Reverting to the mean (just enough, but not too much)

5 under-the-radar datas: LinkedOnwards&Upwards; Happiness; Wars of Inflation and Defaltion; Hiding, Lagging; and Going Nuclear. 1 big thing that strains credulity: a meeting of the mean reversions

Pee-wee Herman has passed. Pee-wee’s Playhouse is a great show, with strong Random Walkian vibes. Phil Hartman was ship captain and Laurence Fishbourne was a cowboy with Jheri curls. What more do you need?

Anyways, on to the Random Walk show of the right-here-and-now:

I. Scatterplots or the five datas that matter most (in a scoring system I will never reveal):

LinkedOnwards and Upwards

Happiness is a warm gun (that disappeared in 1972)

Wars on Inflation and Deflation

Hiding, lagging, in plain sight

Going Nuclear

II. A Great Wall of Text, the prose without the pictures (although this time, with lots of pictures):

A Meeting of the Mean Reversions (or how only some things must go back to normal and only in the right amounts)

Please enjoy, read, ponder and discuss. Also, subscribe and share, or follow me on twitter, if you haven’t already.

Scatterplots

LinkedOnwards and Upwards

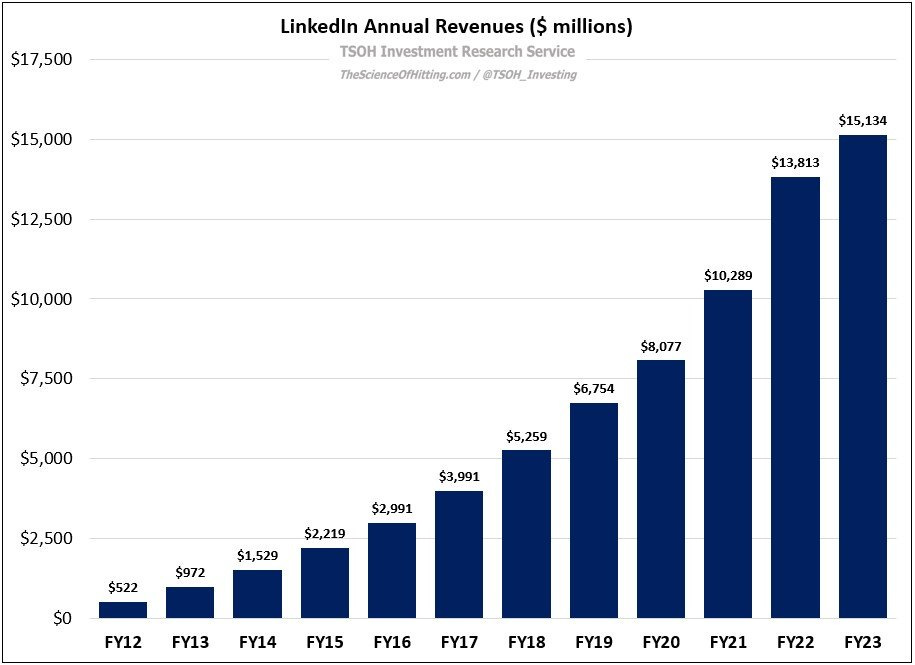

LinkedIn revenue surpassed $15B for the first time ever (

):It’s pretty amazing. Microsoft bought LinkedIn for ~$26B back in 2016, when the company was making just under $3B for the year. Seven years later, the company is making 5X that, with just under a billion users. Tip your cap to Mr. Nadella and crew.

LinkedIn is also the only actual competitor to twitter. It’s professional and word-oriented (as opposed to personal and video-image based). It’s pretty dorky however, and it lacks the style and edge that twitter cultivates (for better or for worse). Anyways, they seem to coexist just fine.

Happiness is a warm drug

. . . and apparently the War on Drugs claimed happiness as a victim, especially for women:

Yeah, ok that was an awful transition-to-pun.

Regardless, the graphs (from a paper circulated by Tyler Cowen) are pretty striking. Women have reported increasing unhappiness since the early 70s (which I guess made Men happier). In around 2000, Women figured out how to make Men unhappy as well. Misery loves company.

Everyone needs to get married asap:

And lol, get the heck out of the Northeast:

Life lessons from Random Walk. But also, ongoing meditations on the theme of “why so serious, young woman?”

War on Inflation meets the War on Deflation

While everyone puzzles where the Fed’s recession went, we can simultaneously marvel at the surge in construction spending driven by all the free money we’re giving away to construct stuff:

We’re doing this again? Free money is so back, baby!

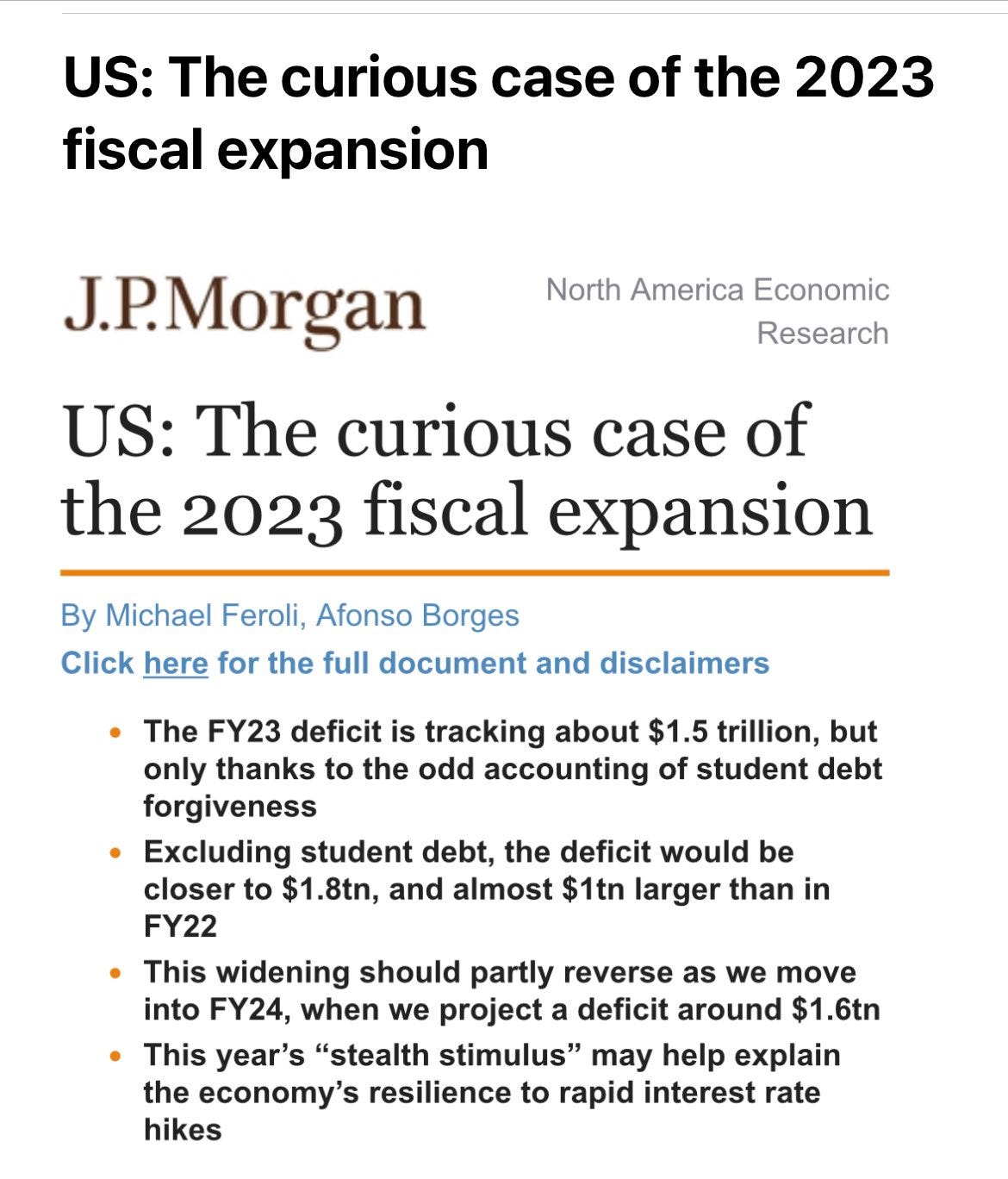

JPM, for its part, just realized that despite all the Fed’s efforts to slow the economy down, Treasury just keeps swiping the credit card to keep spending up:

“Curious” indeed. The Fed is playing “demand destruction,” but the world’s biggest consumer is undeterred.

The category “Government” only accounts for ~.5% of GDP, but query how much of “Business Investment” is also driven by subsidies:

What are we doing here, people? Why exert quite so much effort to paddle in opposite directions? How do these people ostensibly work for the same team at the same time? Is anyone in charge here?1

Inflation, hiding and lagging

RW’s longstanding view of inflation is that goods inflation will gradually cool (as stimmies and “excess savings” wash out), while service inflation and energy inflation remain more troublesome.2

Another related point is that inflation isn’t so easy to track.

Sometimes it’s hidden, like when you get more for less, e.g. paying for your carry-on item, finding smaller packages in the grocery store, or waking up to a minibox of cereal as your “included continental breakfast.”

Sometimes, inflation lags because not all price-increases are immediately passed-through every where all at once. Insurance is a good example—service costs for repairs have gone up, but consumers don’t feel that increase, as much as their insurance providers do. At least until insurance premiums start to go up:

It’s also another story of “getting less for more” insofar as insurers are not only charging more, but they’re covering less.

Going Nuclear

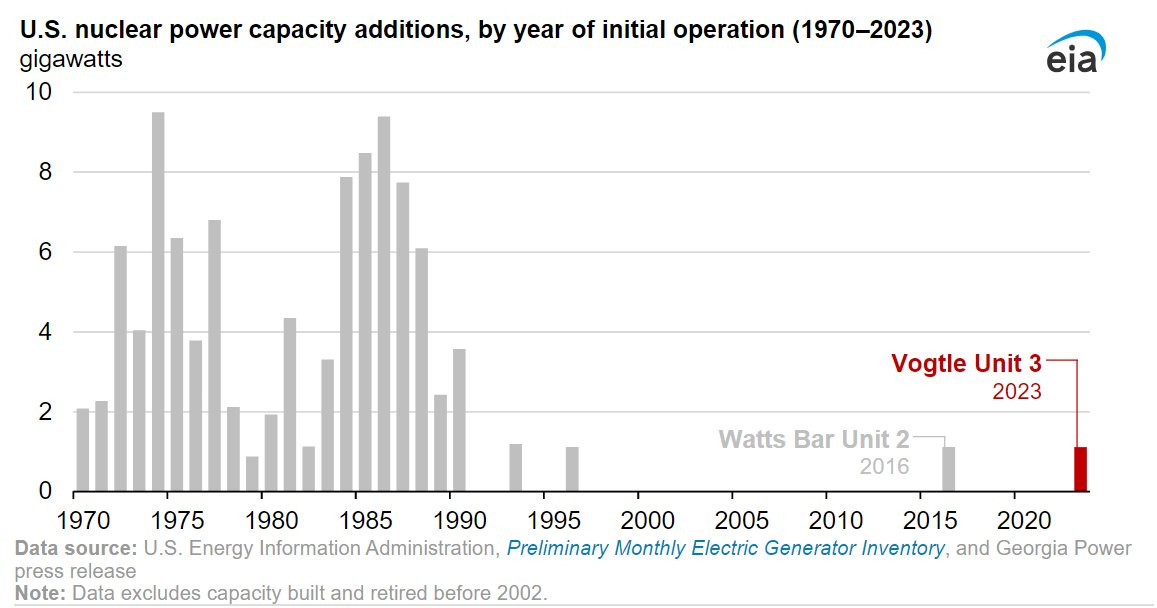

We’ve added nuclear power capacity in the US of A and it’s amazing:

Nuclear appears to be the only clean energy that’s actually sustainable, in that it can be sold for more than it costs to make. All the other “sustainable” energies are, for now at least, unsustainable (given their reliance on subsidies). Go nuclear. Go us!

As an aside, when the GAO (or anyone else) models trillion dollar spending bills and their impact to revenue (or someone else models the precise energy implications of energy subsidies), note again that forecasting is hard and things don’t always go according to plan:

Construction at the two new reactor sites began in 2009. Originally expected to cost $14 billion and begin commercial operation in 2016 (Vogtle 3) and 2017 (Vogtle 4), the project ran into significant construction delays and cost overruns. The total cost of the project is now estimated at more than $30 billion.

It’s worth it. More nukes, please.

Great Wall of Text

A Meeting of the Mean Reversions

One of the best arguments for perma-soft landing (i.e. bullishness) is just the magic of mean reversion. We were generally growing before the pandemic, so we should generally keep growing after the pandemic. Why worry, when everything will be back to normal soon?

There’s definitely some truth to it—mean reversion is a helluva drug and there’s plenty of evidence of means reverting when you look for it. But, not all mean reversion is going to feel good, so the trick is getting only as much mean reversion as we really want or need.

If that sounds implausible to you, or somehow contradicts the notion that mean reversion is a force to be reckoned with, rather than purchased ala carte, well, you’re not alone.

Consumption reversion

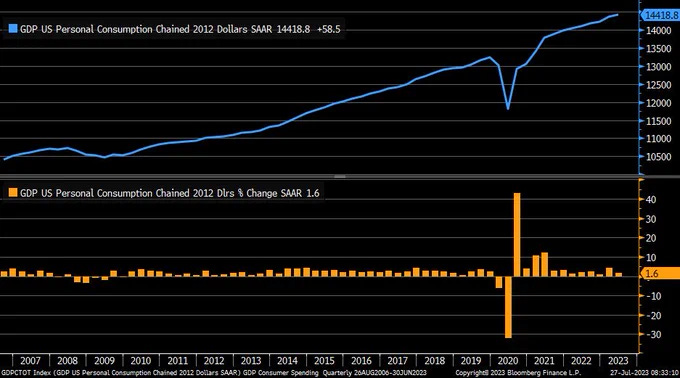

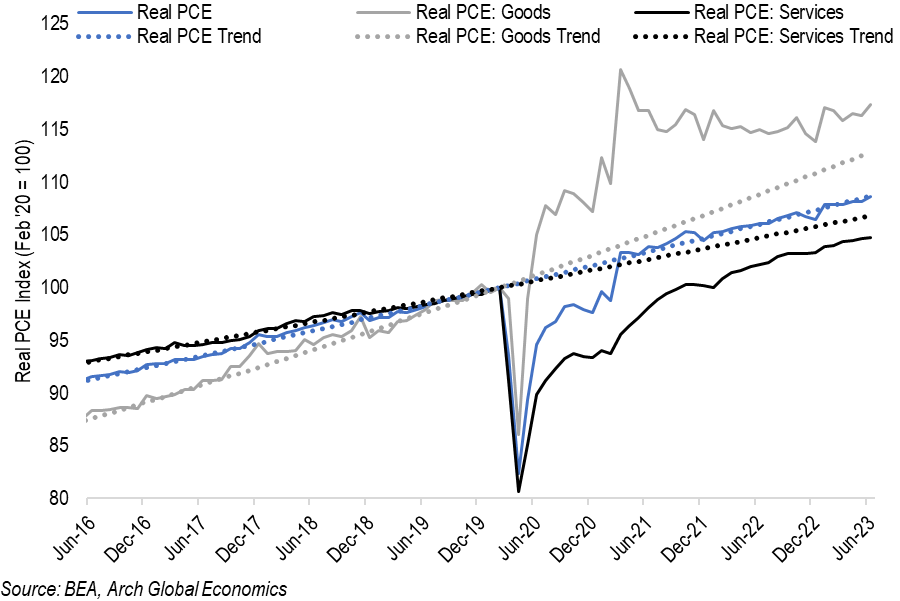

Take real (i.e. inflation-adjusted) personal consumption, for example. It’s just incredibly on-trend:

That’s just remarkable. After the turmoil of the past three years, we’re the spitting image of our pre-pandemic selves. It’s like nothing happened at all.

Here’s another cut, showing that consumption is on trend (light blue), even though we’re consuming more goods (grey) and fewer services (dark blue) than before:

Different mix of stuff? No problem. Substitution is magical and we are stubbornly on trend.

Unsurprisingly (given the initial observation), credit card transaction data shows something similar, steady but unspectacular growth (for now):

And another cut, broken out by segment (from the remarkably predictive JPM panel):

A little spike here, a dip there, but all in all, we’re just chugging along with a mean-reverting consistency.

You can interpret this as:

we’re back (on-trend), baby!

we’re back (on-trend), baby!, but uh-oh that means more inflation is right around the corner; or

back or not, this is just the ongoing calm before the potential storm/middling stagnation.

You know what RW thinks, but I would be thrilled to be wrong.

Oil reversion

Other things are experiencing some mean reversion, as well. Oil consumption, for another example, may finally be returning to prepandemic levels:

As with the non-energy consumption, it’s good, in the sense of “indicating economic strength and normalcy.” But, in this case, it’s also bad, in the sense of “inflationary pressure coming.”

OK, so mean reversion for personal consumption is good. Mean reversion for oil demand is mixed.

Income reversion

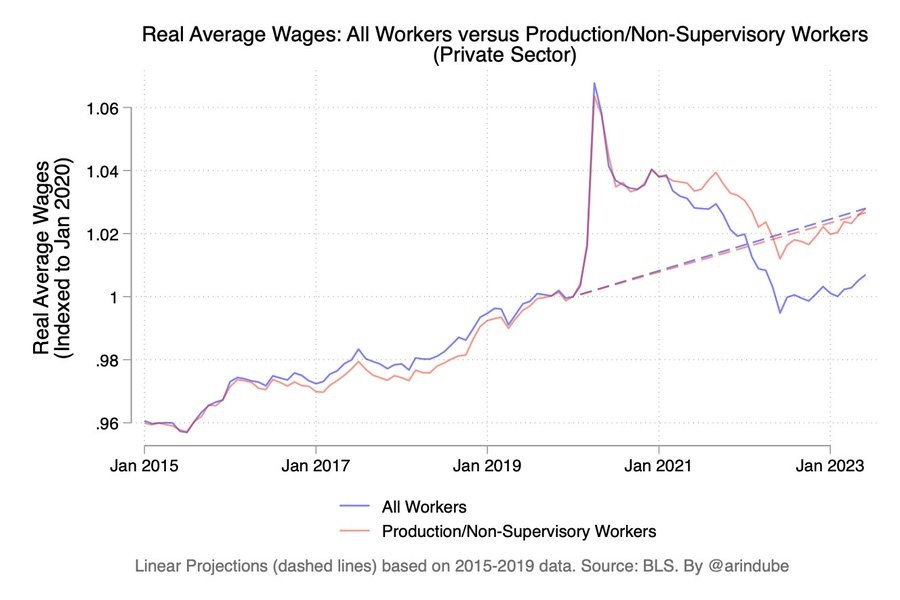

When it comes to income, for a while, we were definitely off-trend. High inflation cancelled out wage gains (and then some), making us poorer than before. That changed recently (for the time being), such that we’re no longer poorer than before. We are still poorer than “we ought to have been,” but we’re getting closer and closer to mean reversion:

For lower-wage workers, there’s at least some evidence that they’re all the way back:

I think it’s fair to assume that this is a little optimistic given the priors of the author, but even so, it shows that lower-earners (i.e. non-supervisors) are basically back on track, while higher-earners (supervisors) are not.

In other words, income mean reversion is a mixed bag. The story is consistent with higher rates creating pressure from the top down, while secular aging creates pressure from the bottom up, so I would expect it to continue like that for a while, but we shall see.

Either way, as with oil, full mean reversion isn’t exactly what we want either, or rather it’s good and bad at the same time: being less rich is not fun, but just as rich would be inflationary. Mean reversion is again “just right.”

Housing reversion

What about housing?

Keep reading with a 7-day free trial

Subscribe to Random Walk to keep reading this post and get 7 days of free access to the full post archives.