Of private cos and private credit

12 charts on the intersection between lending and the private markets

lending to startups (but not the venture-kind)

amortizing GPUs

Status Check on Aisle PE and Private Credit

bid-ask, still too wide

private cos performing pretty . . . well?

looking for signs of chicanery (reprise)

FABN-never, private credit’s ‘hottest’ new trick

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. 👋👋👋Random Walk has been piloting some other initiatives and now would like to hear from broader universe of you:

(1) 🛎️ Schedule a time to chat with me. I want to know what would be valuable to you.

(2) 💡 Find out more about Random Walk Idea Dinners. High-Signal Serendipity.Of private cos and private credit

Just some charts and observations around the performance of privately held companies, and the growing role of credit on the private side of things.

Lending to startups

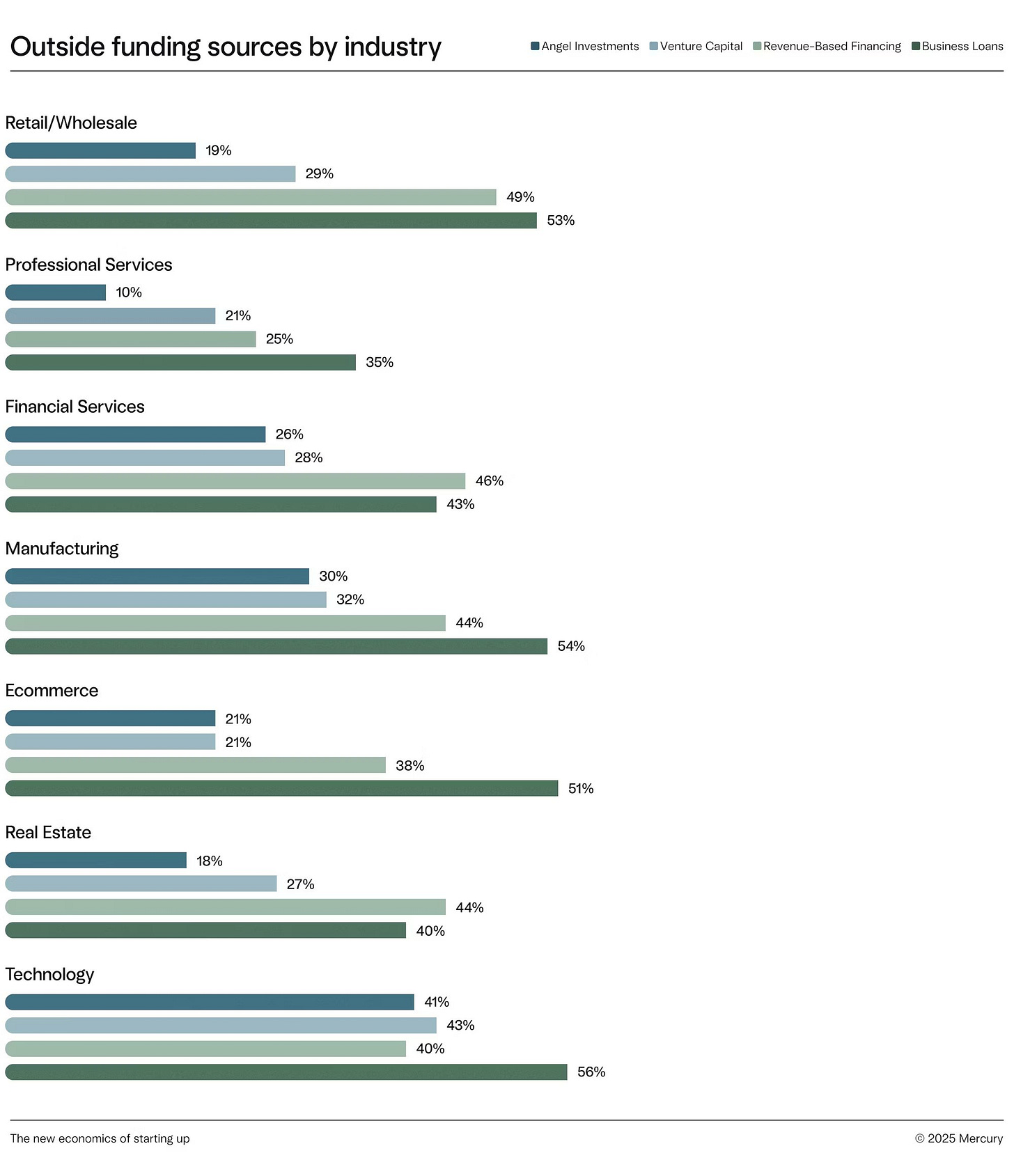

Mercury is a bank for “startups” (broadly defined). It recently produced some interesting data on what startups are doing for cash (and what they’re doing with that cash).

Among other goodies, this one jumped-out:

Startups are increasingly turning to business loans as a source of funding.

There is no longer series here, so “increasingly” is conjecture, but based on experience and anecdata, “using bank loans” is a more recent thing.1

One can only speculate as to what the implications might be (if any).

Are startups increasingly starved for cash? Yes.

Have startups adapted to the new funding normal by making themselves leaner, and more-profitable, and therefore more legible to traditional lenders? Also yes.

Are lenders tripping over themselves to find good loans to make, such that startups would become increasingly in-scope? Yes, that too.

Is there much evidence that lenders have compromised on credit quality to plow money into startups? Not really.

In other words, the only thing one can (barely) conclude is that business loans (and revenue financing) are increasingly part of the “startup” war-chest.

Whether that means doom is nigh, or this is just healthy maturation/diversification (or both), is kind of up to you, but I’m inclined towards the latter.

Amortizing GPUs

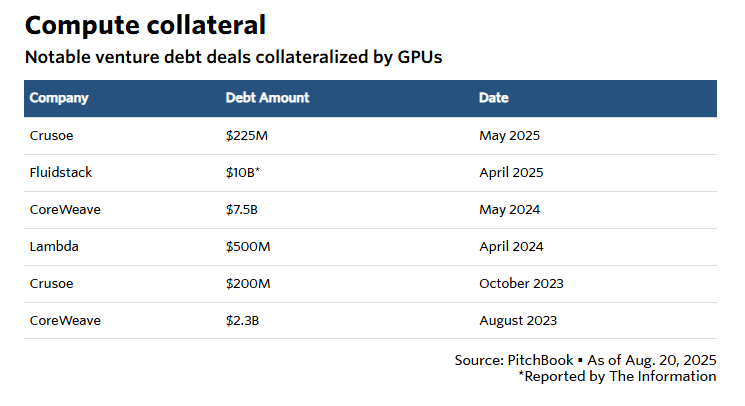

On the subject of lending to private cos, and lending against AI Capex, this too was interesting.

That lending will be an increasing part of the AI Capex picture is basically a foregone conclusion.

It’s been a comfort of sorts that the overwhelming majority of this historic spending spree has been funded with hyperscaler profits, but there’s more Capex to make than there are profits to spend.

Plus, lenders (both private credit and traditional lenders) have money to lend, and lenders really like to lend against assets . . . which historically have not included Data Centers chock full of cutting edge GPUs, but since those are the assets de jour, lenders are highly motivated to find a way.

And lenders have found a way, not only lending to the big techcos, but also lending to little techcos and big-ish techcos, to finance their pursuit of GPUs:

That’s something like ~$30B borrowed by VC-backed cos, using GPUs as collateral.

Interesting so far as it goes, but this is the part that caught my eye: