Tales from private capital markets

Is deal season back? It couldn't come soon enough. Meanwhile, everyone is a lesser fool to someone

‘deal season is back’ they say

startups going hungry for longer

in private credit, suddenly the paperwork matters

the premium to sophistication, and why some covenants are lighter than others

the discount to being a rube, because yes people will buy low-yielding, risky things for no reason other than they’ve been sold

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. Tales from private capital markets, where everyone is a lesser fool to someone

If you think about private capital markets a lot, you might be wondering when the suffering will end.

If you’re new to this story, let me be as succinct in summarizing as possible.

First, there has been very little visible suffering. Everyone is staying remarkably chill.

Second, nonetheless, the fact remains that there is both (a) little appetite for smaller, riskier ventures; and (b) that reflects a complete 180 from only recently such that there was basically unlimited appetite for smaller, riskier ventures. In other words, it’s hard to raise money (or find buyers) for these sorts of businesses, but it’s especially hard because everyone is still clinging to the wildly expensive prices they paid only ~2 years ago.

The net result is that very little money is going from private capitalists to their LPs, which means very little money is going from LPs to private capitalists, which means very little money is going to the sorts of business that private capitalists might fund.

You might even say the business model is broken, in certain ways, or at least, it needs some major tweaking and/or innovation to find a path forward.

Anyways, throat clearing aside, just some quick charts of thises and thats on the private side.

“Deal market is back”

PE is back in business.

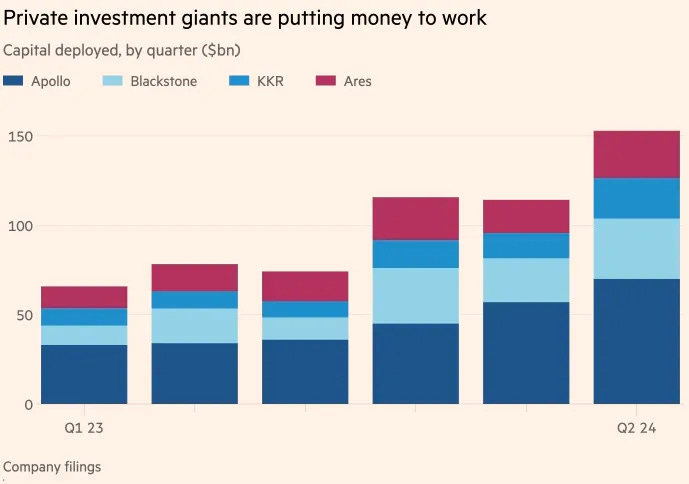

The good news is that some of the very big PE shops are putting capital to work.

The biggest of big PE shops deployed over $150B last quarter.

It’s not as high as ‘21-22, but it’s a lot higher than before. And this is buyout money—not just refinancing or extend n’ pretend—which is the kind of money that leads to exits and investment profits, and all that.

Ares, Apollo, Blackstone and KKR said they had invested a combined $162bn between April and June, with Apollo accounting for more than 40 per cent of the total. Executives at the firms said they were readying for an increase in buyout and merger activity, as the US Federal Reserve edges closer to cutting interest rates.

“The deal market is back,” said Scott Nuttall, the co-head of KKR. “This year, we not only have an open market, we have pent-up supply of deals . . . coming to markets. So we are optimistic.”

Rates will come down any minute, and then it’s hunting season.

So they say.

Fresh capital couldn’t come soon enough, though, because it’s definitely rough out there.

Startup intermittent fasting

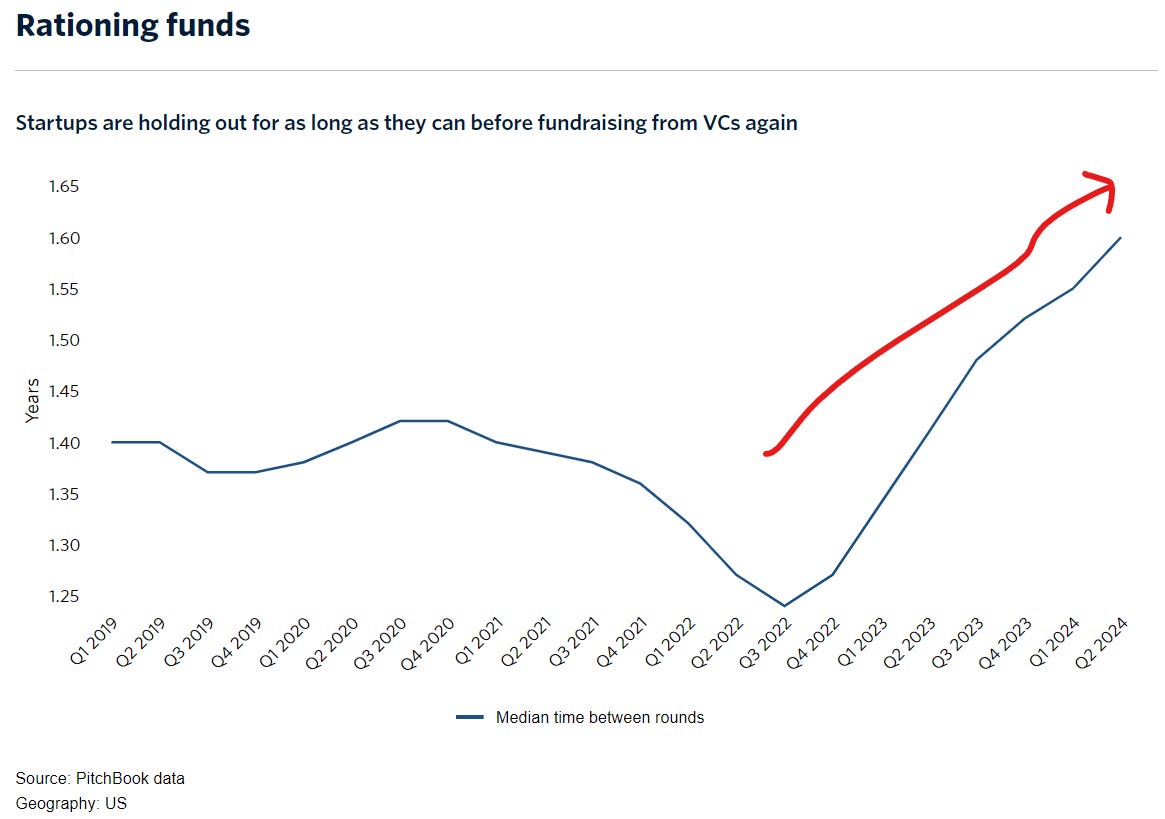

Venture-backed companies are having a very tough time raising money.

After raising a lot of bridge financing, and especially covenant-heavy packages, right when everything broke, startups are basically in full belt tightening mode.

The time between rounds is getting longer and longer.

It’s unlikely that “not raising money” is something startups are choosing to do.

Certainly, some of these companies will have figured out how to playout the string, which isn’t great for their investors, but will keep them in business for a while longer.

Most others will quietly (or noisily) winddown or merge, if they can’t find a corporate M&A team willing to find them a home. And again, it’s not like Corporates are super acquisitive right now.

Intercreditor violence and the non-fungibility of risk/return

The FT wrote a thing on rising “intercreditor violence” i.e. when various creditors fight amongst themselves for whatever they can get.

Everyone is very clubby on the way up, but they get caveman clubby on the way down.

The FT was excited to share some thoughts (via Barclays) about why that increasing nastiness hasn’t revealed itself to the public, as it otherwise might. It’s because of something that Random Walk has written about many times before, so I won’t rehash it all here, but it’s a little innovation called “distressed exchanges.” Instead of going to bankruptcy—which is very public and very expensive—creditors and debtors do clever work arounds by shuffling papers a bit.

The enabler of this phenomenon is the prevalence of “covenant-lite” loan docs. Basically, the “here, just take it” standard of creditor (non)protections that became very fashionable when lenders and investors were rushing around trying to deploy as much money as they could.

Now everyone is reading the docs as closely as they can.

Exchanges have the effect of (a) hiding the true amount of “distress” in the market: