11 (or 13) Real Estate Charts

Rents rising the quickest, first-time buyer supreme, CRE lightening round

money in the cheap seats

first-time buyers in crisis (lol, no)

CRE lightening round

love that dirty water

CMBS delinquencies getting . . . better?

commercial foreclosures getting . . . worse?

mistakes were made

Bonus: FHA mortgages getting hairy, and There is No Housing Shortage, Student Housing edition

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. 11 (or 13) real estate charts

Because prime numbers are the best kind of numbers.

Money in the cheap seats

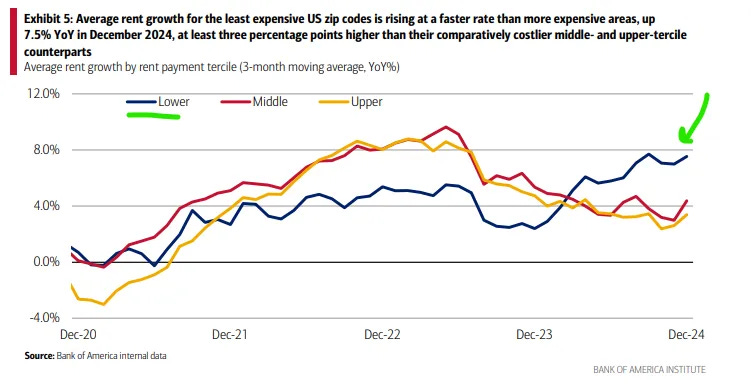

Where is rent growing the quickest? It’s gotta be those super-unaffordable metros where no one is ever allowed to build, right?

Well, no. It’s the opposite of that.

The fastest rent-growth is in the cheapest zip codes:

The lowest tercile of zip-codes has been growing rents the quickest for about a year.

Why rents are growing most quickly from the bottom-up is hard to say, but presumably that’s where the demand is, relative to the supply.

Does Almighty Cautious Consumerism apply to housing, as well? I suppose it might. Plus, if a larger chunk of new entrants into the apartment market happen to be lower-income—e.g. migrants—that could have an effect, as well. Or maybe more people are living alone, which means carrying 100% of the rental cost, which might increase demand for bargains.

Another possibility for why less-expensive zips are in (relatively) high demand is just the ongoing shift to cheaper parts of the country.

The South has been both the great migration winner and the rent-growth winner.

For low-cost zips specifically, the South and the West have been running together (but the Northeast and Midwest aren’t that far behind).

Interestingly, the relative out-performance of lower-tercile zip codes is mostly a Western and Northeastern-driven phenomenon:

The West especially has seen faster rent-growth in the least expensive areas.

The South has rent-growth that’s nearly as fast, but it’s even faster for more expensive Southern zips. In other words, the South has experienced relative demand shifts everywhere, whereas the West (and Northeast) appear to have concentrated gains in the lower-cost neighborhoods.

From an anecdata standpoint, the growth of lower-cost zips in the Northeast is consistent with e.g. the out-performance of inventory-constrained neighborhoods like New Haven or Rochester, both of which have a hospital system as the anchor employer, and a corresponding growth of “workforce” (i.e. lower-income) housing.

Oh, and of course, the other evergreen point to make is that shelter-pricing is obviously sensitive to changes in demand. Southern rents are rising the quickest, and I don’t think anyone would even try to claim “it’s because of the zoning throttling new supply.”1

First-time homeowners own the market

Contrary to popular belief, first-time homebuyers are an increasingly large share of the home-buying market: