Rates went down, and the homebuyers shrugged

The housing market stays stuck and it's gonna take more a few percentage points to change a thing

A podcast!

Rates went down, so mortgage interest should go up . . . but it didn’t (obviously)

Bid-Ask is too wide

What’s it gonna take to solve the “affordability crisis”? Well, it’s not a crisis, so that’s a start

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. Mortgage rates went down, but buyers are still on strike (obviously)

It’s Friday so we’ll keep it brief and light.

Behold, a podcast

First, a podcast that I did with my friend, Blake Janover, CEO of Janover JNVR 0.00%↑and previous podcast guest of Random Walk:

It’s fun and lively. Give it a spin.

Rates go down, mortgage interest barely blinks

Now to the main event.

Many people are acting surprised that despite mortgage rates coming down, homebuying hasn’t perked up.

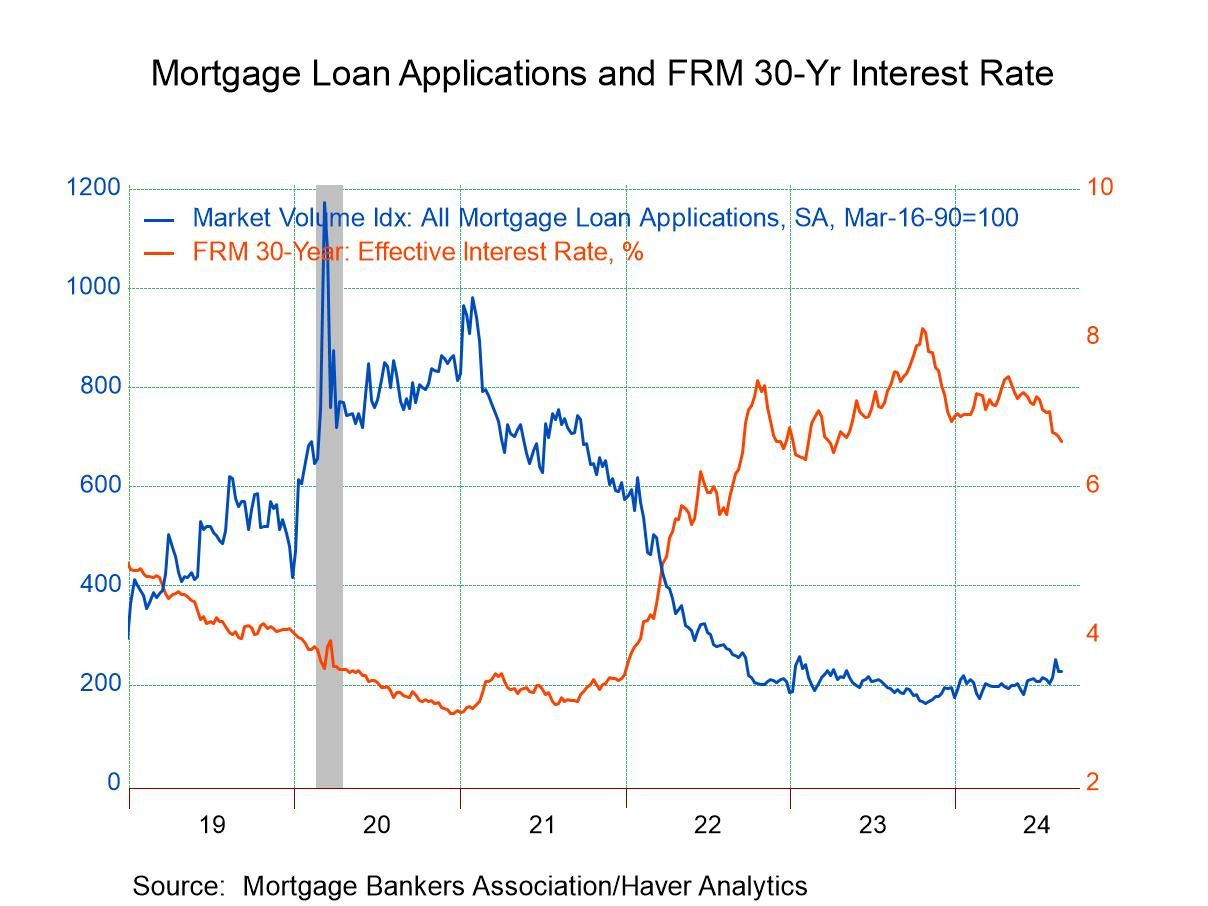

Take a look:

While rates dropped substantially, there was only a feint pick up in mortgage applications.

Rates are cheaper, but buyers still aren’t interested.

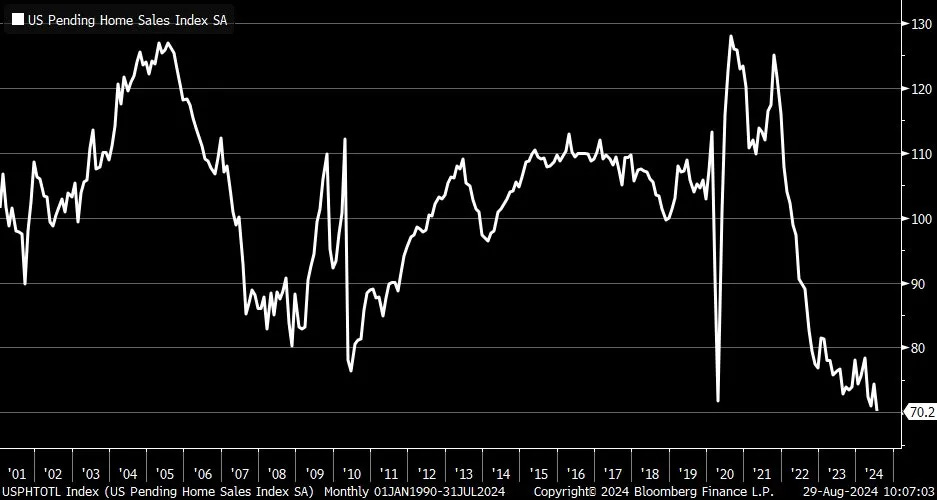

The last read on pending home sales was pretty grim, too:

The pending home sale index dropped to its lowest level in almost 25 years.

And existing home sales, those are really the pits:

Fewer used homes have traded hands than back in 2012, and the country is ~25M people larger since then.

Fact is that homes just aren’t trading (unless they’re all cash, or tiny). Or be California, and just be bat-shit crazy.

I would expect next month to show some small improvement, but the reality is that homebuying is going to stay pretty muted for quite a while longer (unless some big things change).

The only way one could be surprised that buyers were still on strike, is if one was laboring under the illusion that home values are generally in-line with what the indexes suggest, and “all we need is a little rate relief to bring buyers off the sideline.”

That’s silly, of course. The indexes are lying to you.1

The marks are too damn high

So, what’s going on here?