Seven charts about real estate that were made to be gloomy, but really aren't

Things are creaking along, and probably some more lumps to come, but it's not all that bad

Deep seek prelude (of Jevons and spend data)

Multifamily operators getting a bit nervous

All hail the mods

“underwater” loans are coming due (but it really doesn’t seem that bad)

rents are coming down, as non-shortage supply satiates non-infinite demand

construction workers needed (and other silver linings)

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. A Deep Seek prelude

You may have heard that a Chinese hedge fund released a powerful foundational model for a fraction of the cost (supposedly).

It seems all to soon to draw any big conclusions yet, but that hasn’t stopped investors from selling off AI-related hardware, en masse. That includes, e.g. Nvidia, but also some of the would-be industrial beneficiaries of increasingly energy-consumptive compute, like the data center liquid cooler, Vertiv VRT 0.00%↑.

Womp, womp.

The “theory” behind the sell-off is basically “if models can be trained cheaply, then who’s going to buy all that expensive compute—and where is all that extra energy consumption going to come from?” SELL, SELL, SELL!

It makes sense so far as it goes, but as I said, seems way too early to make any high conviction conclusions, one way or another (imo), but better to read someone who knows more about what they’re talking about.

One point is that is worth making, however, is the point that Microsoft’s Satya Nadella made on twitter:

A cynic might say he’s talking his book, but Jevons paradox is an apt reference.

It goes like this: the cheaper something gets, the more people use it (which “paradoxically” inures to the benefit of the something-maker).

The point being that, lower cost AI should increase demand for AI, and if AI demand increases more than costs decline, well, the picks n’ shovels will be just fine.

The reason that that is interesting (other than just being interesting), is that there is already some data that demonstrates that “costs go down, consumption goes up.”

Via the expense management company, Ramp:

Token purchases increased, as the average price per token declined.

Now, two lines representing ~2 months of spending data (that in any event, have a pretty funky relationship) does not a trend make.

But, I still like it. Now, on to the show.

Seven real estate charts that actually aren’t so bad

While the rest of the economy seems to have shrugged off higher interest rates, that’s not true of some of the more rate-sensitive sectors, like real estate.

Even so, while there’s definitely been some bending, and even a little breaking, for the most part, it’s been not-so-bad. Sure, new activity is somewhat depressed, and it’s hard to get financing (and investors have definitely lost some money), but for the bets already made, real estate operators and investors appear to be hanging in there.

Hanging in there is not sitting pretty, that’s true. And, according to the NMHC quarterly survey of apartment conditions, multifamily operators for their part, are getting a bit *anxious.*

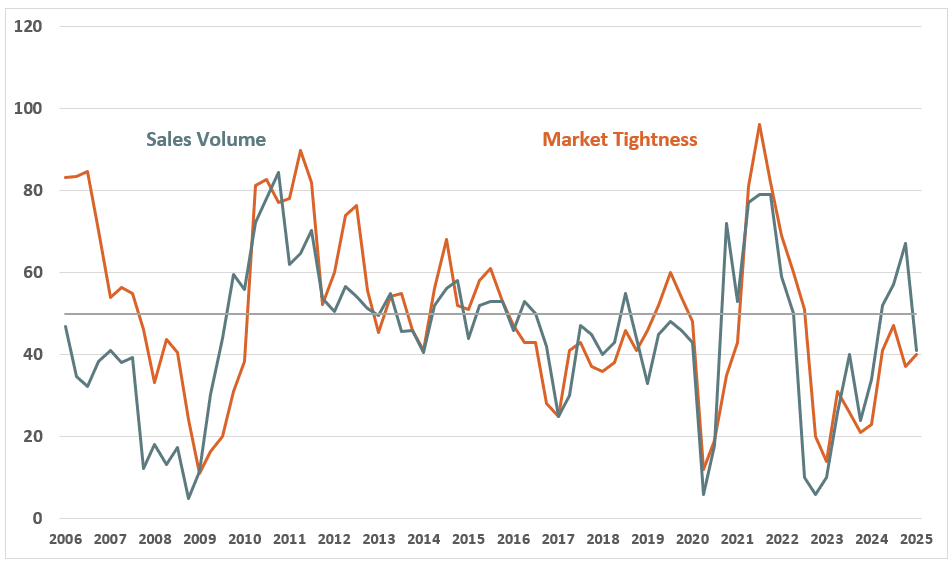

Every survey category dropped below 50, i.e. respondents indicated it was “getting worse:

market tightness (40)

sales volume (41)

equity financing (48)

debt financing (32)

So, the mood is a bit dour, and perhaps getting worse, but that’s not the end of the world. And that’s just multifamily, which isn’t as bad as office, but is still probably worse than some of the other asset classes, like industrial or retail.1

But, anxiousness aside, as best as I can tell, everyone is continuing to hang in there, even if they’re taking some lumps.

Consider the charts . . .

Extend & Pretend, onwards and upwards

Lenders and borrowers have had to get creative to deal with rising rates—deals that made sense when borrowing costs were 3-4% do not make sense when they’re 6-8%.

Rather than simply putting borrowers into default, lenders and borrowers are working it out.

A lot.