Fallen healthcare angels

A portfolio update; where OBBBA austerity hits hardest; managed care strikes back (against PE, the people's champ); China eats biotech; healthcare makes all the lady jobs

Big beautiful austerity is inbound, so healthcare stocks are very cheap. A time to buy?

where austerity hits hardest;

When it comes to coverage denials, PE is the people’s champ (for now);

China eats biotech, cheating edition (reprise);

healthcare makes all the lady-jobs;

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. 👋👋👋Random Walk has been piloting some other initiatives and now would like to hear from broader universe of you:

(1) 🛎️ Schedule a time to chat with me. I want to know what would be valuable to you.

(2) 💡 Find out more about Random Walk Idea Dinners. High-Signal Serendipity.Picking up fallen healthcare angels

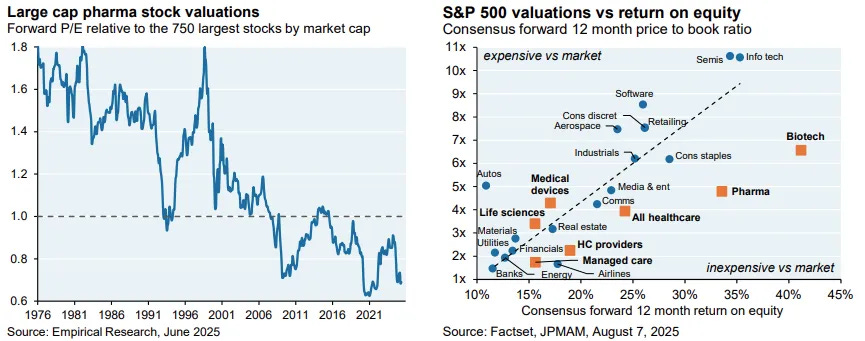

Healthcare stocks are very cheap, relative to the rest of the market.

It’s somewhat remarkable, at an abstract level, given how much money we spend on healthcare (and how much we will continue to spend on healthcare). Like, if there was a more sure-fire secular tailwind than “dollars flowing to healthcare,” then I’d like to be the first to know.

But, healthcare stocks are undoubtedly cheap:

Healthcare valuations relative to other parts of the market are cheap, any way you cut it.

Why is that? Is there something useful here, or just remarking on an interesting aside?

As per always, it’s a bit of both. Read on, my best beloved . . .

ICYMI

Big Beautiful Austerity Inbound

Now, a good part of why healthcare stocks are cheap is because of the fiscally responsible parts of President Trump’s signature budget bill.

The OBBBA includes some big cuts to medicaid and ACA spending, as well as reimbursement pressure, that has led some of the largest managed care companies to say “uhhh, we no longer have any ability to forecast revenues for the foreseeable future.”

That’s not the only reason, but it’s a big one, and well, fair enough.

The market soured on managed care in a hurry.

What did y’all think austerity meant? vibes? papers? essays?! I mean, someone has to take it on the chin.

Incidentally, Consumer Edge took at stab at identifying which facilities and procedures are most/least exposed to OBBBA-Medicaid cuts (where anything more than 1 is “over-exposed”):