What do hedge funds like?

Sectors and stocks that are loved, hated, and everything in-between

Goldman published a hedge fund trend report, and while the signal is low, it’s still a roaring good time.

hedge funds are tilting towards healthcare (and away from financials)

the most important stocks (or PMs get paid to pick these?! My 11 year-old could do that)

old loves (most concentrated) and new faves (new owners)

the most-hated, newly-hated, and yesterday’s news

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. What do hedge funds like?

Goldman Sachs put together a report on Hedge Fund trends, and it’s pretty fun.

Keep in mind that (a) the information is lagging; and (b) it doesn’t capture synthetic positions (e.g. via options, swaps, or futures), so it’s far from a perfect picture, but it still gives a high level indication of what hedge funds like (and what they don’t).

There are 40 charts in the report, but I pulled out the best 12 for your infotainment.

Hedge funds like healthcare

Apparently, Random Walk is not the only one who sees healthcare as a recession-proof, secularly-growing, trillion dollar stream of goods and services.

The “tilt” to healthcare (i.e. allocation relative to the Russell 3000 index) is larger than any other sector:

Healthcare constitutes 17% of total net exposure, which is ~6.6 percentage points more than the index.

Healthcare allocation was already high, but it got even higher in the latest read:

Hedge funds’ net tilt grew the most in healthcare, comm services, and materials.

By contrast, funds rotated away from Financials, Industrials, and Info Tech (which is really not popular for funds, relative to the index).1

The most important stocks

The stocks that are most loved by hedge funds, are the stocks most-loved by most people, unsurprisingly.

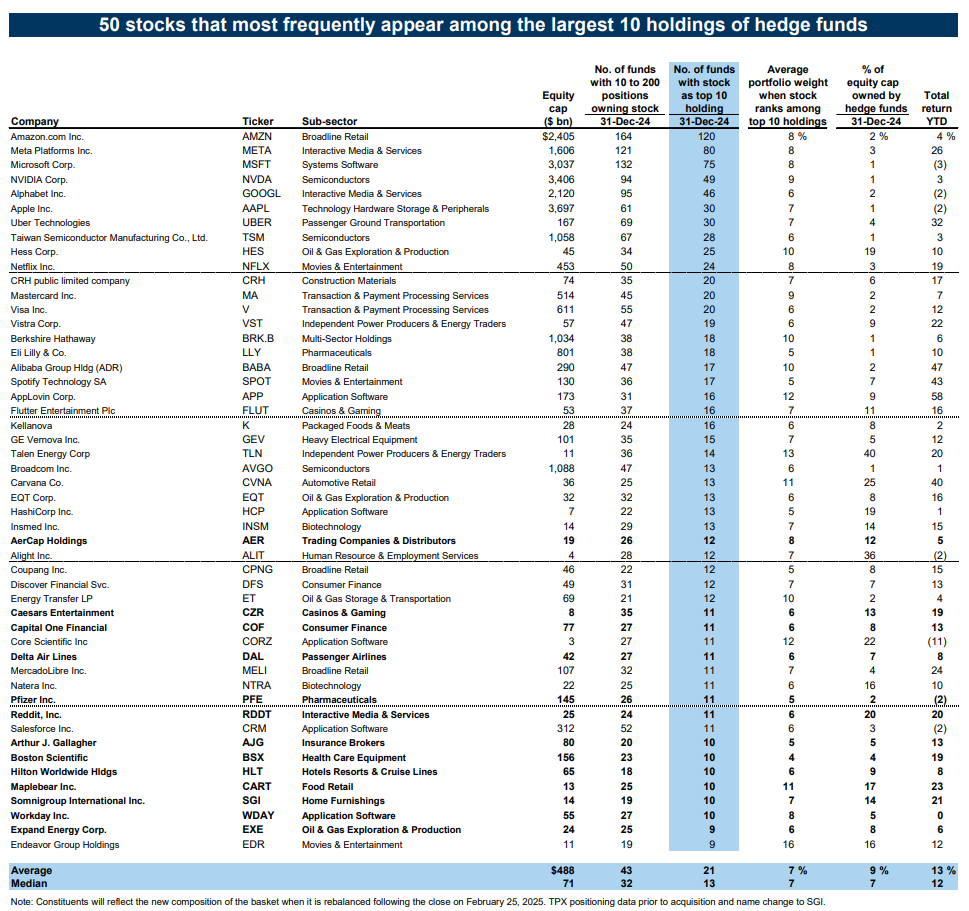

These are the “systemically important” names, in that they are most likely to appear among the largest 10 holdings for hedge funds:

Amazon, Meta, Microsoft . . . and, well, it’s murderers row.

You might wonder why hedge fund managers are getting paid quite so much to invest in such diamonds-in-the-rough like, “Apple.” There’s an answer, I’m sure, but it’s too long and complicated for normal people to understand.2 It’s really not until you hit the #11 spot (the building materials conglomerate, CRH CRH 0.00%↑ ) that you get a non-brand name on the leaderboard.

In fairness, Hedge Funds did trim their exposure to the Mag 7, ever-so-slightly:

Only Tesla had a net-increase in HF owners during Q4.

I guess that’s a Trump trade?

Old loves, and new favorites

If you want a list of stocks that are uniquely loved by hedge funds, Goldman’s got that too.