Checking under the hood for signs of chicanery

And private credit continues to come back clean

private markets are taking all the risky stuff (true), while the syndicated market plays boy scout (true)

using lots of tricks to hide distress (true, but also, still not so bad)

default rates for private credit loans are

worsebetter than general corporate default ratesdirect lenders are getting paid more for whatever it is they’re doing that syndicated markets are not

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. Checking under the hood for signs of chicanery

One ongoing mystery or question regarding the crisis-that-wasn’t-when-rates-went-up is whether:

(a) things are fine because actually investors are smart, and operators are adaptable and resilient; or

(b) things appear fine because the can has been kicked-down-the-road (in lots of clever ways), but eventually the music will stop because you can’t extend n’ pretend forever.

The answer, as with most things, is likely some combination of both.

Random Walk, for its part, is becoming increasingly convinced of the first option, but perhaps that’s simply recency bias, and the truth is, I’m genuinely unsure.

To be fair, part of why it’s hard to “get to the bottom of this” is how much of the activity has shifted to private markets.

You see, banks don’t lend much anymore, especially for riskier, illiquid stuff, so it’s relatively out-of-sight-out-of-mind.1

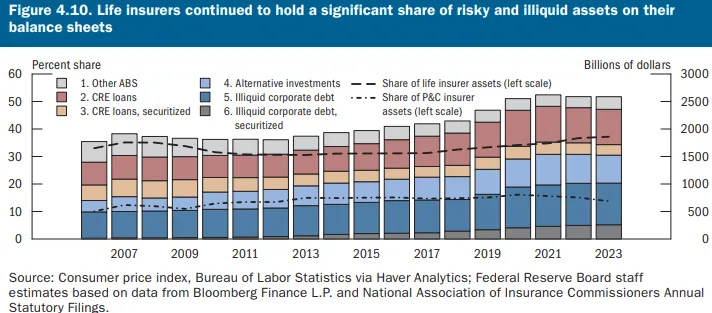

The riskier stuff is what life insurance is for:

FRB Financial Stability Report

Life insurers are carrying an increasingly large share of the illiquid and risky stuff.

And that’s because life insurance premiums are the fuel for the private credit lending machine.

But that’s a digression. I just liked the chart (and well, the fact that the nation’s retirement funds are capitalizing the future of lending is probably underappreciated).

Back the point at-hand.

Not only is the financial state of affairs somewhat harder to observe, but opacity creates both motive and opportunity—if anyone has the will and the way to engage in the sort of near-termist financial chicanery that could sweep stress under the carpet, it would be “shadow banks,” aka non-bank lenders aka Private Credit. And whether or not shadow banks are actually doing any chicanery, the fact that it’s harder to know, means that it’s easier to let the imagination run wild.

That all being said, to the extent one can find evidence of anything, it really doesn’t look that bad.

Yes, there are PIK loans. Those are a bit fishy.

What else?

Distressed exchanges are somewhat distressing

Yes, there are distressed exchanges, which are out-of-court workouts, and can-kicking exercises, that not only keep companies out of formal bankruptcy (and the scrutiny that comes with it), but also generally don’t end well, in the longer run.

Those are definitely happening, and happening with greater frequency than ever before:

Distressed exchanges continue to increase by count, and are now an all-time high share of overall defaults.

So, there are PIKs, and there are distressed exchanges, and dividend recaps, and things like that.

Sounds bad.

Default rates are . . . pretty good?

And yet.