Consumer retailers are cutting headcount

Daily Data: And other sundries from "more spending" but "higher people costs"

Market Recap

Netflix is undefeated

In today’s dispatch:

Consumer retailers are dropping headcount

One in particular

More trade downs (maybe)

Etsy’s growing pains, or why more is not always better

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. Market recap

People are still mad that it’s hard to sell EVs (or any cars) when rates are high. Idk. Not much here. [Update: big moves over night]

Big winner: Netflix. Just keeps adding subs (more than anyone expected), but did give some cautionary forecasts. [More].

Big loser: Equifax. Higher rates are keeping consumer credit applications lower than hoped for.

Other news:

Existing home sales continue to fall, and inventory is building, ever so slowly.

Philly PMI reported more activity (good), but also higher prices paid, and expectations for further wage increases (bad). [More]

Daily Data

Consumer retailers are cutting headcount (maybe)

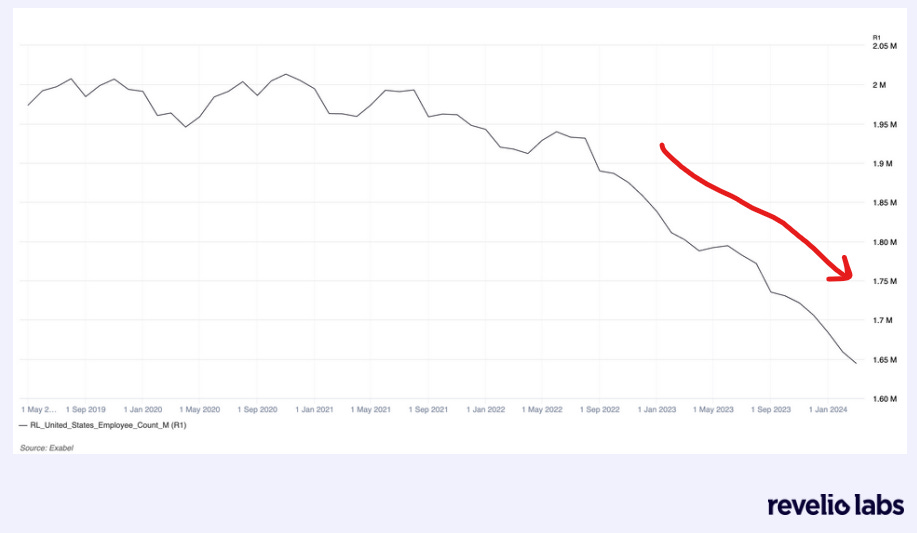

Consumer retailers appear to be cutting headcount, rather dramatically:

Source: Exabel

That’s ~200K fewer employees over the past year (taking the data at face value).1

Target . . . in the crosshairs(?)

Target especially jumped out, as both a cost-cutter and price-increaser:

Better margins, amiright?

Random Walk actually knows very little about Target, so this all may be according to a well-publicized plan. For what it’s worth, better margins do seem to be a stated goal, so mission accomplished.

Retailers are stuck between more spending and higher costs

Truth is, consumer retailers are in an odd spot.

On the one hand, higher wages for lower-income shoppers is a tailwind for stuff-buying. On the other hand, higher wages for lower-income workers (because there are fewer of them to go around), is a headwind for costs.

For some retailers, that’s meant losing some customers, and gaining others. There have been plenty of anecdotes (and data) that consumers are “trading down” (i.e. higher-income folks going to e.g. Walmart, and lower-income folks going to dollar stores).

When everyone steps down a rung on the ladder, luxury takes a beating (including even LVMH), but the middle rungs stay occupied (albeit with different people), and the bottom rungs get a bit busier.

It’s not all bad. It’s just a delicate dance.

Consider the case of TikTok shoppers: