The real "affordability" crises

8 charts on the rising costs of people and capital (maybe)

maintenance and repair costs, through the roof

domestic prices > imports

$kills & Trade$, and it continues to be a good time to be in the skilled trade outsourcing business

insurance rates visualized

power generation is fine, it’s transmission that’s the problem

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. 👋👋👋Random Walk has been piloting some other initiatives and now would like to hear from broader universe of you:

(1) 🛎️ Schedule a time to chat with me. I want to know what would be valuable to you.

(2) 💡 Find out more about Random Walk Idea Dinners. High-Signal Serendipity.The real “affordability” crises

Riffing on themes

Just some charts that (to varying degrees) touch on a few running Random Walk themes:

if there’s any affordability crisis in real estate, it has little to do with zoning, and much more to do with the cost of capital and the cost of labor (and, in some cases, the cost of stuff);

the labor shortage, especially in skilled trades, is real and persistent—hence the affordability issues;

immigration (but really birthrates) are far more consequential to prices than tariffs because of infra;

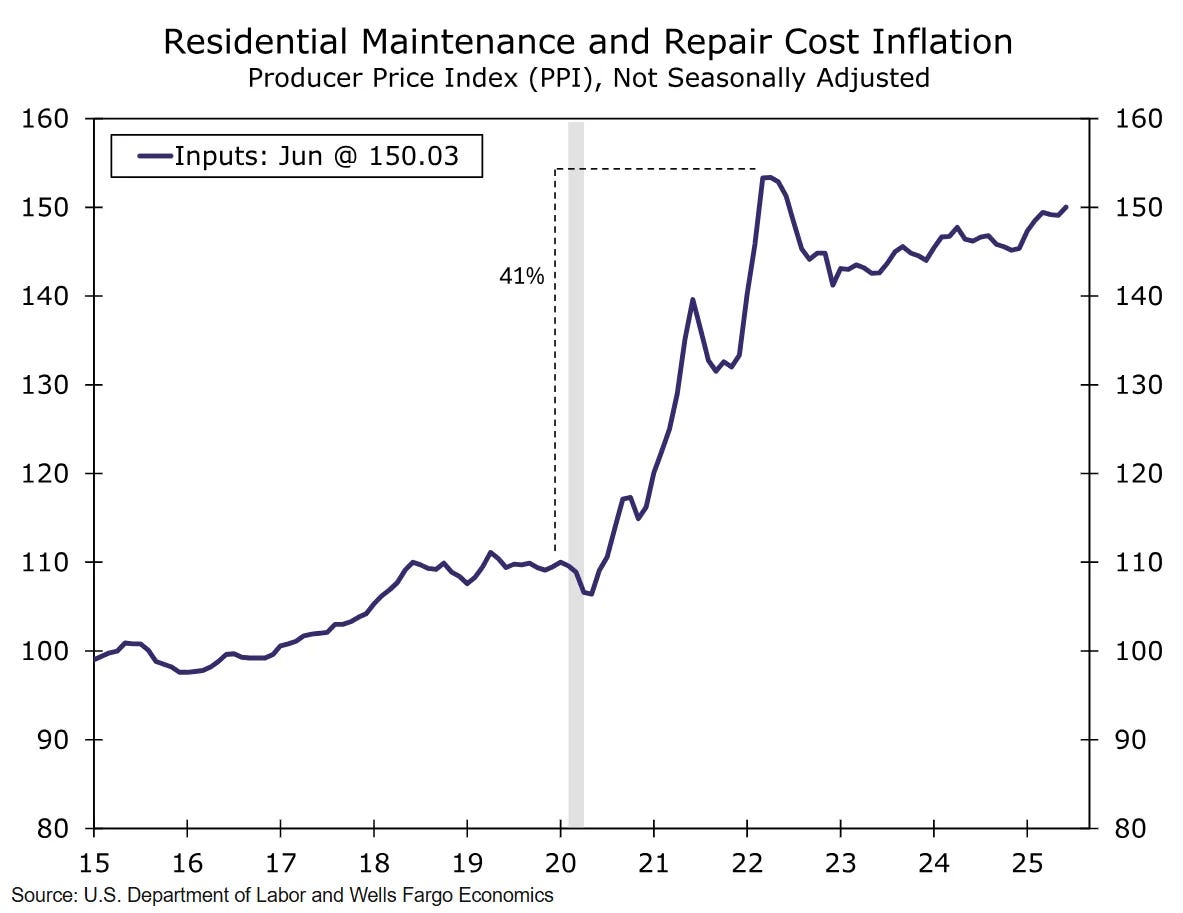

Maintenance and Repair Costs through the roof

Wells Fargo

residential and repair costs are ~40% higher than before the pandemic, which is consistent with the secular labor shortage story;

the rise really began in 2017, which one could attribute to Trump I immigration policies, but also Trump I tariffs, I suppose

Domestic prices have increased the most (especially recently)

Here’s another one for ‘it’s the people, not the tariffs,’ that matter more:

domestic goods and services have gotten substantially more expensive, relative to imported goods—the divergence really began in Dec. 22, but has accelerated again, recently (as of Sept. ‘24);

to be clear, ‘domestic’ and ‘imported’ are a bit misleading here, because the cost of tariffs would be passed through in the price of domestic goods and services, so tariffs are likely part of the “domestic” cost picture.

Still, if tariffs were quite so impactful, then it’s hard to understand why the prices of imported goods barely budge (if not decline), and/or why the domestic price inflation kicks off in ‘22;

It seems more likely that domestic labor costs are the pass-through, and the Sept. ‘24 bump, reflects the flurry of ‘Trump Trade’ activity, which included tapping a labor force that has “no juice left to squeeze.”

$kills & Trade$ shortage is real

On a related note, some parts of the labor shortage (and subsequent price-pressure) reflect certain segments of the skilled labor force getting older, without reinforcements: