Pouring cold water on compute (maybe)

Searching for evidence that the Nvidia rocketship is slowing

data center momentum (or not)

unit economics of an llm

compute

shortageglutearnings led growth, means earnings led growth

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. Pouring cold water on compute

By now, we’ll all know what Nvidia NVDA 0.00%↑ has to say about its GPU sales. But Random Walk is speaking to you from the past, and is therefore unburdened by what has been.

As of now, there are reasons to think the rocketship may be slowing. There are also reasons to not think that, but these are reasons to think that.

Data center momentum

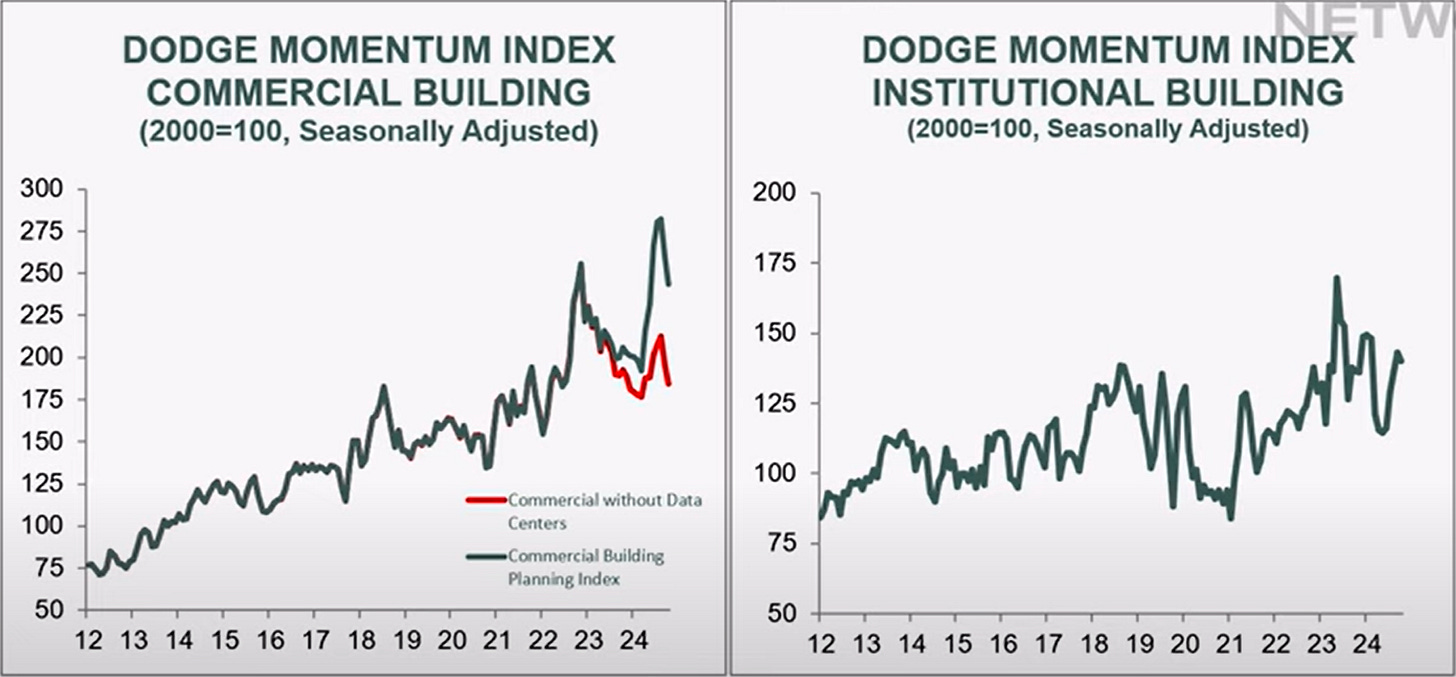

One thing that caught my eye is the Dodge Construction Momentum Index.

The DMI tracks the value of non-residential construction projects entering planning, and is generally regarded as a leading signal of commercial and industrial construction.

In this case, the DMI reported its second straight month of declines:

The DMI dropped ~5.3% mom, but is still ~13% higher yoy.

OK, so non-residential construction is slowing down a bit. That’s neither surprising, nor terribly worrisome. It’s very expensive to build right now, and regardless, whatever the MoM declines, the longer series is very much on-trend.

So why surface the DMI at all?

Well, it’s the commentary, that’s why:

“In addition to data center planning normalizing, a moderate pullback in the number of planning projects for several other nonresidential sectors also contributed to the decline in the Dodge Momentum Index for October,” stated Sarah Martin, associate director of forecasting at Dodge Construction Network . . .

Most commercial categories faced declines throughout October, aside from hotel planning – which continued to gain momentum. On the institutional side, education and public planning activity expanded, offset by weaker activity in healthcare, recreational, and religious projects.

Umm, what now?

Data center planning is “normalizing”? That’s not good. Everything else can normalize, but not data centers.

Recall that data centers are the drink stirred by the Nvidia straw. Demand for data centers is downstream of demand for GPUs, and if the former is normalizing, what does that say about the latter? What does “normalizing” even mean, in this context?

Normalizing to the time when there was nothing special about data centers? That’s really not good. It’s very unlikely it means that, but what does it mean?

To state the obvious, data centers (and Nvidia and AI generally) are the thing making investors excited about the future. AI is the capital cycle now, and huge investments are riding on expectations for continued growth.

I mean, look at what happens to the DMI without data centers:

Without data centers, the commercial DMI is basically flat with 2021. That’s no growth in 3 years.

Again, data centers are pretty much the only exciting thing we’ve got going right now, so “normalizing” data center planning is a pretty big deal, depending on the details.

I mean, if I told you that Nvidia’s share price was “normalizing” what would you make of that information?

Why precisely fewer data centers are being planned is an open question. Perhaps it’s a grid issue, as Random Walk proffered a while back, capacity constraints mean that We Couldn’t Build More Data Centers If We Wanted To. That wouldn’t be so bad, although it might slow demand for new GPUs, etc. a little.

If, on the other hand, demand for compute itself was beginning to taper, such that building new data centers is less economically attractive . . . well that would be worse.

Maybe it takes a quarter or so to show, but it’s worth watching.

Unit Economics of an LLM

Elsewhere, on the demand question, more cold water to dash.

Alex Kolicich jotted some thoughtful notes on OpenAI’s unit economics, and they are not terribly encouraging: