National Nursing Home v. Finance Bros (republished)

Random Walk at Night: Evidence of coexistence is slim, but everyone seems to think otherwise

Republishing this one from earlier this week (with some minor tweaks), because I’m still thinking about it and, as per always, I invite everyone to tell me how wrong I am. This one too, is related.

It’s good and smart though, and I have not heard a satisfactory response:

Two growth models: Finance Bro and the National Nursing Home

Scoreboard says, it’s a zero sum fundraising game. Uncle Sam’s gain, is Finance Bro’s pain.

Why does everyone assume then, that if one is good, then two are better? How does mutually exclusive become positive-sum?

The Schrödinger’s Cat phase of interest-rate uncertainty

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. National Nursing Home v. Finance Bros

A theory: There are basically two ways for “the economy” to continue to generate growth, but they are mutually exclusive with each other.1

The first way is what I’ll call the “Finance Bro” method.2 This one exists when rates are low.

The Finance Bro method works like this: private investors raise huge funds, invest in various kinds of business ventures from tech companies to real estate, wait a few years for there to be even bigger funds, and then sell at a higher valuation to some other finance bro who will repeat the same steps, etc. LPs and entrepreneurs and investment bankers and consultants and lawyers make lots of money, which they then use to spend on stuff, like restaurants, travel and manicures.3

The second way is what I’ll call the National Nursing Home.4 This one exists when rates are high.

The National Nursing home method works like this: Uncle Sam borrows trillions of dollars from our grandchildren to pay millions of newly minted quasi-americans to provide healthcare to a steadily growing class of retirees.5 Voila. It’s Healthcare Domestic Product! In turn, the quasi-americans spend lots of money at Walmart and Amazon, and “yay” for the economy—look at how much credit card debt we’re borrowing!6

From 2010-2022, Finance Bro method reigned supreme.

From 2023-present, it’s been the National Nursing Home.

As best as we can tell, these two models do not coexist.

And yet, everyone seems to assume that they do and will do so just fine, with no tradeoffs.

Strange.

Regime change

What caused the regime change, of course, is that interest rates went up.

When rates went up, the Finance Bro party ended, and they’ve been suffering ever since.

Private investors are doing basically no deals, raising very little money, and generating very little wealth for their investors or portfolio companies.

The whole thing was premised on perpetually cheap money, and lack of a better alternative, but now neither is true: Uncle Sam is paying a prem-o price to fund the Nursing Home, so it hogs all the money. Finance Bros are SOL.

Fortunately, Finance Bros made a lot of money during their 15 year reign, so they’ve got a nice rainy day fund to ride things out. Make no mistake, however, that for their wealth-creation engine to rev up again, rates must come down.

Sure, Finance Bros say the “value of our unsold assets is at a record high,” but what they mean is the “value of our unsold assets is at a record high if interest rates come back down.” If the “record high valuations” weren’t dependent on lower rates, then the assets wouldn’t be piling up unsold.7

Look, low rates made asset-values skyrocket, but curiously higher-rates haven’t had the opposite effect (via Moody’s):

Mysterious.

No. It’s just extend-and-pretend.8

So, for now, the Finance Bros idle their stalled engines and wait, because what else can they do (besides record podcasts, and stuff)?9

National Nursing Home is ripping

The National Nursing Home model, however, is growing like gangbusters.

Uncle Sam is raising and spending more money than ever:

Uncle Sam is taking private fund managers to fundraising school. Now, that’s how it’s done, Finance Bros.

Not only is Uncle Sam doing all the fundraising, it’s creating hundreds of thousands of jobs for quasi-Americans, and turning healthcare into the job-creating industry.

It’s a very different kind of growth, but it’s technically growth.10

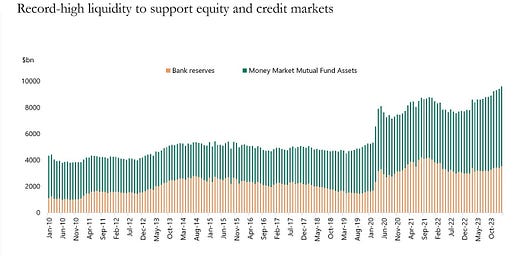

The reason that Uncle Sam has been able to pull this off, is because it started generating serious yield for investors (i.e. interest rates went up):

Keep reading with a 7-day free trial

Subscribe to Random Walk to keep reading this post and get 7 days of free access to the full post archives.