Real Estate Dispatch, single family edition

Daily Data: Some odds and ends about single family housing

In today’s dispatch:

homeowners are a-ok

home appreciation stalls out

buying in all cash

they’re basically giving houses away in one state

wall st. isn’t buying all the single family homes and whoever says that is a liar who should not be trusted

no more stork (endless reprise)

no more lock-in (endless reprise)

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. Real Estate Dispatch, single family edition

Homeowners are a-ok

Homeowners are very secure in their mortgages.

Delinquencies remain basically non-existent, and defaults as a reason for prepayment (purple) are barely visible:

Almost no defaults, but finally, a small uptick in ReFi activity (likely as a result of the small dip in rates at the beginning of the year).1

The banks are locked-in to these long term, low interest mortgages. Homeowners, though, are living large at their expense.

Home appreciation stalls

Home values, on the other hand, are going sideways or down.

Homeseller profit margins dropped to its lowest level in 2 years (although still at a healthy ~55%).2

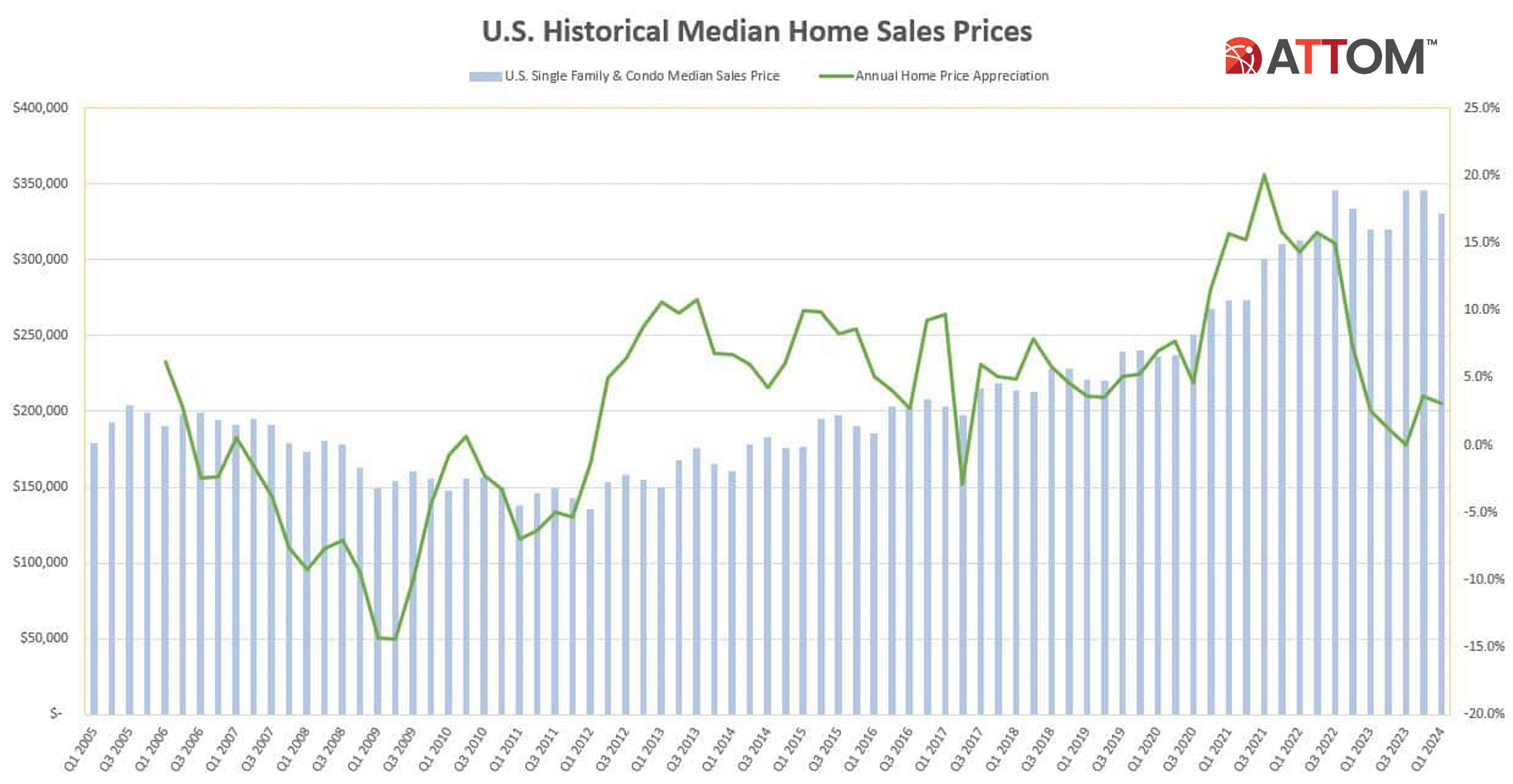

Margins dropped off one of the biggest quarterly declines in median sales prices in the last decade:

Annual appreciation is now trending below the prepandemic period (and post-GFC low rate recovery).

The slow rate of appreciation is consistent with Opendoor’s analysis, as well:

Source: Opendoor

It’s a little hard to see with all those shades of grey, but home price appreciation is trending towards a decade low.

In terms of where/why this is happening, it’s mostly the higher cost of borrowing (which leaves less money for homebuying). Home values would be even lower, if most homeowners had any inclination to sell in a down market (which, unsurprisingly, they do not).

It’s also a bit of supply/demand as some of the hottest southeastern markets are adding (or have added) new inventory, even as purchasing power declines.

It is not, however, those markets which saw the largest median decreases in prices:

QoQ declines were mostly in the midwest/Rust Belt, while supply-constrained mid-cities in the Northeast that everyone used to hate (Rochester, Hartford, and Providence), continue to appreciate (off of very low volumes).

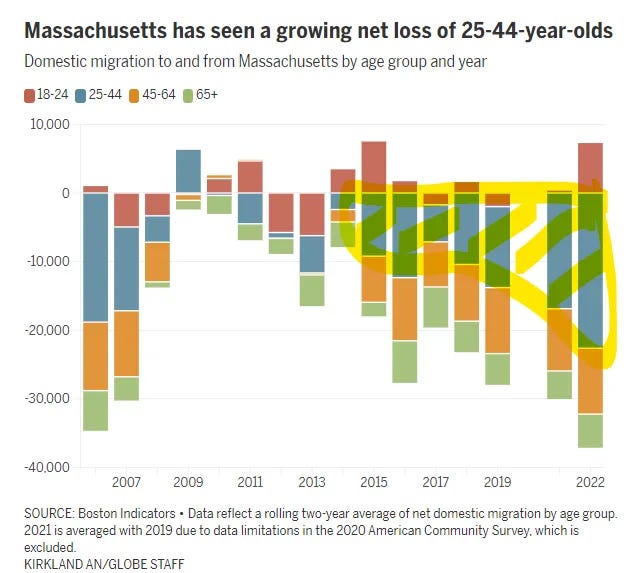

Maybe Hartford got all the prime age workers that have been fleeing Massachusetts over the last 10 years:

That is just brutal outmigration.

Anyways, the price moves are QoQ changes, so not that meaningful, but they’re broadly representative of longer-term trends.

All cash

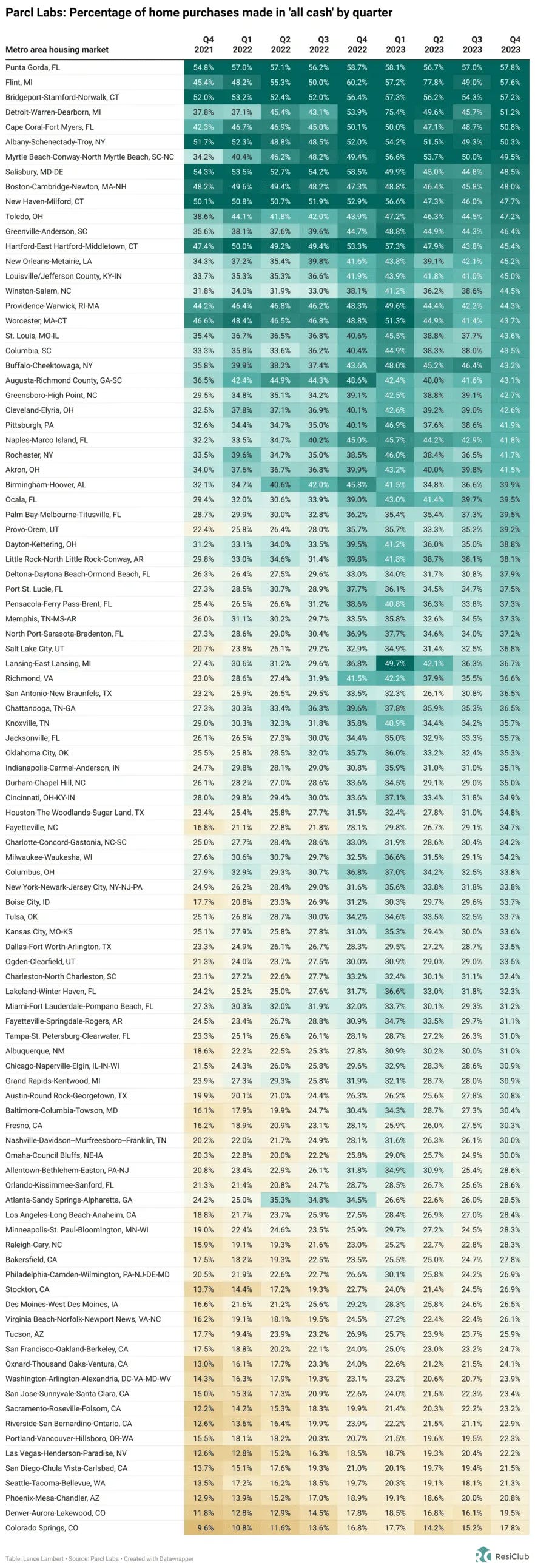

Somewhat hilariously, but on the subject of Flint, MI, Flint had one of the highest shares of ‘all cash’ transactions:

Flint, MI, Bridgeport, CT and . . . Punta Gorda, FL are famously cash-flush places, so there is probably not anything weird or criminal going on.