Technology is leaving Venture Capital behind (and VC would be wise to let it go)

Five great datas on credit scores, Uranium, the summer's hottest item, Coffee is different, and NY I love u, but you're bringing me down

It’s a short week this week, so maybe just one post. Or maybe two, depending on how tomorrow goes.

First, SCATTEROPLOTS, the five six datas that learned me things I didn’t know (or kind of knew), but I’m now glad that I do know more certainly than before, for reasons that are hard to describe:

What’s my credit score? Asking for a friend

Waiting for Uranium

Summer’s must have trade down item

Coffee is different now because we’re different now

New York, I love you, but you’re bringing me down

Everything bubble, still everywhere

Second, a GREAT WALL OF TEXT:

Yesterday’s VC. Technological change is moving the party elsewhere and VCs aren’t on the list. It will feel weird without VCs in the driver’s seat, but they will become (more) boring, and boring is good, even if it doesn’t feel that way.

Scatterplots

What’s my credit score? Asking for a friend

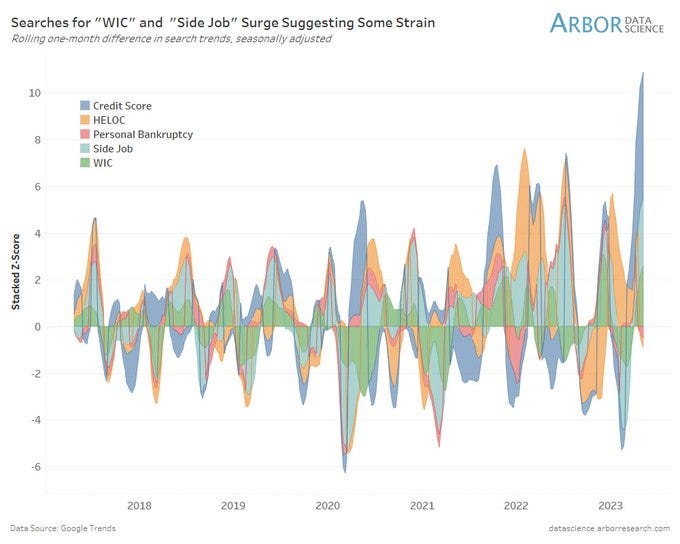

Searches for “credit score” have become very popular lately:

This seems like a stress signal to me (among various others too gloomy to recap in full). People want to know about their credit score when they’re in the market for a loan, and loans are just the thing that are hard to get right now, especially for credit scores that are less than perfect.

Waiting for Uranium

RW was reflecting about our curious dependence on both Russian oil and uranium (and our commitments to “net-zero”), and I wondered whether non-Russian uranium—like, U.S. uranium for example—was becoming more en vogue. Demand, meet supply, etc.

Lo’ and behold, it has, albeit nothing like a funky diva with soul, whatsoever:

Not exactly a rocket ship, but up is the only way to go.

Last month, Finland turned on a nuclear reactor (14 years behind schedule) and a few weeks later, energy was so plentiful that prices went negative. Some (perhaps most) of that has to do with seasonal flooding causing a bump in hydro power . . . but come on. With all the hard problems we’ve got, it never ceases to amaze when we leave the low-hanging fruit to rot.1

Summer’s must-have item

Speaking of rocket ships, everyone’s favorite summer wear is making a comeback:

The implications of this are two-fold:

nah, I’m just messing with you. I was just tickled that jorts are a trending consumer item (by search interest).

New coffee routines

Riddle me this:

The only time of day that people visit Starbucks less than before is morning time. Every other time of day is above prepandemic levels.

Random Walk has flagged Starbucks patterns before because it’s a reasonable proxy for daily routines (and degrees of normalcy). This one is hard to figure, but presumably it has something to do with WFH habits, including perhaps slightly less “work” than folks let on. Or alternatively, just different work . . . as a reminder, success can be had by embracing the vibe shift.

New York I love you, but you’re bringing me down (reprise)

Remember how $40B in gross income walked out of New York and into Florida? Here’s another cut:

It would be so much easier to eat the rich if only they’d stay still.

Everything bubble, still everywhere

Debt ceiling deal? Not gonna matter. Not one bit:

As a reminder, it’s not just us who binged on free money, as we got older:

China’s roaring re-opening is still pending. It may yet be around the corner, but if you’re not people-growing, how do you anything grow?

Great Wall of Text

Yesterday’s VC

The hottest new thing in technology spells the end of an era for the cool kids of tech. AI is where the action is, but it’s the kind of action that’s a poor fit for VC dollars. Fortunately, there are still plenty of boring old software companies for VCs to fund, but getting boring is never fun, and trend-chasing is a hard habit to break.