Is the economy firing on all cylinders?

Daily Data: Some cylinders are firing, others are not

Another look at the state of everything in charts, including yet another AI earnings success . . . and yet another ALERT signal from employees.

Everything reads better in your browser or in the app. The footnotes especially, and Random Walk is really leaning into the footnotes. Plus, if you have the app, you can set delivery to “app only” and then my daily barrage will feel less like a barrage. Alternatively, sign up for Weekly Recap only.

If this email was forwarded to you, please click the shiny blue button:Daily Data

Is the US firing on ‘all cylinders’?

On the strength of the economy, Noah Smith recently wrote:

[O]bjectively, the US is firing on all cylinders.

It’s an odd thing to say because, objectively, the US is not firing on all cylinders. Objectively.

The US is certainly firing on some cylinders, perhaps even most cylinders—e.g. GDP growth, income growth, deflation growth, low unemployment, plenty of liquidity, stock market highs and blow-out earnings for AI-adjacent companies1—but other cylinders are decidedly not firing, objectively.

Random Walk thinks those other cylinders still matter.

Or rather, if you’re committed to making sense of things, in all the helter skelter, you must take inventory of both helter and skelter. (And then concede that making sense of things is awfully hard.)

Anyways, among the cylinders not firing (and apologies, in advance, for some repetition):

*Consumer spending doesn’t scream ‘Good times roll’*

Consumer spending has grown modestly, if at all, and discretionary spending—y’know, the good times spending—remains in the pits.2

There was a big bump over the holiday season, but other than that, it’s a pretty middling picture, and January looks pretty bad.

Was it just the cold, or was Nov-Dec a dead cat bounce? More on that later this week.

*Healthcare spending isn’t growth*

GDP Growth is actually just the national rotation to the Great Nursing Home.

GDP growth, such that we have it, is driven primarily by old folks buying healthcare stuff (variously, on the taxpayer’s dime).3 You can now add Humana to the list of large insurance payors, saying “oopsie, we wildly underestimated how many knee replacements old folks were going to buy.” Buying healthcare isn’t growth. And you know what comes next? Higher rates.

More broadly, buying growth by blowing out the deficit even wider, isn’t growth. That’s a cheat code, and we all know there are no cheat codes (because if there were, why work at all, like ever?).

*Service inflation is still too high*

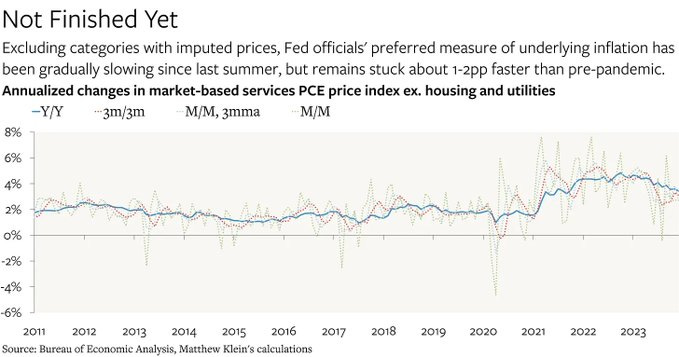

Relatedly, service inflation, i.e. people costs, remains stubbornly high (via The Overshoot):

Service prices (excluding housing and gas), which is what most people think of services, are cooling, but very slowly, and far too slowly for a 2% inflation target.

In other words, inflation is playing out exactly expected, which isn’t exactly a cause for celebration, or consternation.

Goods inflation went the way of stimmies, while service inflation goes the way of a secularly aging nation of retirees.4 One is transient, the other is a much less transient babymaking (and technology) problem, but in the meantime, there’s an open border.

*Earnings are starting to wane and the stock market is still just seven six names*

The stock market is really just a 6 trick pony, and the rest of the tricks aren’t doing so hot.