The month the labor market broke?

One bearish labor market take, and the reasons why it might not be correct

some alt data says, “this time, the labor market is different”

other alt data say, “not so fast”

‘tight but not strong’ and the two-cylinder economy, reprise

whither college grads?

step aside, old man

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. 👋👋👋Random Walk has been piloting some other initiatives and now would like to hear from broader universe of you:

(1) 🛎️ Schedule a time to chat with me. I want to know what would be valuable to you.

(2) 💡 Find out more about Random Walk Idea Dinners. High-Signal Serendipity.The month the labor market broke?

The CEO of an employment data and analytics company, Aura Intelligence, published a very bearish take titled September 2025: The Month the Labor Market Broke.

It’s a little hard to summarize, but basically, “lots of signs of contraction, mass layoffs on the way, this time it’s different.” I mean, there’s more to it (and the CEO is a friend), so just read it, if you’d like the specifics.

Personally, I’m not persuaded.

Certainly it’s true that our structurally fragile economy is down to basically two-cylinders: acyclical healthcare, and pro-cyclical AI.

AI is a job-maker, but not much, especially because data centers are pretty labor non-intensive.

Healthcare is definitely a job-maker, but the gangbusters catch-up period of ‘22-’24 is over, and one can expect more moderate growth, going-forward.

Narrowness, normalization, plus a now-closed border, basically explain the present state of affairs.

It’s not the best, but two cylinders is better than no cylinders, and while job growth will be middling (and sometimes non-existent), that’s “ok” because people-growth is also middling (and sometimes non-existent). We need less job-growth to keep unemployment manageable—that’s what’s referred to as the “lower breakeven.”

Of course, what’s different this time around, is that “low unemployment” doesn’t mean that everything is awesome.

A lower breakeven means that we can have low unemployment and still maintain an otherwise uninspiring growth trajectory, which continues to be Random Walk’s headline view of where we’re going. Not great. Not terrible.

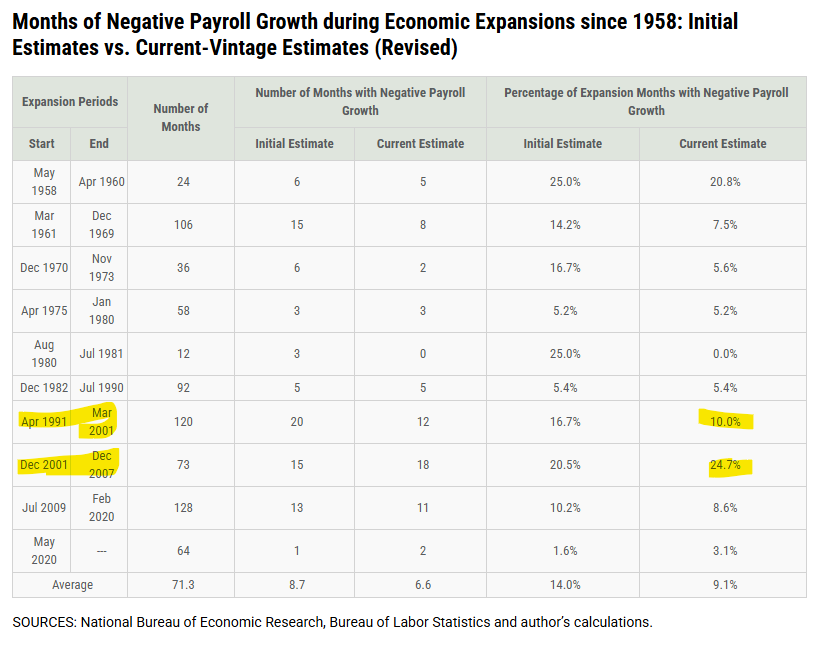

Incidentally, we can have periods of growth with intermittent periods of negative job-growth:

1991-2007 (but especially 2001-2007) had the highest share of negative payroll months for any expansionary period.

You might even call it the “neoliberal period.” That credit-driven expansion would have some bumps in the road, from a labor-growth standpoint, isn’t surprising.

Anyways, while a more catastrophic break to the downside ala Aura’s doomcast, is definitely possible, it’s unclear why it would happen, and more importantly, it’s not really showing up elsewhere in the data.1

ICYMI

Tax-Man Cometh

First, the favorite indicator that most people have never heard of (courtesy of wabuffo).