When it comes to housing, it’s the interest rates, stupid

Home values are coming down, because there is no affordability-shortage crisis, but there is a 30-year fixed rate mortgage subsidy crisis

Apologies for the delayed send. I messed up the post-scheduler again.

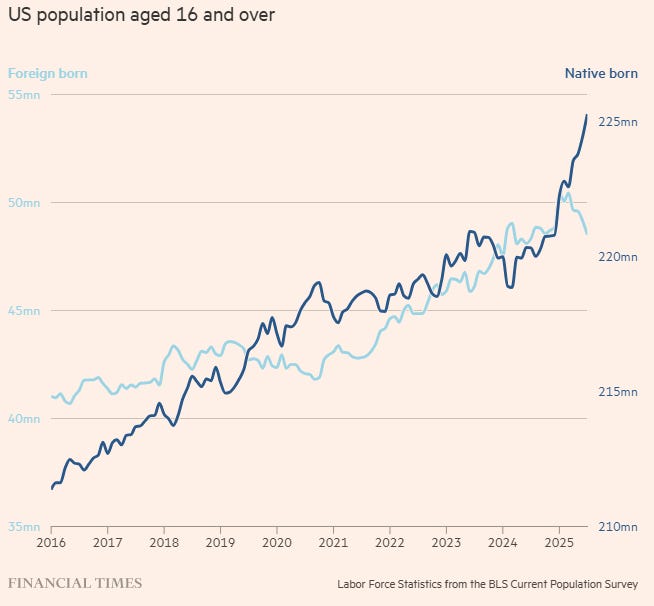

first, a data caveat to the ‘foreign born’ workforce reversal

And then, the main event: It’s the interest rates, stupid

decline in home values is obvious, if you know where to look

CRE values are down, rents are down . . . but owner-occupied single-family homes just go up? Puh-lease.

St. Louis Fed confirms: Random Walk is right, it’s the interest rates, stupid

Decline in existing home values is showing up in clearing prices

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. 👋👋👋Random Walk has been piloting some other initiatives and now would like to hear from broader universe of you:

(1) 🛎️ Schedule a time to chat with me. I want to know what would be valuable to you.

(2) 💡 Find out more about Random Walk Idea Dinners. High-Signal Serendipity.When it comes to housing, it’s the interest rates, stupid

A brief reminder that there is no “housing affordability-shortage crisis,” but there is a 30-year fixed rate mortgage crisis.

But first, a quick update on Rock meets hard place, as ‘foreign born’ inflows reverse.

An update on population changes, and ‘data is hard,’ BLS edition

As per earlier this week, Random Walk reiterated that closing the border is a far more consequential policy move than tariffs. That point is still valid, but some caveats on the data, specficially.

The FT points out that at least some of the shifts in “foreign born” population may be due to reclassification as “native born”

The native born population of 16+ jumped by 5 million people.

Counting people is hard. Did the BLS head deserve to lose her job? Honestly, I have no idea—maybe the org could be run better—but there is no consipiracy, of that I’m fairly sure.

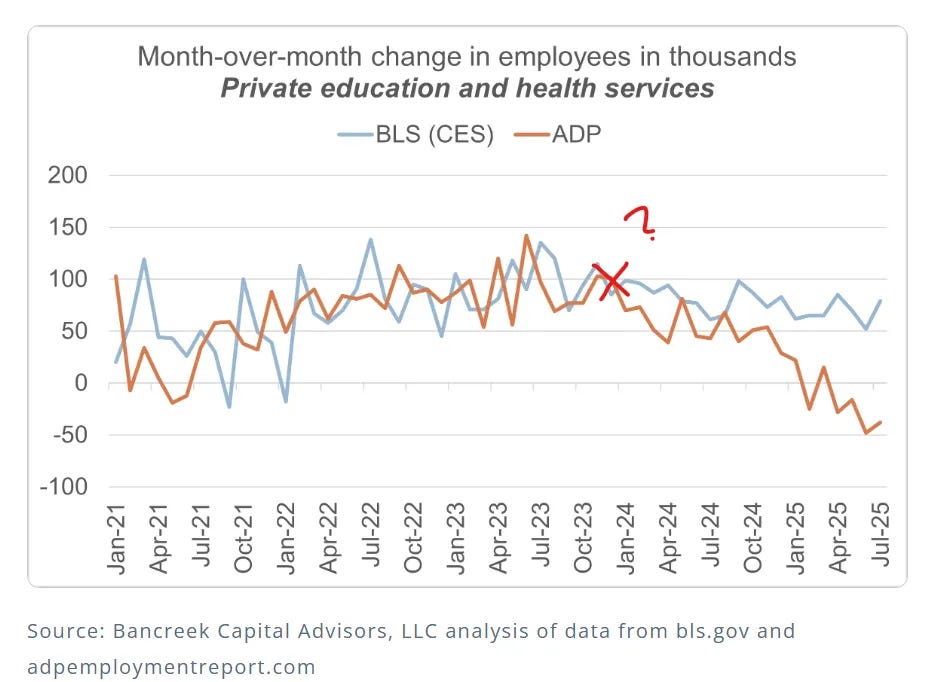

Here’s another interesting aside.

Apparently the ADP’s labor market counts began to diverge with the BLS only ~1.5 ago:

Why that divergence happened, I don’t really know (and no one else seems to either), but there was some methodology change, so perhaps it’s that.

The real takeaway is that this is noisy data, as per always, and data is hard, but it’s also good caveat re. the decline in foreign born workers.

Home values are coming down (because it’s the interest rates, stupid)

There is, of course, no housing shortage (and here), no affordability crisis, no lock-in effect, and no perma-upward-ratchet in home prices.

All that there is are sticky prices and unmotivated sellers. But just because transactions aren’t clearing, doesn’t mean that values haven’t declined (because they have).

When rates go up, asset prices go down, especially when the asset is heavily financed, like a car, or real estate. With higher borrowing costs, purchasing power goes down, therefore prices go down. It’s that simple.

The reason it doesn’t look like existing homes have gotten cheaper (as opposed to new homes where price depreciation is indisputable)1 is solely because existing homeowners are less inclined to sell in a downmarket, and they don’t really have to.

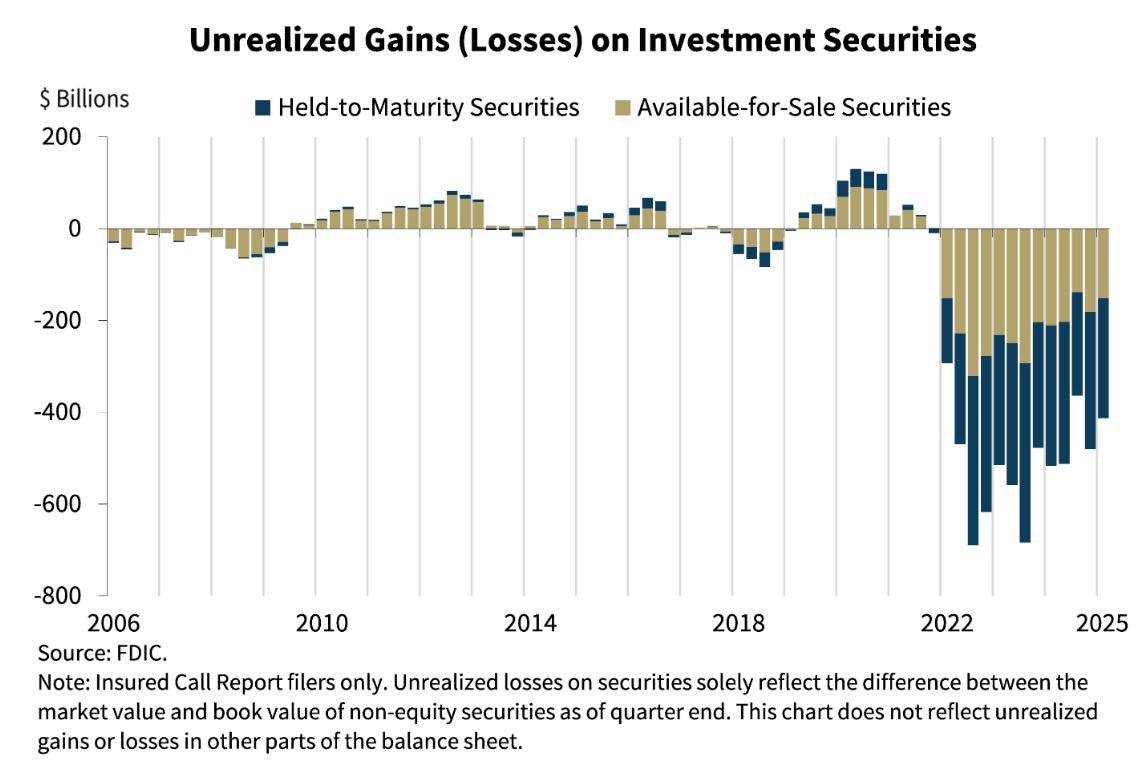

Banks bear the decline in home values, for the most part

All those increased borrowing costs are born by their banks, who are locked-in to low-rate 30 year mortgages—the loss in value shows up as “unrealized losses” on their balance sheets:

Low-interest mortgages have lost hundreds of billions in value, but the underlying collateral just gets more valuable . . . sure sure.

If you wanted to “fix” the housing market, the correct and effective solution would be to convert 30-year mortgages into floating rate or shorter-term fixed mortgages. If you did that, homeowners would be forced to internalize higher borrowing costs, and they would be much more inclined to sell—at prices that would actually reflect prevailing borrowing costs.

CRE values are down (because their mortgages aren’t 30 years long)

In other words, homeowners would become more like institutional property owners, and you’ll never guess what’s happened to the values of institutionally-owned properties: