Four doomer charts that are probably fine

Mass firings, part-time struggles, broke youngs, overdue loans, and really, nothing to worry about (probably)

Mass firings, oh no!

part-time unlovers

the youngs are going broke!

‘a friendly reminder about overdue loan payments’

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. 👋👋👋Random Walk has been piloting some other initiatives and now would like to hear from broader universe of you:

(1) 🛎️ Schedule a time to chat with me. I want to know what would be valuable to you.

(2) 💡 Find out more about Random Walk Idea Dinners. High-Signal Serendipity.Doomer charts that are actually probably fine

Four doomer charts about the labor markets and the Almighty Consumer that seem really bad, but probably are no worse than normal.

Mass firing!

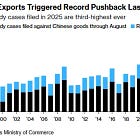

The first doomer chart is about layoffs.

The “no firing” part of the “no one is hiring, no one is firing, no one is quitting” isn’t keeping its end of the bargain:

Challenger job cuts are already higher than they’ve been since 2020!

A report from outplacement firm Challenger, Gray & Christmas showed almost 950,000 US job cuts this year through September, the highest year-to-date total since 2020—and that was before the heavy October run of announcements.

Sounds bad. The “announcements,” in this case, refer to UPS cutting 48,000 roles, Amazon cutting 14,000 roles, and a few other big names announcing smaller layoffs, as well.

But, here’s the thing: Challenger is a pretty low-signal dataset. To quote Guy Berger, “Challenger is informative directionally, but gets the magnitudes wrong.”

So, while Challenger is showing a dramatic increase in layoffs, it’s more likely that we’ve got a fairly moderate increase in layoffs instead.

Again, as per the inestimable Mr. Berger:

If you squint, the layoff rate nosed up.

Big dramatic job cuts have made some headlines, but they don’t seem to be broadly representative of the current state of things. Not yet, at least. Challenger is just being dramatic.

Slow hiring? Yeah, we got that, but that’s a different thing.

ICYMI

Part-time un-lovers

Here’s another doomer chart, that’s actually a bit more troubling.