Some creaking and two shocks, walk into a bar

Musing on the tenuousness of an otherwise fine state of affairs with 12 charts

eerie, but fine

‘panic at the shadow banks’ or just a very special situation

Oracle makes history, as lending enters the picture

ai revenue gap or nah?

shocking rise of electricity, but how much does AI cost really?

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. 👋👋👋Random Walk has been piloting some other initiatives and now would like to hear from broader universe of you:

(1) 🛎️ Schedule a time to chat with me. I want to know what would be valuable to you.

(2) 💡 Find out more about Random Walk Idea Dinners. High-Signal Serendipity.Some creaking and two shocks, walk into a bar

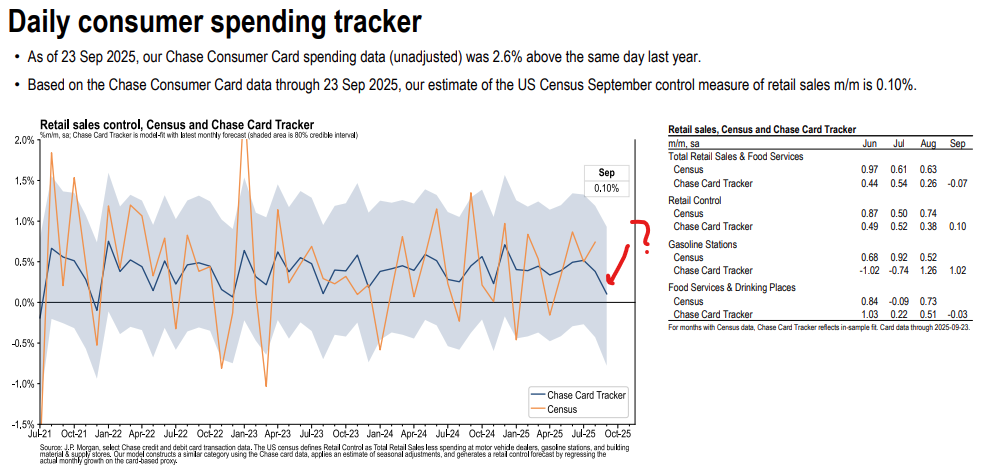

Things continue to be a bit eerie, but otherwise fine.

Labor market is the same story: no one is hiring, no one is firing, no one is quitting.1

If people are employed, they continue to spend, and so they have.

Are stocks pretty expensive, with some signs of speculative behavior? Yes, sure.

Is there some downside risk as margins compress and growth slows, which they certainly might? Also, yes.

We can certainly expect some creaking in the joints as we ‘normalize’ to the middling outcome, but nothing catastrophic appears to be in the offing.

Any shocks to look out for? I can think of maybe 2 (which is kind of 3), but for whatever reason, they’re not keeping me up at night.2

Consider this a little meander through the creaking, normalizing, and wonder.

ICYMI

Cracks to emerge in private credit

This oldy-but-goody never fails to excite.

Shadow banking is finally ready to blow!

Oaktree says that some of the older vintages of private credit “will have some problems.”

Ms. Poli also says “I’m still bullish” and saw “no chance of wider systemic risk.”

She would say that, wouldn’t she.

I mean, yes, both because she’s talking her book, but also because “some problems” but “no chance of wider systematic risk” is the god-honest truth.

Random Walk has done this dive repeatedly before, looking for signs of chicanery, and mostly coming up empty. Yes, there’s some creaking at the bottom-end, as loans re-price at higher rates for businesses that lack the growth to cover the difference, but the industry (like Ms. Poli) is mostly licking its chops.

Consider the following, from old Random Walk friend, Steve Tesoriere, also of Oaktree:

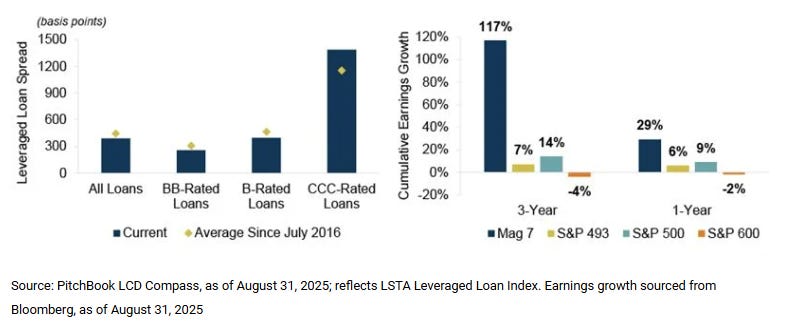

We see a similar pattern [of haves and have-nots] in credit, shaped by lender risk tolerance. Solid borrowers face little resistance: BB-rated loans yield 6.9% – a spread of just 257 bps – yet still attract capital from both public and private markets. (See Figure 1.)

In contrast, CCC-rated loans trade at 1,388 bps. The spread reflects a bleak outlook. From 2010 to 2021, LBO volumes accelerated on the back of zero-rate policies, fueling acquisitions with excess leverage and high multiples. Today, floating-rate debt from those pre-2022 deals has doubled in cost. The result: median cash flow coverage for CCC-rated loans has dropped below 1x and is only slightly higher for bonds . . .

For opportunistic credit managers, the stage is set for a structurally elevated opportunity to buy deeply discounted debt, potentially for many years to come.

Catch that?

Most companies are fine. Some companies, however, are in deep trouble—coverage ratios less than 1—because they can’t afford the higher cost of debt, and that ‘sets the stage’ for a discount buying bonanza.

In other words, it looks for all the world like there’s some pockets of wreckage coming, and ‘shadow lenders’ have been monitoring its approach like a batting-practice ‘fastball.’

Oh, you don’t think that the industry has been gearing up for this?

Follow the flows: