The Housing "Shortage"

Housing "Shortage"; WFH is good (sorta); Solar is good (sorta); BNPL is good (sorta); Consumer is good, the taxpayer is not. Reads on elder care, Insta, AI+Law, and more.

Nvidia did a thing where it sold almost 2x as much stuff as it did last quarter. Fortunately, people never buy a lot more than they need when they get very excited and think supplies are going to run out, and they’re always very disciplined when the magic of technology doesn’t immediately deliver significant results.

Random Walk will be on vacation next week, so this is especially loaded edition of Thinks and Reads.

RW Thinks:

The Housing “Shortage” or perhaps a different kind of shortage

WFH is good, albeit imperfect (reprise)

Solar’s time to shine (and also blot out the sun)

People like to buy now, pay later, which is a win for technology

Consumers are fine, but taxpayers are screwed

RW Reads:

The Scam in the Arena (or thoughts on Chamanth and his SPACs)

Fading elder care in an aging nation

Instacart’s growing (ad) revenue

AI is reinventing the legal industry

Have a wonderful last week of Summer everyone, and remember, it would mean the world (seriously) if you would just push the button:

Random Walk is an idea company dedicated to the discovery of idea alpha. Find differentiated data, perspectives and people, and keep your information mix lively. A foolish consistency is the hobgoblin of small minds. Fight the Great Idea Stagnation. Join Random Walk.

Random Walk Thinks

The Housing “Shortage”

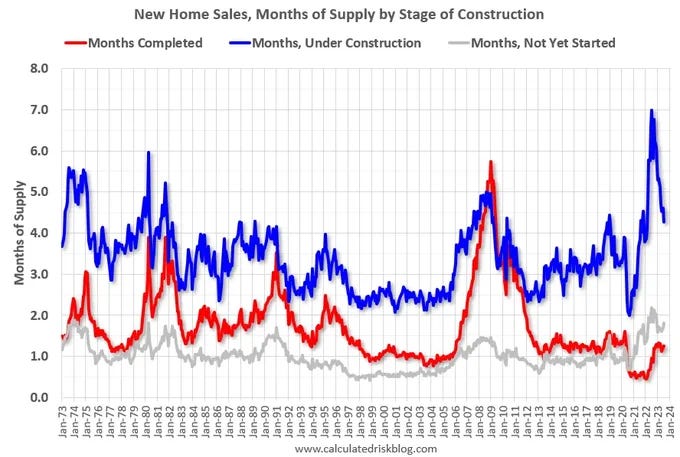

The supply of new homes is now at or above pre-pandemic levels:

The backlog for homebuilders, i.e. unserved customers, is now getting back to normal, as well:

Purchase interest, as indicated by new mortgage applications, reached a 30 year low (which, OK, because rates are high, and would-be sellers are “locked-in” by unrealized losses on their homes):

Still, none of this screams housing “shortage” to me.

Remember, the number of would-be homeowners hasn’t really increased much in a while (blue, orange and black):

Housing units have largely kept pace with people-growth:

Again, nothing screams shortage.

I get that the places builders build (the South and West), aren’t the places where “shortages” might be, like the Northeast (which, y’know, is losing people). Still, zoning and/or lazy builders can’t be the only impediment to this supposedly rampant housing “shortage.” It just doesn’t make sense. Oh look, too many vacant lots . . . the mystery abounds.

Now, perhaps there’s a housing inventory mismatch.

Yeah, that could be, for an aging, lonelier nation who may need smaller places to live. That helps explain why New York City, for example, has lost hundreds of thousands of residents, but doesn’t have the same number of vacant units suddenly available—because now more people are living alone and without children (so fewer people, same number of units).

That also helps explain why ADUs (Accessory Dwelling Units) are a new hot thing. ADUs are basically one-person mini-homes that you can set up in your backyard. New York State is apparently giving money away to people who put them on their property.

But a shortage? No.

Look, there may be very few homes for sale in the places that people want to live. That seems to be the open and obvious observation that is leading most people to casually conclude “shortage.”

But that’s a “places that people want to live” shortage (not a housing shortage) and you need a theory of what makes a place worth living to tie it together.

In suburbia (as opposed to urbia), limited density is a feature and not a bug. The simplistic bleating of YIMBYs saying “BuILD MoAr” is just a recipe for making those suburbs less attractive places to live, and self-defeating in the longer run. “People are fleeing the cities for the suburbs, so what we need to do is make the suburbs more like cities” is an impoverished line of reasoning, to put it mildly.1

I think the harder truth is that the shortage isn’t homes, but places where people want to build homes—and it’s not for lack of land. Outside of a few truly exceptional places, like Malibu or Martha’s Vineyard, “location” isn’t that special. The special thing that drives value are the bundles of high quality social capital that make places worth living. Critical mass. Hard to achieve, but once it’s there, it has it’s own gravitational pull. At the end of the day, though, it’s the people, not the place.2

The question then isn’t “why aren’t there more homes in Westchester?” The question we should be asking is “why aren’t there more Westchesters?”

It’s a hard question, and RW doesn’t know the answer, but it’s at least the correct question, and that’s a good start.

WFH is still good, even if it’s imperfect

The New York Fed offered some survey results that perfectly capture the tradeoffs of remote work. It’s good for employees, and from an expense standpoint, but it’s bad for one-team-one-dream cohesion and communication:

Interestingly, the respondents were mostly split on the impact to productivity, with a slight bias towards “it’s bad for productivity.”

Look, I get it. As a fan of (hybrid) WFH, RW knows that there’s always tradeoffs, and it’s pretty intuitive that in-person interaction is relatively better at building a shared culture for most people.

RW’s longstanding view has been:

‘all-day, everyday,’ never made sense (even if ‘no-day, never’ presents its own set of challenges);

there are lots of positive externalities of spending more time with your family and neighbors, as opposed to sitting in traffic for three hours everyday; and finally,

the productivity question is complex—outside of the lost commute-time, lots of functions and people do not need constant oversight to perform (especially top-performers), and in fact, the “water cooler” talk is a net drag on productivity (and offers little benefit in the way of “idea generation” or some other nonsense).

Hybrid is the way to go for most people, most of the time.

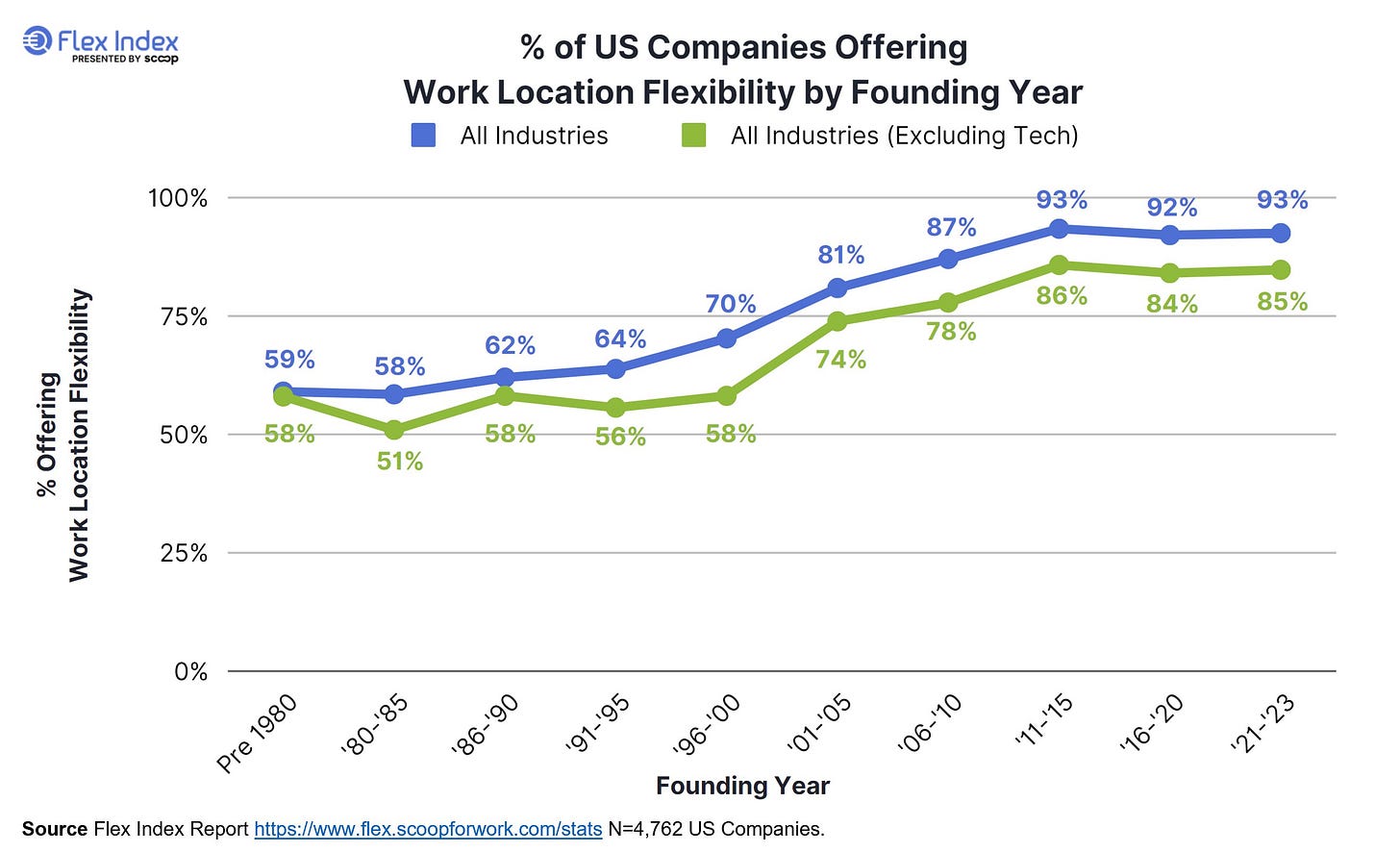

Nick Bloom, the co-founder of wfhresearch.com, makes the interesting point that cohort effects ought to drive the persistence of WFH going forward—younger firms are more likely to offer flexibility, and as those firms mature (presuming that they do mature), flexibility should become increasingly the norm:

Idk, that’s the outcome I’m rooting for, at least.

If you’re curious, the pre-Labor Day swipe card data keeps telling the same story:

The glass is pretty consistently half-empty for now, but post-Labor Day data will be when the rubber hits the road.

No sunlight for you

There’s been a decent amount of optimism around solar recently.

It’s hard to get a good sense of how valid it all is because the lines between analysis and boosterism are so thin, but it seems accurate to say that solar energy has been carrying an increasingly large share of energy consumption, and substantial additional capacity is on the way. That seems like a very good thing.