Strong jobs data and other stuff to ignore

Six great datas on restaurants, VC funding, builders, REIT mistakes, streaming, and bills-to-pay. Plus, "strong jobs data" is a distraction from what matters

It’s Tuesday, which means we go wide with Scatterplots, and then we go deep, with a Great Wall of Text.

Six datas on the world-as-it-turns:

No soup for you;

Stretch it out, and other stories from ventureland

Homebuilders are the new price makers

REITs . . . at least someone is lying or mistaken

What have you streamed for me lately?

Debtor-in-chief

One great polemic on why everyone is wrong and Random Walk, alone, is right:

Ignore the jobs . . . it’s the money that matters

Thanks again for listening and I hope you enjoy this as much as I do.

Scatterplots

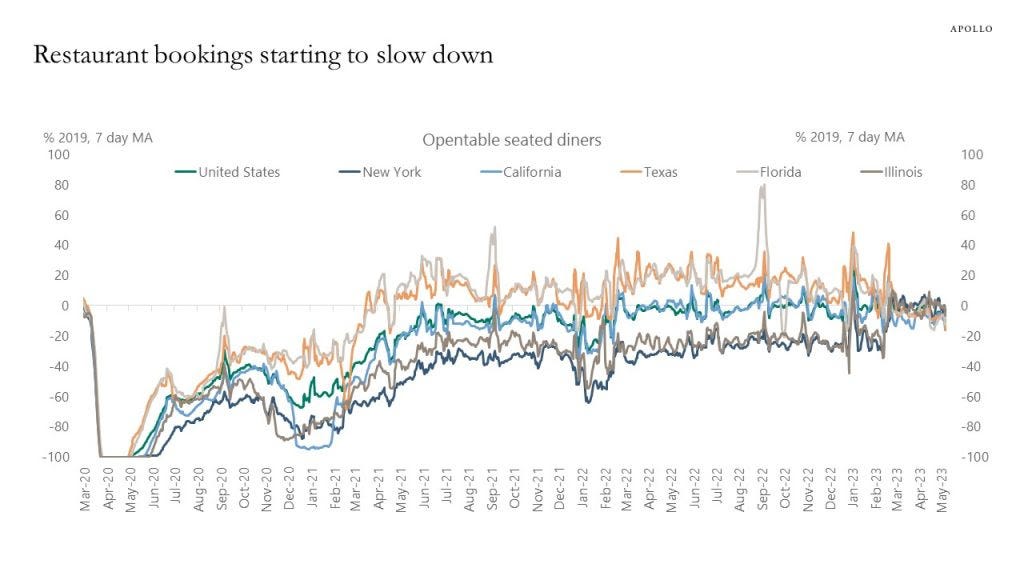

No soup for you

“Eating out” was one of those consumer behaviors that seemed to defy the broader slowdown in discretionary spending, but that too is getting with the program:

My guess is that the “young and restless” cohort who patronizes restaurants overlaps in no small part with the “young and restless” cohort that’s about to start repaying their student loans. Prices are still high, as well, which can’t help.

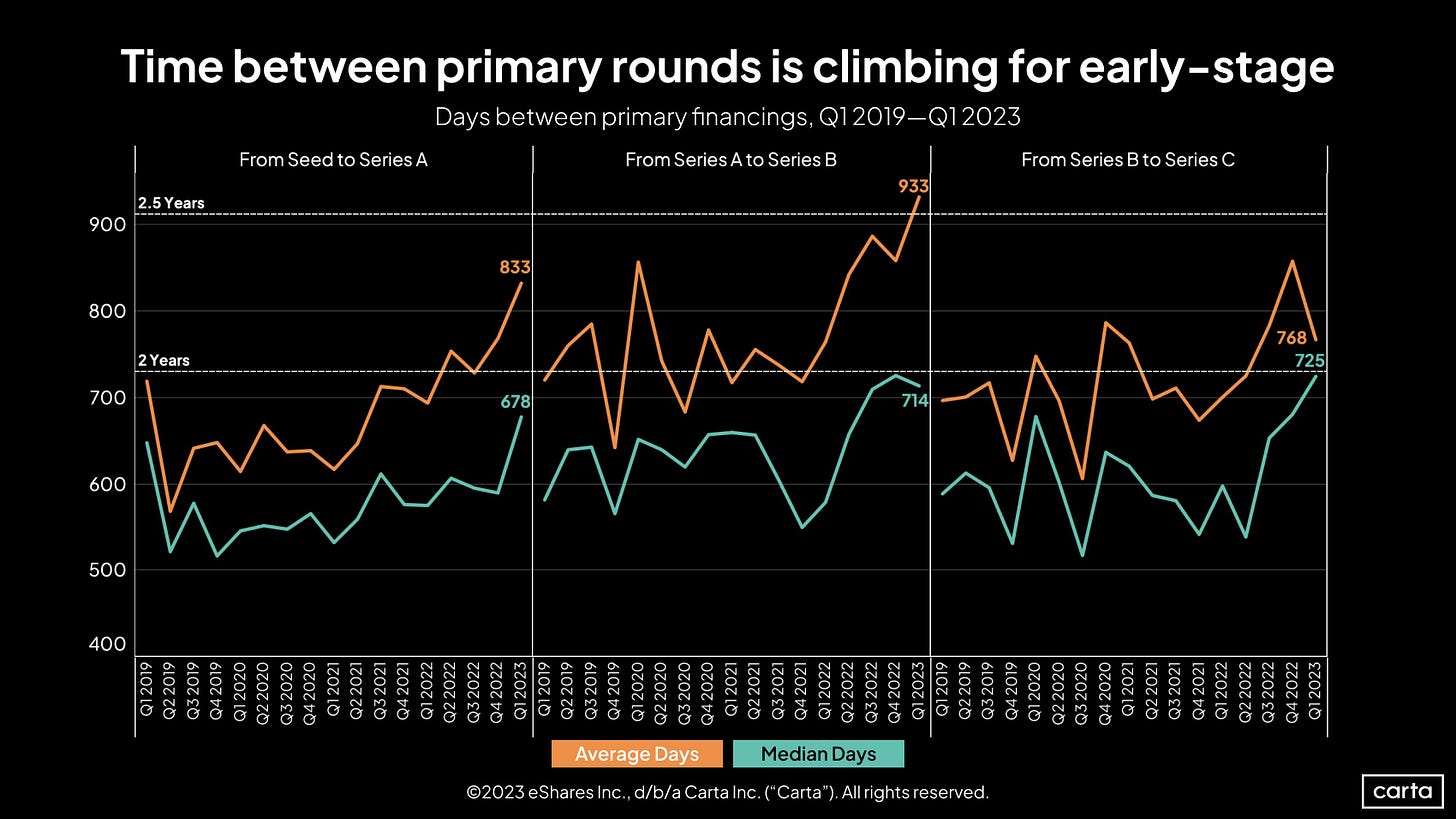

Stretch it out

This is what it looks like when start ups extend their cash burn and VCs throttle down on funding:

The time between rounds is getting wider. That’s not necessarily a bad thing (and actually may be a good and healthy thing), unless closing dinners are your specialty.

Carta’s data is interesting throughout and confirms much of what would expect—late-stage is toast, early-stage is fine, more participating preferences (i.e. hidden downrounds).1 The good news is that valuations are starting to stabilize—Series A, B, and C valuations all perked up, while D’s plateaued:

Although it shouldn’t, the pattern seems to be following the optimism of the public markets. To RW, the whole thing has a ‘07-’08 “hey-it’s-not-so-ba—*UH OH*” feel, but I’d love to be wrong.

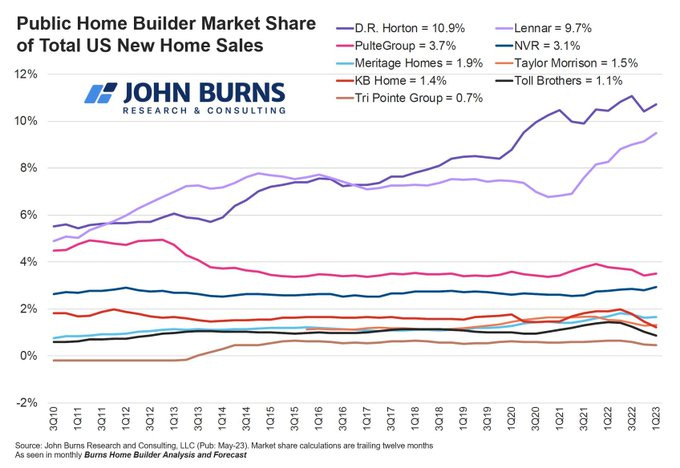

Price makers

New homes (and homebuilders) continue to take the lion’s share of home sales:

RW has covered this before, but the basic theory (which has thus far been born out) is that existing homeowners don’t want to sell at a loss, so they don’t sell. Builders however make their money on services, not asset-price appreciation, so their less-afraid of lower home values.

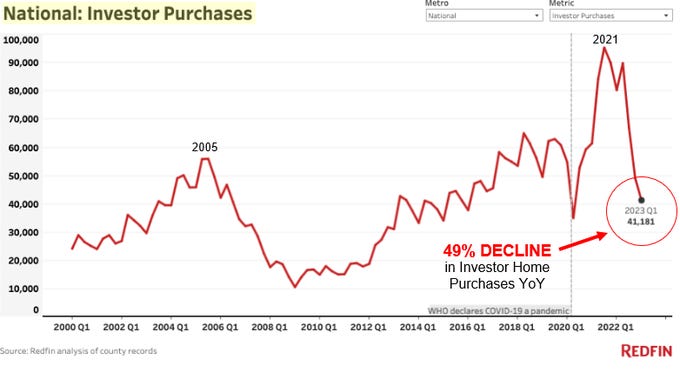

Investors and homeowners are out-the-game:

Builders are the price-makers now, and the more they build, the more price-discovery there will be.

At least someone is lying

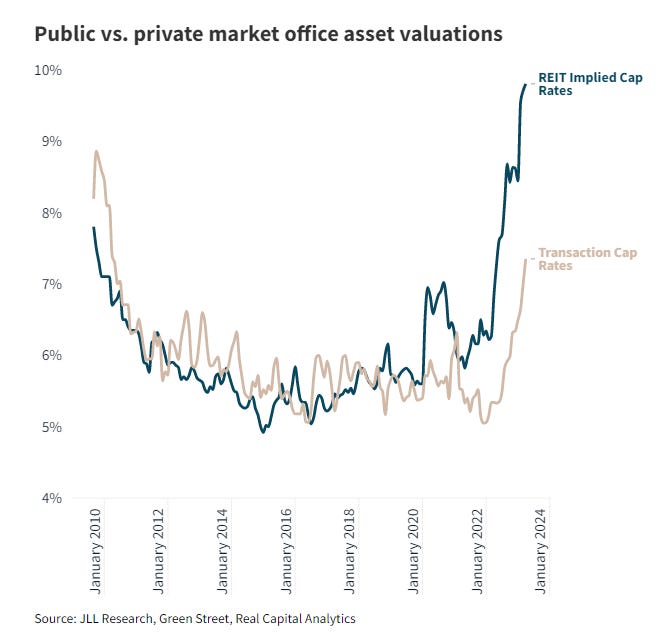

Well, no. RW used “lying” to get your attention, but “at least someone is wrong” is probably fair. Investors in publicly traded REITs are far more gloomy about asset prices than actual buyers and sellers of assets:

In real estate, a higher cap rate for a building means a lower price. If you use stock price as your starting point, the implied cap rates for the office assets held by REITs is about ~40% higher (i.e. worse) than the market is actually clearing. That would suggest that REITs are either priced too low, or that private market investors are getting fleeced (or both).

I haven’t validated the underlying, but even though JLL has some incentive to paint a rosy picture, I generally trust their analysis. One reason why there might be a divergence (other than low volume) is time-preferences . . . if you’re a private market buyer, you don’t necessarily need to wait for the bottom to make your move. In theory that’s true of public market investors too, but they’re more sensitive to near-term prices changes.

What have you streamed for me lately?

As TV networks begin to internalize the slow death of cable, they can take comfort that all is not peachy in streamland.

E-sports . . . not so hot:

Tik-tok is yesterday’s news:

But Netflix is unstoppable:

I’d take all this data with a grain of salt, but it is no easy thing to get consumers to focus for very long.

Debtor-in-Chief

Some gold bugs point out that ~40% of government debt is set to mature in the next two-years:

That big blue bar is a lot of expiring bonds.

If all of that debt is refinanced at prevailing rates (which are now much higher than before), then Treasury’s interest payments will double to $1.2T by 2025, representing 25% of tax revenues. The gold bugs say the only way out of the revenue hole is print, baby print. Bad for dollars, good for gold (so the theory goes).

Incidentally, BTC no longer goes where Nasdaq goes (for the moment at least) . . . which would suggest that BTC is finally, actually an inflation hedge, instead of a risk play.

RW hasn’t thought that all the way through, but has pointed out repeatedly, that the one firm who really can’t afford higher rates is the US Treasury. Something’s gotta give.

Great Wall of Text

The big story was that we appeared to add a lot of jobs. “See? Everything is great!” and the stock market goes up.

Some renowned doomers and anti-establishment technologists declared “lies! The data is fake! Everywhere I look, I see layoffs!”

To which certain renowned establishment wonks responded “no, you’re the liars, liar-liar pants! This is the greatest economy of all times!”

RW says “You’re both wrong. The correct response is ‘It doesn’t matter.’”

It doesn’t matter?! But RW you love jobs and employment stuff.

True, but let me explain.