Buyout funds are saving the worst for last, aren't they

The gap between the have-solds and the have-nots

Publishing note: Random Walk is going to experiment with a different publishing cadence over the next few weeks (more details forthcoming). I will endeavor to trade some frequency for depth, at least some of the time.

there are qualitative differences between the assets buyout funds are still holding v. the one’s they’ve sold

not-exiting because they can’t or because they won’t?

the importance of being profitable

saving the worst for last

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. Buyout funds are saving the worst for last

There’s an open question vis-a-vis the liquidity challenges in private markets as to whether stuff isn’t selling because:

the timing isn’t right—the IPO (and M&A) markets are “closed” and/or these assets just need more time to ripen; or

the unsold assets are just not very compelling, and the only “right” timing is when the market goes back to wildly overpaying for things.1

The answer is, of course, “both,” (and not all private markets are the same), but as longer-term Random Walk readers know, a good chunk of the problem is that The Marks are Too Damn High. In other words, Door #2: unsold assets stay unsold because they’re not very compelling relative to the prices paid, and the bid-ask is too wide.

It doesn’t make investors stupid or mean, but it does mean that plenty of assets are still priced for an interest-rate regime that’s done gone, and isn’t likely to come back any time soon.2

For today’s note, just a little more data to support that claim.

In this case, the data focuses on the valuation and performance differences between PE’s sold companies and PE’s still-held companies.

Held-cos getting higher multiples

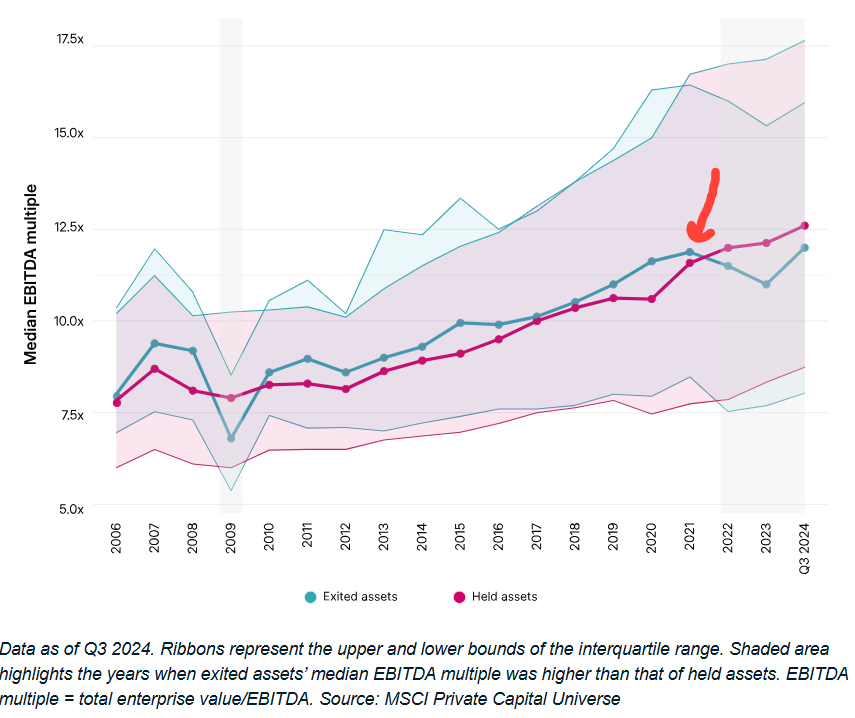

Historically, exit-cos have higher earnings multiples.

That flipped in 2022:

Assets on the books currently have a valuation premium to actual clearing price, i.e. assets on the books are over-valued relative to clearing prices.

If PE was holding by choice, then you’d expect to see clearing-prices higher than holding-prices—because that’s what it takes to get someone to sell: an offer at- or above what the holder thinks the asset is worth.

If, on the other hand, PE was holding assets by wishful thinking, then you’d expect to see the opposite: clearing-prices lower than holding-prices—PE managers valuing their assets at prices no one else is willing to pay.

That’s exactly what we see (in MSCI’s data, least).

Held-cos see margin contraction

Here’s another one.

Now, maybe the reason held-cos are valued so highly is because they’re the crown-jewels, and PE doesn’t want to sell those too soon.

That would be nice, but it does not appear to be the case. Quite the opposite—it’s the better companies that are selling, while the poor(er) performers languish.