital-shortage pushes returns down for the titans of capital.

The rich get less-rich and the poor get less-poor. Hooray?

Of leggings and lipstick

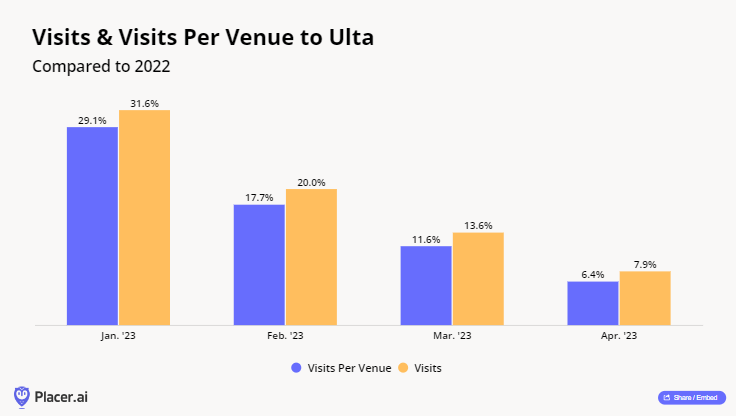

There is a somewhat apocryphal exception to the retreat of discretionary spending in a recession. It’s called the lipstick effect: when times are grim and everything else goes, we still make sure to look pretty.

Ulta ULTA 0.00%↑ Beauty, still crushing it:

As it turns out, so is Lululemon LULU 0.00%↑ which has kept its head remarkably above the fray:

I’m highlighting Lulu (a) because it’s in the same report; (b) because it confirms my priors about trading down more broadly (even if Lulu itself bucks the trend); and (c) because Lulu is just a wild company that’s impressed me before for the devotion it inspires.

I mean, who thinks “I’m going to get my tax refund and immediately buy leggings and running shorts?” Apparently, lots of of people:

I’d love to know if this observation endures YoY at all (or if those bars stack entirely differently year in and year out). I doubt that it does, but it would be fun if it did.

Great Wall of Text

Disappointing re-opening? OMG China, we’ve got so much in common!

I know that China is a very different place faraway across the sea, and a rival with whom we’ll inevitably engage in a world-ending conflagration.5 It’s a shame though, because we seem to have a lot in common, at least when it comes to structural economic and cultural malaise.

These are anecdotes, so discount them accordingly, but still: