SaaS Attacked (ongoing)

The big selloff on swiftly-growing software businesses continues apace

double-beat, raise guidance, and get crushed

return of the GAAP?

terminal value is . . . $0

of reflexivity and the incentives to beta and chill

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. 👋👋👋Random Walk has been piloting some other initiatives and now would like to hear from broader universe of you:

(1) 🛎️ Schedule a time to chat with me. I want to know what would be valuable to you.

(2) 💡 Find out more about Random Walk Idea Dinners. High-Signal Serendipity.SaaS-Attacked (and then some)

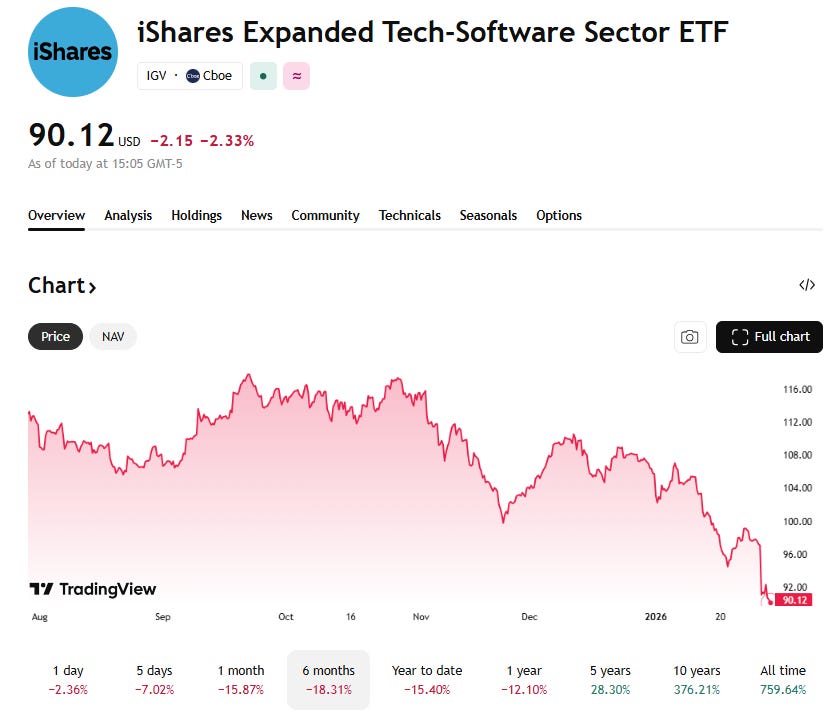

The SaaS bloodbath continues apace:

Just using the IGV 0.00%↑ SaaS ETF as a proxy, the segment dropped another ~7% last week (and is down ~15% for the year).

It’s a pretty remarkable thing for a segment that continues to grow topline revenue at a pretty healthy clip, and continues to improve profitability.

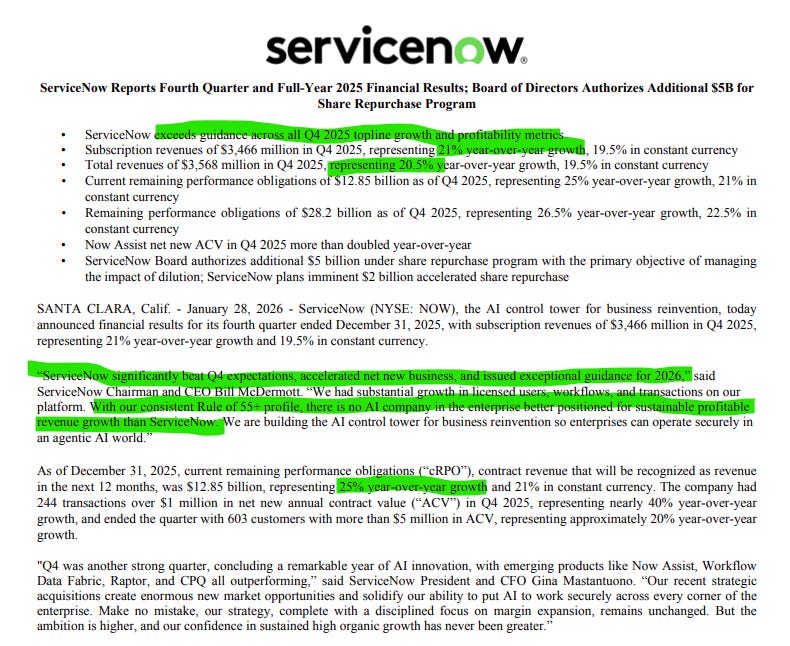

I mean, ServiceNow NOW 0.00%↑, the grand poobah of enterprise workflows, announced a double-beat and raised guidance:

20%+ yoy revenue growth and 31% (non-GAAP) operating margins is pretty good!

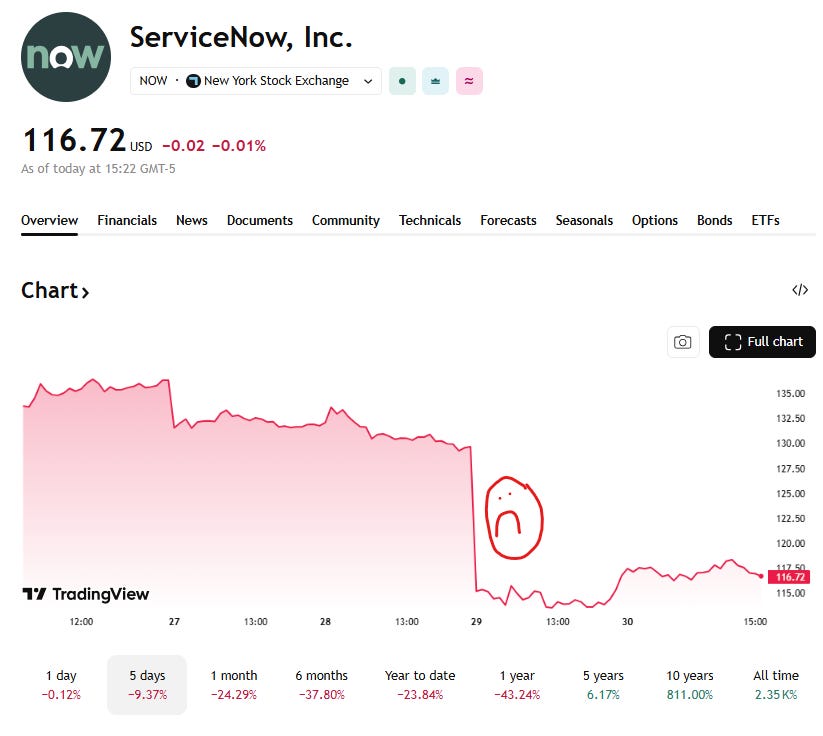

And yet, here’s what happened when NOW 0.00%↑ announced the good news to the world:

NOW 0.00%↑ plummeted ~8% after its double-beat and raise.

I mean, seriously? How does one figure? If folks were bearish on these big enterprise saascos, that’s fine, but why wait for a pretty stellar earnings call to initiate a big selloff?

As per always, “the market” does not think just one thing, so no one answer is going to explain these moves. Still, it continues to puzzle.

ICYMI

Return of the GAAP

It could be that some part of this is the “non-GAAP” reckoning for software businesses.

For years, software cos have used a good chunk of their profits to fund “stock-based compensation” (SBC) for their employees. They don’t have to do that, but if they didn’t, all those equity grants would dilute preexisting shareholders. So these companies look extremely profitable (bc they are), but then they immediately allocate those profits to SBC to avoid dilution (which means those profits aren’t really flowing to existing shareholders, which means these companies aren’t so profitable).

They can be more profitable and dilutive, or less profitable and non-dilutive, but not both (for the most part).

Any other business (and GAAP accounting) would simply call that SBC “payroll,” and operating margins would look much less impressive. But SaaSCos just kind of ignore it, and focus on non-GAAP metrics instead.

It’s not a secret, though, and investors have always sort of grumbled about it for years, but they’ve mostly just chosen not to care. At a certain scale, SBC dilution would just not matter, as much, most of these techcos are (in theory) valued on longer time horizons.

But maybe they’re starting to care?

On a GAAP basis, profitability for the median SaaSCo is much less impressive: