AI everything cycle, and SaaS strikes back (maybe)

The paradox of the AI everything cycle that's bullish for pretty much only one thing

AI’s contribution to the GDP (reasonable minds differ)

A general purpose technology, but the “general purpose” part takes a few years

A SaaSCo riding AI into the future?

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. 👋👋👋Random Walk has been piloting some other initiatives and now would like to hear from broader universe of you:

(1) 🛎️ Schedule a time to chat with me. I want to know what would be valuable to you.

(2) 💡 Find out more about Random Walk Idea Dinners. High-Signal Serendipity.AI everything cycle (the latest charts)

There’s been some disagreement about how to calculate AI’s contribution to GDP growth.

It’s a little academic, bc a lot of it comes down to the specific accounting features of GDP, and I don’t personally find it that interesting.

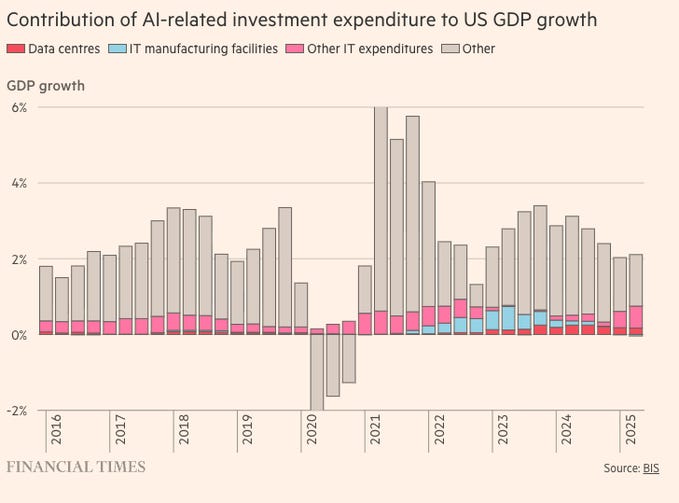

Anyways, whether you buy the math or not, by this calculation, AI capex is about ~third of net-new GDP:

Data centers and “other IT” constitute ~75bp of GDP growth, thus far.

The AI contribution, when measured that way, isn’t actually that large in the big scheme of things. 2018, for example, had nearly the same contribution. The difference this time is that the rest of the economy is doing comparably less.

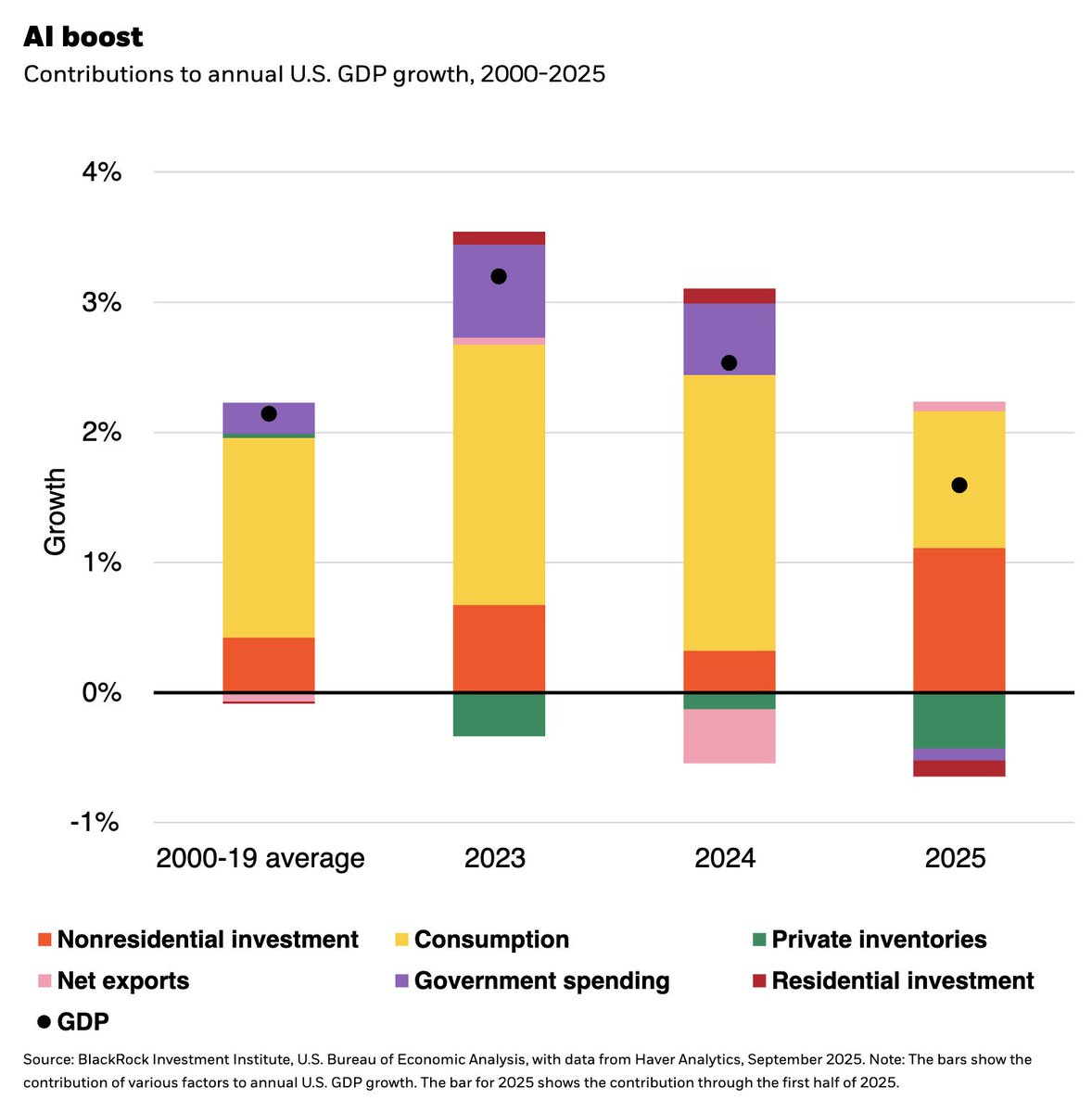

Over a longer time horizon, it looks like this:

Blackrock’s estimate is that AI has contributed roughly half of net-new GDP.

If previous cycles were about building structures for people (“residential investment”), this cycle is about building structures for supercomputers (“nonresidential investment”). Quieter neighbors, I suppose.

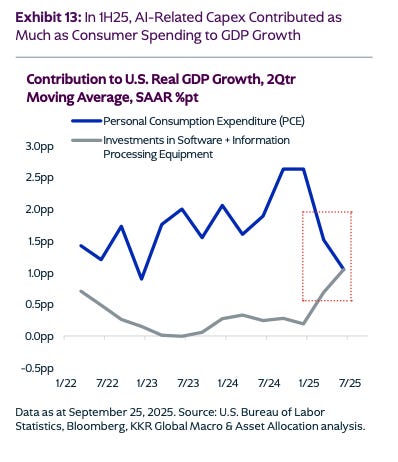

Here is yet another way of looking at it:

AI Capex is now contributing roughly the same amount to GDP as personal consumption.

Or, it was contributing the same amount back in July. The more important point, and really the indisputable one, is that the AI investment impulse is increasingly the only pro-cyclical game in-town.

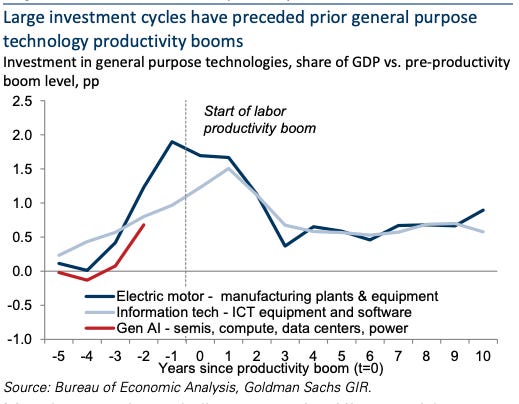

For now, at least, because of course the hope is that AI will unleash a pro-cycle everywhere, although that may take some time:

If past GPT investment cycles are any guide, we’ve got a coupla years before the productivity gains kick in.

While I’m a little skeptical of measured productivity, I do think we’ll see substantial productivity gains, often in unexpected ways. Remember that YouTube wasn’t even around until almost 10 years after the internet took off.

ICYMI

Real AI winners please stand up and/or SaaS strikes back?

On a somewhat related note, Random Walk has observed that whatever bullishness is justified by the AI buildout, it’s not manifesting in any appreciable stock market gains for the putative beneficiaries of the buildout.

It presents something of a contradiction: either we’re wildly investing in the infrastructure, or investors are wildly under-valuing the field that stands to benefit.

Here too, is another way of looking at it: