High Priests of Healthcare

The 6 datas: Calms before storms; Big wrong predictions; Who, not how many; Sameness; Negative earnings reversion; and Dumber robots. The 1 prose: High Priests of Healthcare

As per Tuesual, it’s six bites of data (databites?) to learn important things:

Calms before the storm

Big wrong predictions

It’s who, not how many (reprise) or Miami is very different than NYC

Oh the sameness and the coffee chain that’s fighting back

Mean reversion (for negative earnings)

Robots getting dumber

And finally, one speculative whimsy about healthcare that will surely anger the doctors in my family:

The High Priests of Healthcare (wherein Docs are more priest than scientist than any of us would care to admit)

It’s the dog days of summer, but Random Walk is doing its best to surface interesting things that make the world turn. Please read, enjoy, and spread the good word.

Scatterplots

Calms before the storms

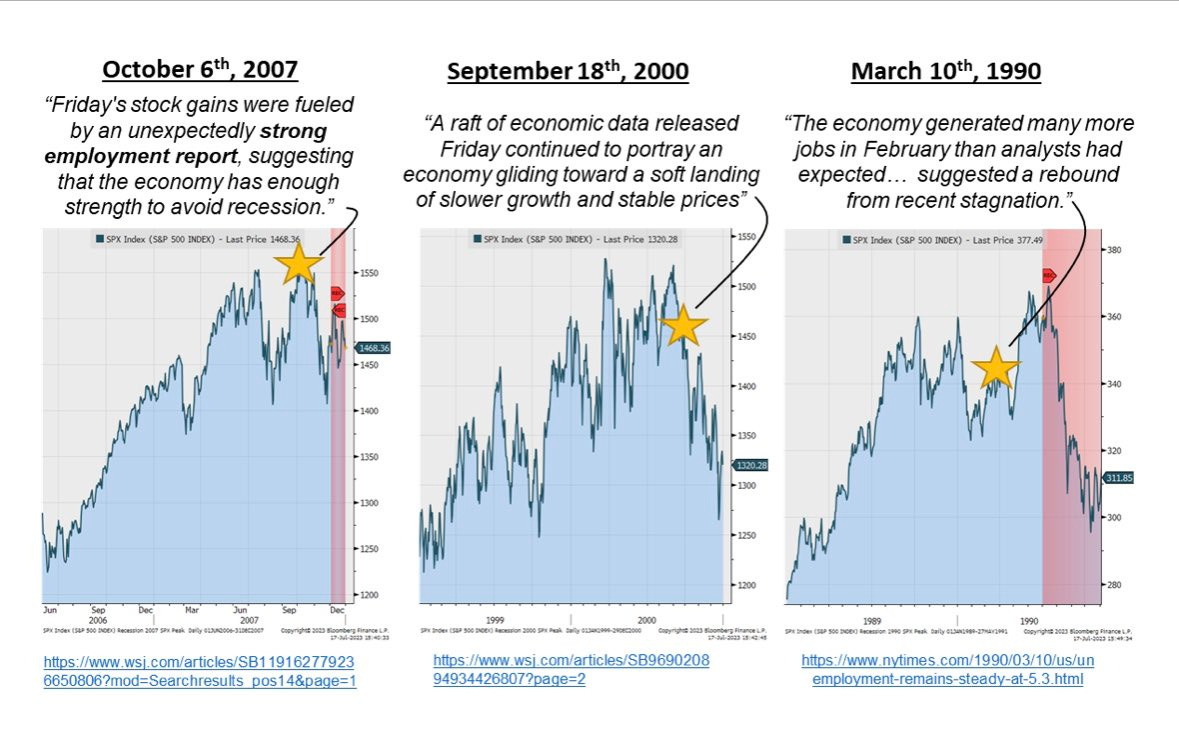

Here’s a nice visual reminder that recessions are often preceded by bouts of optimism (that were preceded by bouts of pessimism):

In 1990, 2000 and 2007 there was evidence of a soft-landing (and in two cases, a big run-up in stock prices), before the big one finally hit, just as the elders foretold.

This isn’t evidence that we’re heading for a hard landing, by any means. It is evidence however that “animal spirits” are noisy, the “market can stay irrational for longer than you can stay solvent,” and momentum trades work until they don’t. Fundamentals though are resolute. They show themselves eventually.

Credit is still tightening, loans still need to be refinanced, and there’s plenty of evidence of slowing consumption from the folks who use borrowed money to consume. Further upstream of the almighty consumer, demand from businesses continues to slow:

Don’t look now, but oil and food prices are going up, imports too, and the people who deliver our amazon packages are getting a raise. I mean, by one measure, we still haven’t cleared out all the extra cash we pumped into the economy, but we likely will soon (and then perhaps the rubber hits the road):

But it’s also true that consumers keep spending, household delinquency is pretty low, and everyone who wants a job, has a job. Even old folks may be coming back to the work force.

In other words, nothing has changed, and I still don’t know what the future holds, but I’ve made my guess and I see no reason to change it yet.

Bold predictions from smart people are sometimes wrong

I’m not entirely sure why, but the bowels of the hivemind1 have resurfaced an old, very bad prediction that McKinsey made about phone lines:

There’s no shame in being wrong. It happens to the best of us, which is good to remember, in case you’re ever on the giving end of terrible advice.2

Anyways, noted oil bull, Josh Young, was reminded of another confident expert prediction . . . the one about having hit “peak oil consumption.”

Young makes no effort to hide his priors, so discount accordingly. RW also thinks there are more legs to the peak oil prediction (especially given the rate and pace of EV adoption), at least in the longer run, than Young does, but it’s worth mentioning, nonetheless.

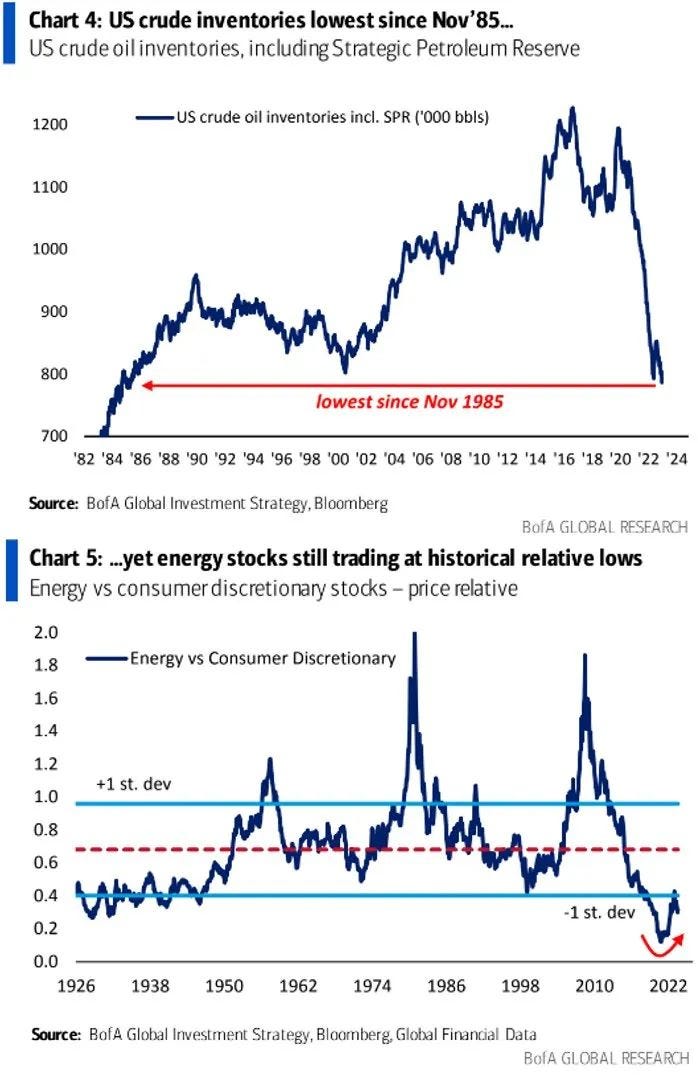

Also, remember how we were going to refill the strategic petroleum reserves (or like, any reserves)? Well, the check must have gotten lost in the mail:

I’ve already said that I no longer pretend to understand commodity pricing, but it sure seems like the “structurally short” thesis is very much in play (i.e. we’re going to do more [work] with less [oil]).

Not how many, but who (reprise)

Last week RW made the observation that not all out-migration is the same. Both Miami and New York City are losing people, but that does not mean that both cities are giving off worrying signals. Miami is losing people because it’s becoming a more exclusive place to live, while NYC is losing people because of the opposite of that. The evidence was in the income differences between stayers, leavers and comers.

Anyways, right on cue, the always excellent Economic Innovation Group put out a new report visualizing the national income migration—the more blue you are, the larger the positive income differences between comers and goers:

Migration heavily favors the New Centers of Attention, i.e. the South and Mountain West, as well as non-urban areas. As with most of the pandemic shifts, these were already underway (since at least 2015), but accelerated substantially during that time:

Oh, just $60B in income leaving the big city behind. No biggie.

I’m sure some of this will revert with evidence from ‘22 and ‘23, but I don’t think the overall picture will change. Anyway, nothing new from RW’s perspective . . . just confirming my priors (and calling attention to EIG’s excellent work).

Oh the sameness

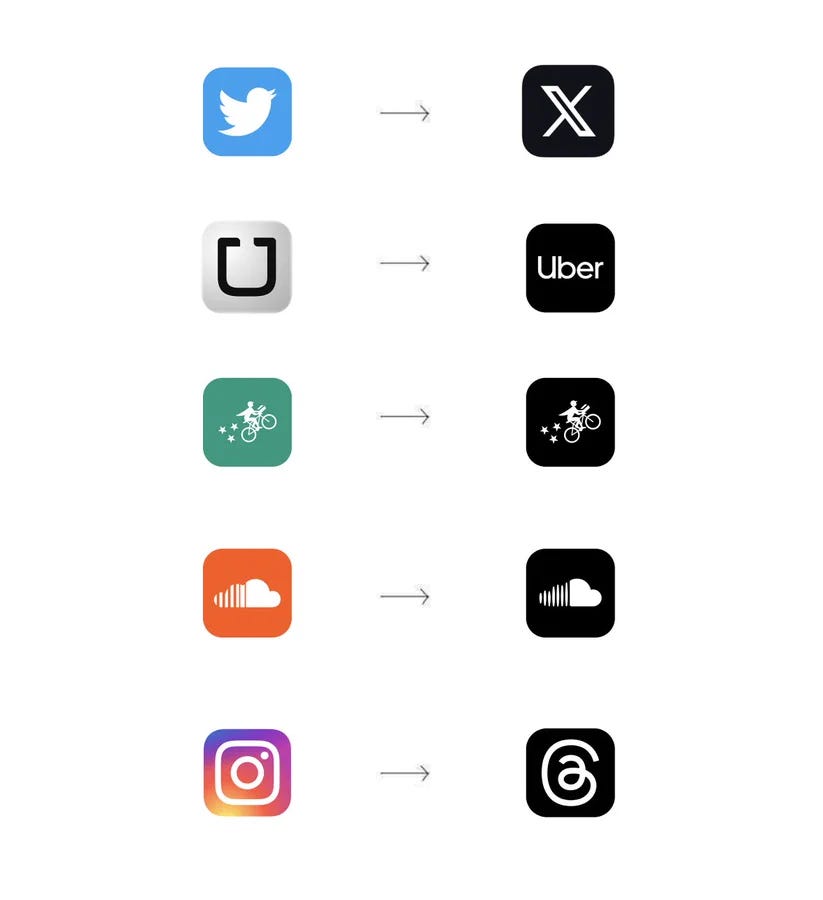

It’s been noticed before, but every now and again, there’s an example of “everything becoming the same” that jumps out:

Bird—>X is terrible. Instagram/Threads now looks like ear hair. Only Uber looks a little better, imo.

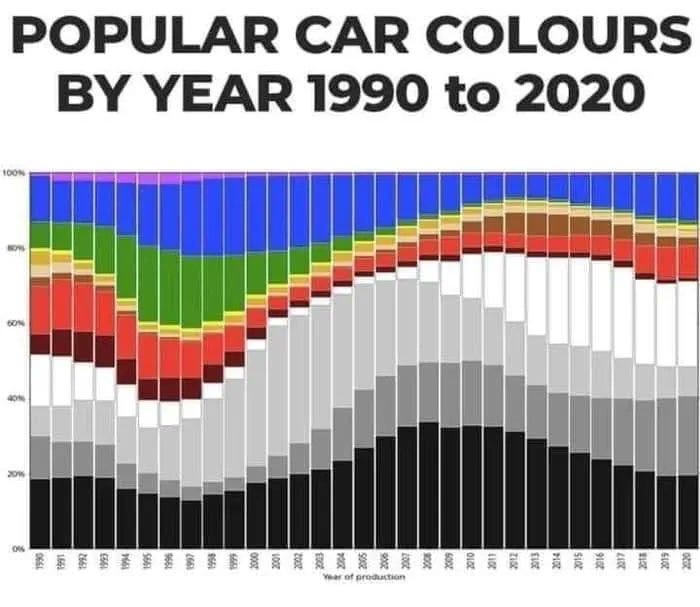

What did they do to our green cars (h/t Don't Worry About the Vase)?!

As a champion of serendipity and outliers, Random Walk finds this distressing.

Fortunately, companies like Starbucks—the conventional paragon of sameness—are fighting back by going long customization (and reaping the rewards):

Way to be, you weird green mermaid coffee lady, you! Cold foam, hot foam, room temp foam. Just mix it up, and add a third tail, while you’re at it.

Mean mean reversion or nice mean reversion?

On the subject of consolidation towards the same, Torsten Slok points out that now ~40% of small- and mid-cap companies have negative earnings:

He suggests that it’s a sign of stress. It’s also consistent with the hypothesis that higher interest rates will first inflict pain on smaller, weaker companies, while the available credit flies to the ones who need it the least. More concentration, less variety. Boo-urns.

OK, so far as it goes, but you know what else it looks like?

The share of Russell 2000 companies with negative earnings has been steadily increasing since 2012. After a pandemic bump, we appear to be right on track. Heck, you could go back to 2007, and it looks like we’re pretty much on the same pace.

It’s mean reversion alright. Is it the good kind or the bad kind though?

Dumber robots

There is some evidence of ChatGPT getting dumber:

These sorts of observations have been cropping up more and more, and I’m not really sure what to make of them. The mechanism by which AI is (supposedly) getting dumber is described as “model drift,” which sounds like a fancy way of saying “getting dumber.” If an expert says “AI is getting dumber because it’s getting dumber” I would conclude that (a) they don’t know why it’s getting dumber; or (b) they’re unwilling to explain it to idgits like you and me.

There’s speculation that model drift happens when the creators attempt to insulate models against jailbreaking. By neutering the robot so that it does not say the thing that probability suggests it ought to say, they simultaneously neuter the model in unintended (and unpredictable) ways. “Fill in the most probable series of words, except when we’d prefer otherwise” is a complicated set of instructions to execute at scale.

A scarier (albeit very speculative) possibility is that an old limitation with AI is surfacing it’s ugly head.