China feelin’ the pinch (maybe), and pinching back (maybe)

China is 'losing' the trade war, but then why get iced up?

China approaching its demographic winter differently (reprise)

China ‘dumps’; we do industrial policy

‘sell more, earn less,’ can’t keep it up for long

gold is acting a little bit odd

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. 👋👋👋Random Walk has been piloting some other initiatives and now would like to hear from broader universe of you:

(1) 🛎️ Schedule a time to chat with me. I want to know what would be valuable to you.

(2) 💡 Find out more about Random Walk Idea Dinners. High-Signal Serendipity.China feelin’ the pinch (maybe)

Random Walk has long articulated the view that a good way to understand China is that they are approaching their demographic winter differently.

While the US subsidizes demand by borrowing globally to finance domestic consumption, China subsidizes “domestic” manufacturing to meet global consumption, pretty much everywhere.

Put another way, we subsidize our consumption by selling credit to the world (and ourselves), while China subsidizes its production to sell stuff to the world (and itself).

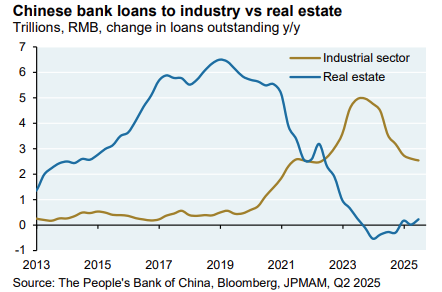

If the blue bump created a Chinese real estate bubble, then what will the yellow bump do?

In both cases, growth is at least partially engineered (which it has to be, given slowing/declining population growth), but the mechanism (and downstream effects and tradeoffs) are obviously pretty different.

That China depends on selling stuff to everyone everywhere for growth, is also why China will “lose” a trade-war. If your entire strategy is satisfying the world’s demand for stuff, then you cannot lose the world’s preminent stuff-buyer, without considerable pain. Sure, we’ll definitely incur some costs by finding other suppliers and/or substitutes, but China cannot substitute for ~300M of the biggest spenders.1

China can, of course, try to make up the shortfall by redirecting exports to already saturated markets with the effect of (a) further crowding-out domestic manufacturers in those markets, e.g. German automakers, thereby triggering even more tariffs; and (b) driving down prices to compensate for the glut of supply, making Chinese exports, considerably less profitable.2

In other words, there are outer limits to both strategies.

ICYMI

China “dumps” (but our industrial policy is ‘just right’)

Anyways, that China has tried those things, and that it is scraping those outer limits, is precisely what has transpired. There’s even a trendy new word for it, called “involution.”