Stablecoins have lots of uses, right?

Decompose stablecoin transaction volume (and you might not like what you find)

Circle’s early returns

Stablecoin transaction volume is nipping on Visa’s heels (or is it)

a proliferation of use cases for stablecoins too, like, umm…

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. Stablecoins have lots of uses, right?

Stablecoins are very hot right now.

For those of you keeping score at home, Circle CRCL 0.00%↑ is now ~$50B company (on ~$65M in Q1 profit):

Circle has returned a humble ~222% since its IPO.

And who said the IPO market was closed?

Truth is that I haven’t spent enough time with stablecoins (or Circle) to really have a view other than the same view I’ve always had, which is ‘ledgering is way too complicated and if you can make it easier, then that’s better.’

Stablecoins do seem to make ledgering a bit easier in that they function more like a ledger than tradfi—and that’s not nothing because there is billions in enterprise value built on the relatively high transaction costs of tradfi—but that’s about as far as my thoughts go.

Anyways, I’m inherently wary of the hype, and so I found these observations about the explosion of stablecoin volume amusing.

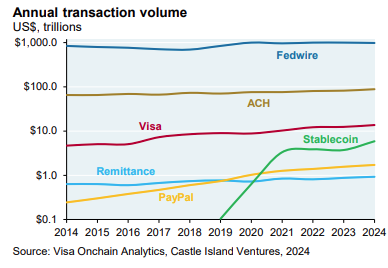

Transaction volume for stablecoins is about to surpass Visa!

Behold, stablecoins have exploded into the trillions:

Stablecoin transaction value has gone from zero to nearly $5-6 trillion in a blink of 4 years (and by now, a run-rate of ~$8T).1

Several trillion is a lot of trillion—stablecoin transaction volumes are catching up to Visa!

But, actually, not-so-fast.