Searching for signs of a slowdown

Have the prospect of tariffs finally showed up in the real economy?

This post got caught in scheduled-send purgatory. Apologies.

Tariff Uncertainty means ‘Wait n’ See’ is the name of the game (supposedly)

are consumers actually pulling back? what does the data show?

are businesses actually pulling back? again, what does the data show?

Ramp’s spending data says firms are pinching in at least one category . . . but the data doesn’t actually say that (or not quite so clearly)

a small business profitability alert

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. Searching for signs of a slowdown

10 days of mostly disconnecting, and the remarkable thing is how little appears to have changed.

‘Will he won’t he of tariffs’ seems to have resolved in favor of ‘this is really about China.’ That’s still a pretty big deal, because Breaking Up with China is Hard to Do, but the whole ‘global trade war extravaganza’ seems to be hooey.

In the meantime, asset prices fluctuate as money flies from equities and UST to gold (mostly) on the ‘will he’ news, and then back again on the ‘wont he’ news. That’s because the trade deficit is good for dollar-denominated risk assets (bc the world has more dollars to invest). Plus, tariffs are taxes, and the higher they get, the bigger the headwind (certainly in the near term).

Still, asset prices are just that—they swing to and fro. It’s fundamental changes that really matter. The question then is what does end state with China look like? And, in the meantime, when does the ‘uncertainty’ of import prices spillover into the real economy (and to what extent)?1

As Random Walk readers know, for the first couple of months of the year, the information mix was rife with false claims of a Great Tariff Uncertainty Crisis. The reality was that there was basically no evidence that the prospect of tariffs were having any impact on consumers or businesses, at all.2

Liberation Day almost certainly changed that, however, at least with respect to businesses.

Wait n’ See Mode, engaged(?)

A potential 2x increase in import costs for manufactured goods has to effect business planning, especially for retailers of the cheap stuff, but also makers of the big stuff. It’s not just Cheap Tchotchkes on the Internet that come from China, but all kinds of building materials and intermediate products, as well.

The ‘good’ news is that once there is more certainty, the new-normal (whatever that may be) can begin to take hold. Random Walk is still skeptical that the end state will be all that costly—again, commerce finds a way—but that doesn’t mean it won’t be costly, at all (or that those costs won’t tip an already weak economy into something weaker).

For now, though, Random Walk is looking for evidence that ‘wait n’ see’ is more than just talk (because again, there is definitely talk):

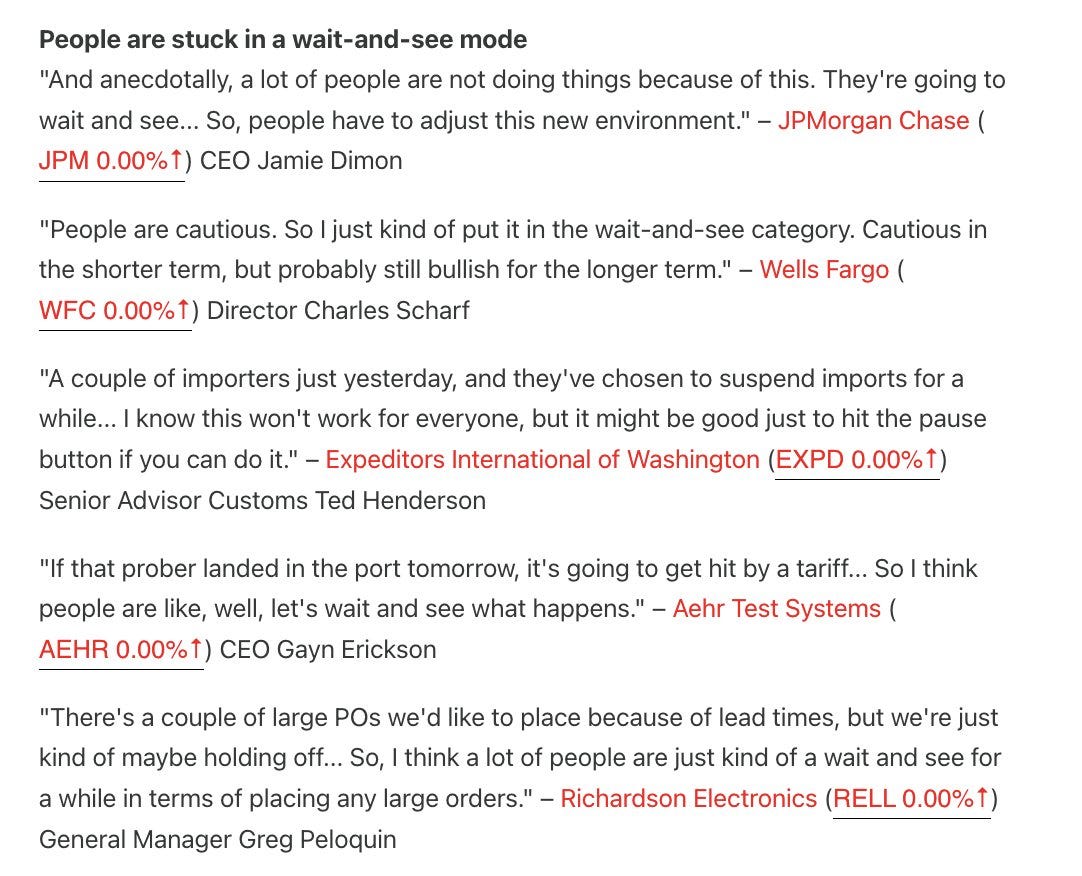

‘Wait n’ see’ is definitely a theme of executive commentary to the street.

From a dealmaking standpoint, it’s almost certainly the case that swinging asset prices have put deals on pause. Deal-making is important, so that’s not nothing.

But, in terms of caution actually showing up in the fundamental data? The answer appears to be ‘idk, still not much, but perhaps some?’

Here are some snips of what I’ve been able to find (and not-find) thus far. It’s not comprehensive, by any stretch, but just dishing it out, as I see it.

Consumers . . . still spending (and wages still growing)

The first thing to notice is that consumer spending and employment show very little change.