For VC, the song remains the same, which is why it's totally different now

17 Charts on the current and future states of VC, a multi-part series

Publishing Note: My apologies for the extended silence. I’ve been traveling, and separately, have had to attend to some other things. I’ve been working pretty hard, though, and have some pretty beefy posts lined up, and a few other fun projects in the queue, so I’m not that sorry.

Hopefully, you missed me though. Distance makes the heart grow fonder.

Today, Random Walk does VC. 17 charts on the current state-of-play to purge the old-cycle, and usher in the new. If you’re an LP, GP or founder (or just a curious passerby), this one is for you.

Part I of a multi-part series on what is, and what ought to come next, for the funnest of the asset classes.

an ‘extinction event’ foretold, and come to pass;

go public, startup man, because the exit market is WIDE open—it’s never been opener;

liquidity, liquidity, everywhere, and not a drop to drink (but why?!)

Also of note, the footnotes are the fully-loaded variety, so ignore them at your peril.

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. For VC, the song remains the same, which is why it’s totally different now

It’s been a while since Random Walk took a look at the state of private capital markets, particularly VC.

The story largely remains the same:

liquidity events are few and far between, leaving a large overhang of invested capital with nothing to show for it;

lack of exits has made liquidity scarce for LPs, which has made fundraising tough for VCs, which has made fundraising tough for tech companies, which is something of an “extinction event” for both of them;

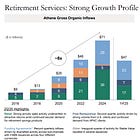

the exceptions are the megafund multistrats, and AI-related startups, where fundraising and deployments are bigger and pricier than ever.

There are some big changes afoot, which Random Walk will begin to unpack, but as a 10,000 ft view, that’s basically the lay of the land.

👋👋👋Random Walk has been piloting some other initiatives and now would like to hear from broader universe of you:

(1) 🛎️ Schedule a time to chat with me. I want to know what would be valuable to you.

(2) 💡 Find out more about Random Walk Idea Dinners. High-Signal Serendipity.ICYMI

An ‘extinction event’

I mean, does the following look like an ‘extinction event’? I think so, although perhaps ‘healthy correction’ or ‘normalization’ is less catastrophist.

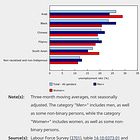

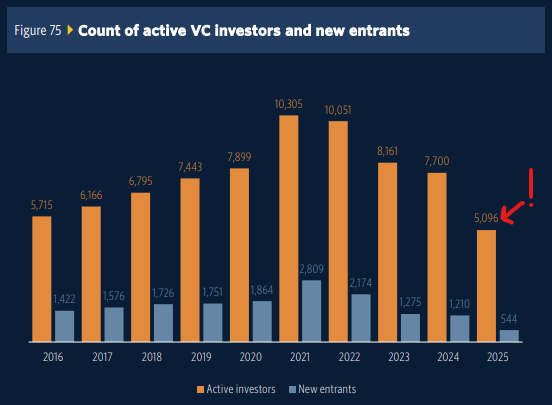

VC has created a large cohort of ex-VC:

The count of “active” VC is below 2016 levels.

Obviously take the data with a grain of salt, but that means more the half of the active VC from just a few years ago are out-the-game. That’s just brutal.

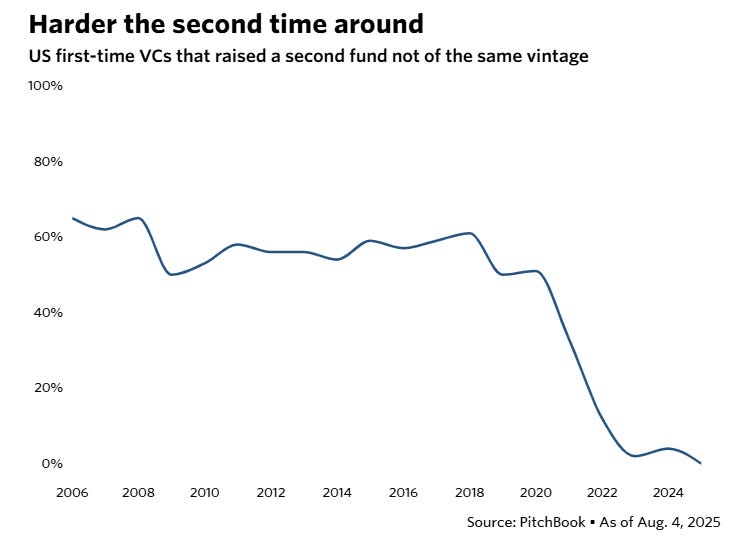

It’s especially brutal for ‘emerging,’ or first-time managers, that only recently entered the game:

Less than 10% of first-time managers have been able to raise a second fund.

Let that sink in for a moment. Historically, the graduation rate to fund II was ~55%, or slightly more than half. That number has dropped to just 1 in 10.

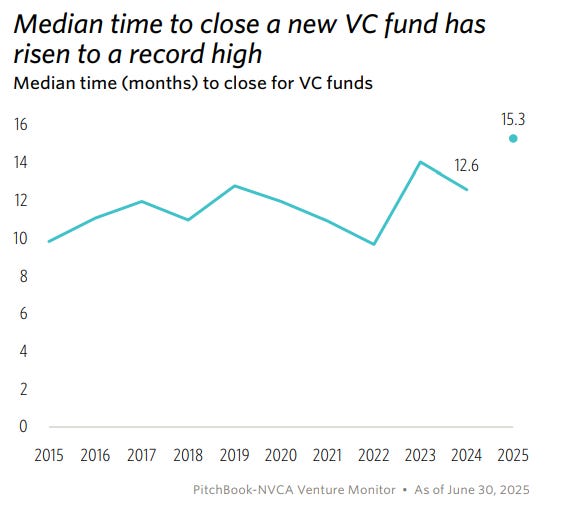

How long does it take to raise a new fund? That too has hit an all-time-high:

Median time to close on a new fund is now 15.3 months, or about 25% longer than it used to be.

Of course, fewer funds, means less funding for startups.

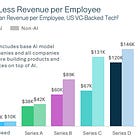

Unsurprisingly, graduation rates for startups are at all-time lows, as well:

At basically every stage, the 12- 18- 24- and 36-month graduation rates are lower than ever.

36-month graduation rates, i.e. the share of startups to proceed-to-next in less than 3 years is now approximately the same as 18-month graduation rates used to be. In other words, after 3 years, about the same number of companies have proceeded-to-next as they did in just half the time back before this whole pandemania got started.

To repeat, less money to go around means fewer VCs, which means less funding, which means less graduation. This stinks, but it’s been as obvious as an inbound freight train for the past three years, and no amount of “it’ll go back to normal” hopium was going to change it.

And so it didn’t.1

VC is dead! Long live VC!

The point is not to dwell on the negative (really). The point is that is that, by now, it should be obvious that the story is what it is.

The game has changed, a new cycle has emerged, and there will be no “return to [ab]normal” for venture. And that’s ok. Good, even. Onwards and upwards. VC is dead! Long live VC!

That isn’t to say that there aren’t plenty of unanswered questions, with various twists and turns, and shoes left to drop, because there most definitely are (some of which, we’ll get into below).

But whatever happens next—whether it’s some fashion of resolution for pre-2023 vintages, and/or just venture investing going-forward—will necessarily involve a whole lot of “new and different.” And that’s exciting, even if “new and different,” necessarily offers a mix of elation for some, and disappointment for others.

Still, it’s mostly just exciting, both at an abstract level (“yay! explore parts unknown!”), but also for the opportunities it creates (“yay! untold riches!”).

“New n’ different” also happens to be where Random Walk is going to focus the most attention (both as a general matter—in interviews, posts, and strategy—but also in this series of posts, specifically).

But first, let’s set forth some non-exclusive threshold questions and observations:

what’s going to happen to all those un-exited companies, and the VC who aren’t Sequoia, Andreesen, Founders Fund, etc.? What’ll it take to compete and survive?

Will investors (GPs and LPs) make any money from those prior vintages, or not so much?

is the liquidity broken (and if so, what’s the fix, is it secondaries, something else?), or are the investments broken (and, if so, what’s the fix)?

Random Walk isn’t going to address everything all at once, or perhaps ever, because that’s a lot to address, and Random Walk has varying degrees of insights on each one (ranging from ‘incisive, sharp,’ to ‘desolate, rank speculation’). But, what does follow is [now broken into multiple posts for concision and sanity]:

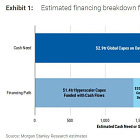

Part I: exit if you wanna, because I cannot reiterate it often enough that there is plenty of liquidity (because the IPO and M&A market is wide open);

Part II: why no exits, then? Secondaries are most definitely inbound, but secondaries will not save VC. There is, however, a semi-radical solution for saving at least some of VC, and adapting to the new normal of ‘private for longer’; and finally

Part III: some interesting charts I’ve picked up along the way.

It’s a lot, and it’s been backing up in the queue for a while now. But with table-setting and throat-clearing outta the way, let’s dig in.

The IPO (and M&A markets) are wide open

At this point, anyone who blames the lack of exits on “the market” is either lying speaking euphemistically or simply misinformed. The IPO markets are wide open.

As Michael Dempsey put it recently, and I’m paraphrasing, this is a peak exit market, and founders and VC would be foolish to miss it, because exit markets like this don’t come around often.

The fact is that investors are paying historically high prices for risk, and I’ve got a whole bunch of charts to prove it. These are *slightly* dated, because of the aforementioned publishing break, but the differences are immaterial.

To wit . . .