One narrow case for cuts

Fed life in the age of fiscal dominance

labor market moment we’ve all been waiting for, but a case for cuts?

a reminder that recessions are bad bad bad

the undisputed beneficiary of rate cuts has a debt-cutting trick, if the Fed plays along

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. 👋👋👋Random Walk has been piloting some other initiatives and now would like to hear from broader universe of you:

(1) 🛎️ Schedule a time to chat with me. I want to know what would be valuable to you.

(2) 💡 Find out more about Random Walk Idea Dinners. High-Signal Serendipity.One narrow case for cuts

The admin wants rate cuts, but the case for cuts is a bit mixed.

Asset prices are already historically high, and there’s not too much evidence that there’s a shortage of risk-capital out there;

Even if we had an expansion, it’s unclear who would do the work—yes hiring is slow, but unemployment is still pretty low (even if it’s no longer comfortably low).

I mean, what productive work is lying fallow but for cheaper cost of capital? I’m sure some, but it’s not so obvious.

‘labor market balance’ and a reminder that recessions are bad

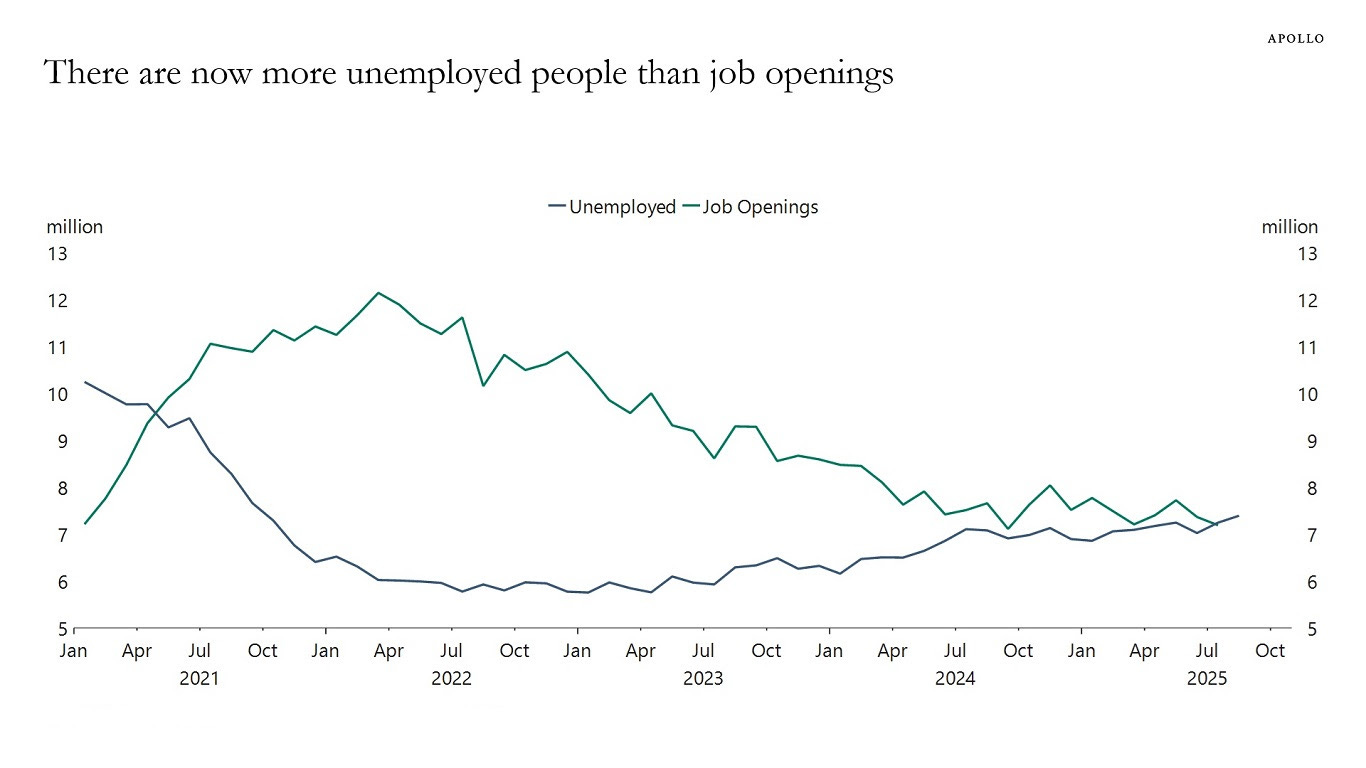

To be fair, this is the moment we’ve all been waiting for:

The number of unemployed is about equal with job-openings (after the latter ran well-ahead of the former for years).

So, there are signals that we’re on the verge of something worse, but being on the verge, is also consistent with just a new equilibrium of low-hiring, low-firing.

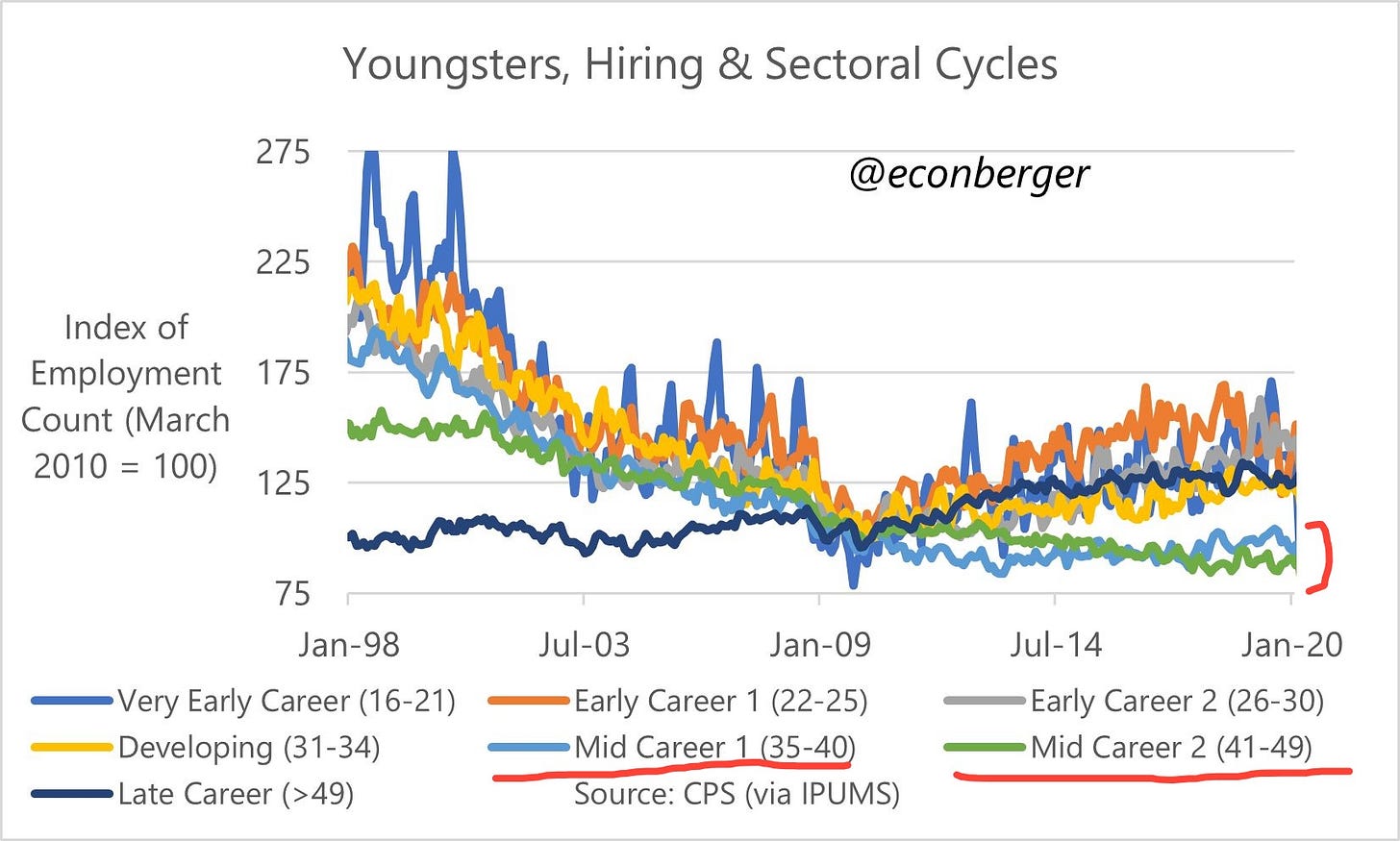

As an aside, this was a fun little observation from the always good, Guy Berger about the last time hiring went into a long-and-steady decline (i.e. 1998-2010):

The net-result was a “K-shaped” recovery—good for olds and youngs—but brutal for “mid-career” types. In other words, rather than slow-hiring leaving a hole at the bottom of the career ladder, it left a donut-hole in the middle instead.

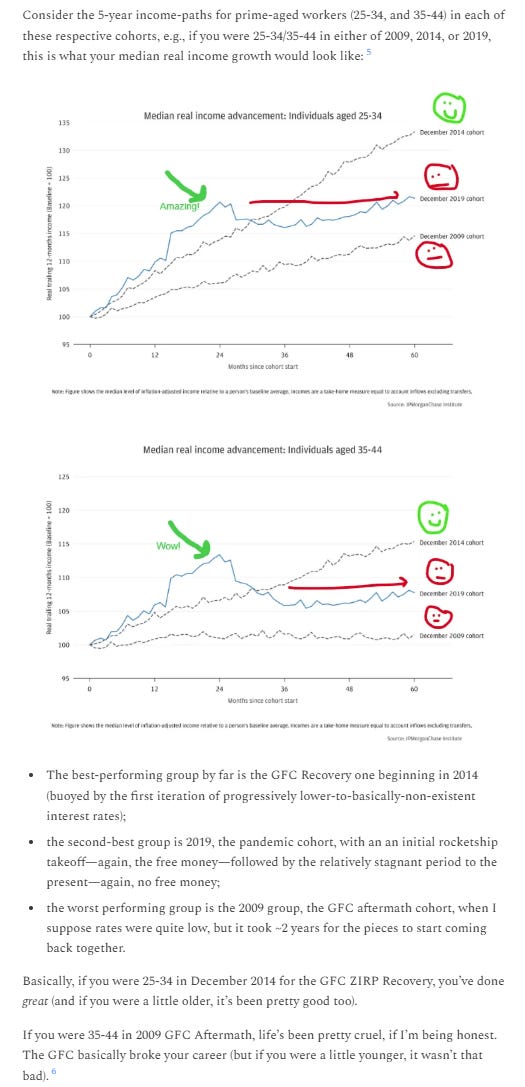

It reminds me of these two charts that show how brutal the GFC was for people mid-career:1

Recessions are bad, bad, bad.

Does that mean the Fed should be more inclined to safe than sorry? Perhaps, but it’s not obvious that cutting rates is even the “safe” path.

. . . which brings us back to the rate-cut story at-hand.

The most obvious beneficiary of rate cuts (reprise)

The most obvious beneficiary of rate cuts is, of course, Uncle Sam. Uncle Sam borrows a lot of money, and pays a lot of interest.