Silver linings in VC-land

Priming the liquidity pump

Boo for discounts (on secondaries)

try a little tenderness (offers)

a ServiceTitan aside (it’s never too early to go public)

multistage will eat the minnows . . . unless.

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. Silver linings in venture

Two silver-linings and some coal in your stocking.

Boo for discounts

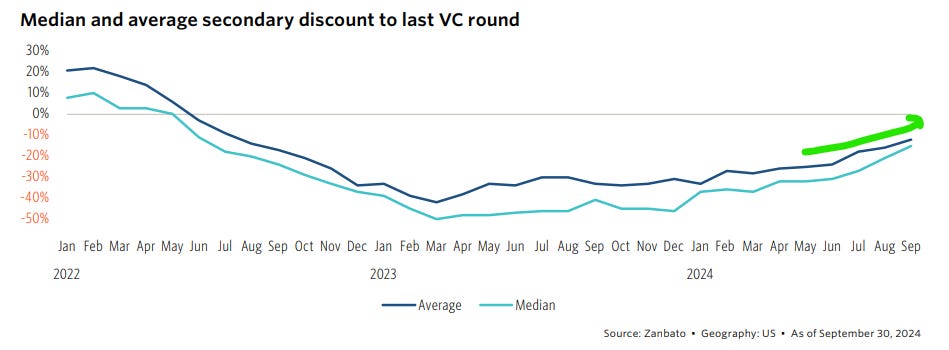

The first silver-lining is that the discount on secondary sales is steadily closing:

The median secondary discount is ~20%, and slowly, but surely, closing.

That there’s any discount to the last priced-round is, of course, not the best. But the fact that it’s getting gradually tighter is good.

Secondary funds have become an increasingly popular source of liquidity for VCs. While there’s no universe where secondary capital ever gets large enough to bail out the madness of pandemania, it remains the case that certainly some liquidity is better than no liquidity.1

My guess is (still) that the discount reflects some selection effects—it’s only the very best companies that are being sold in the secondary market, so the actual “price” of venture assets is probably weaker than that. Likewise, the “last round” continues to get farther and farther into the past, so you’d expect some appreciation (and if not, that would be very bad indeed).

But again, some appreciation is better than no-appreciation, and clearing prices don’t lie.2

This is good.

Try a little tenderness

Silver-lining the second.