The Almighty Consumer continues to be fine

A quick check on consumer credit, spending, BNPL, living paycheck to paycheck, gas and cars

Banks report “nothing to see here” for consumer credit

spending is up, ecommerce FTW, and BNPL gains share

except for gas

“living paycheck to paycheck” is definitely a thing, especially for one kind of household

auto-prices only go up, and never go down (lol)

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. The Almighty Consumer continues to be fine

Between the holiday shopping bonanza, the strong retail sales report, and generally rosy credit outlooks from the banks, the Almighty Consumer seems pretty ok.

Spending is up (except for gas)

Plenty of banks reported, and not a one reported anything too scary on the credit performance side of things.

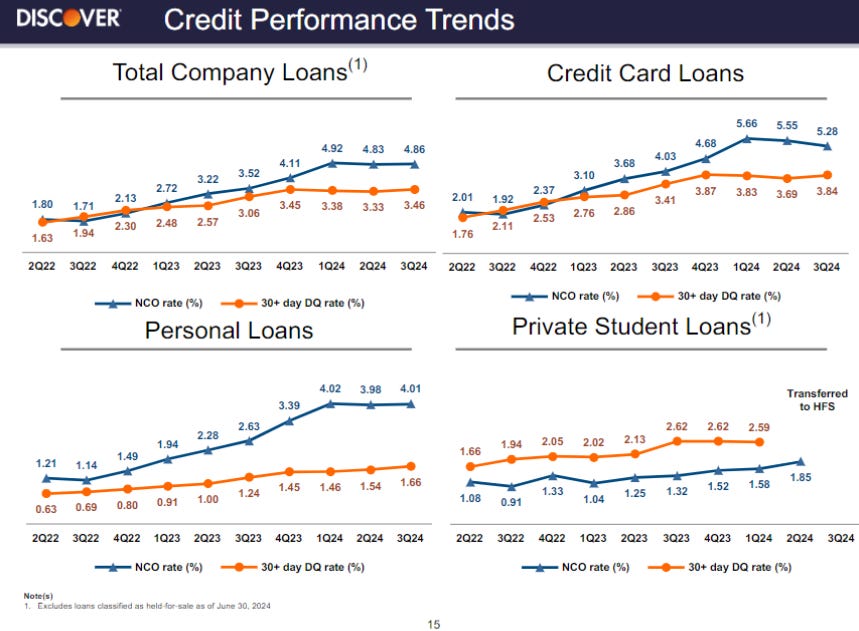

I randomly picked Discover DFS 0.00%↑ to illustrate the point, but if you see any consumer distress, please let me know:

NCO and 30-day delinquency rates both look pretty stable, and have been for about a year.

No consumer stress there. Are delinquencies still a bit high for auto and credit card in certain pockets? Yes. Did the banks increase loss reserves a bit? Also yes. But still, no consumer stress, in the main.

And people are definitely still shopping (which we already knew).

At least as of the first week of October, yoy consumer spending improved pretty much across the board.

Household spending was up 2.5% yoy, with online retail up 5%(!)

e-commerce is undefeated!

Is it buying cheap tchotchkes on the internet with BNPL? It just might be: