10 charts riffing on homebuilding, private credit, fiscal dominance (aka the futile Fed), private capital fundraising, and manager selection

Quick hitters on capital flows

no profits in homebuilding (and a data puzzle)

who will lend to the lenders (and one thing Random Walk got wrong about ‘zombie banks’)

what if the Fed lowers rates and rates just go up?

it’s really, really hard to raise a fund

manager selection is a big deal because the dispersion between strategies is pretty wild (especially for VC)

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. 👋👋👋Random Walk has been piloting some other initiatives and now would like to hear from broader universe of you:

(1) 🛎️ Schedule a time to chat with me. I want to know what would be valuable to you.

(2) 💡 Find out more about Random Walk Idea Dinners. High-Signal Serendipity.10 charts riffing on homebuilding, private credit, fiscal dominance (and the futile Fed), private capital fundraising, and manager selection

A quick grab-bag of riffs on themes.

No profits in homebuilding (reprise)

Just as a quick follow-on to Monday’s post re. the housing supply ‘glut.’

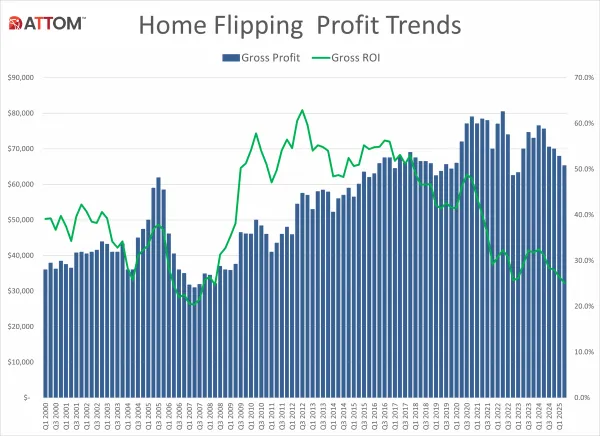

Not only are builder margins at GFC lows, but home-flipper margins are also at GFC-lows:

At 25% gross ROI, home-flippers are as profitable as they were in 2008.

Adding inventory in a softening market is no easy thing.

Conor Sen points out that Mr. Market agrees:

DR Horton DHI 0.00%↑ has massively out-performed Lennar LEN 0.00%↑ this year.

Why? DHI pulled back on building a while ago, while Lennar just got the memo.

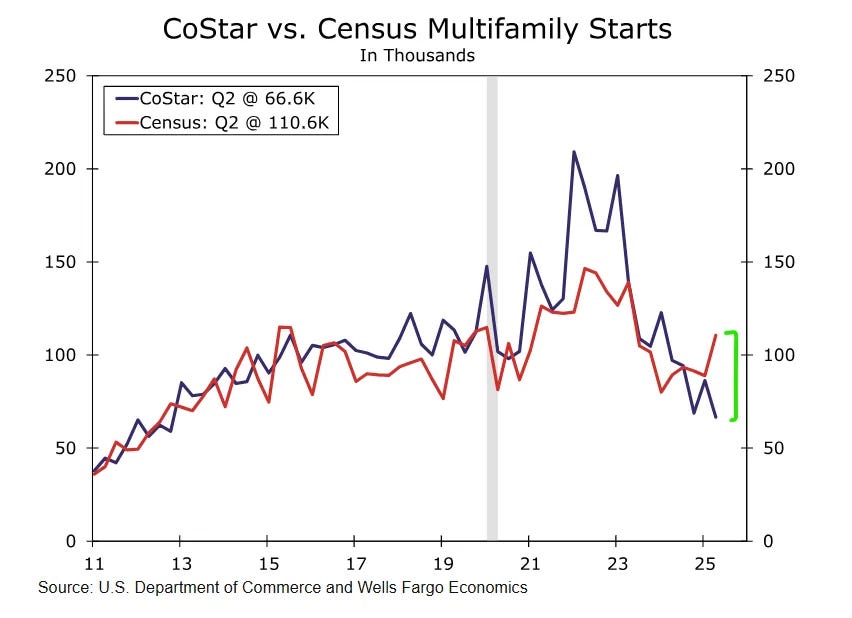

One interesting aside on “to build or not to build,” there’s a bit of a data divergence in multifamily starts (to put it mildly).

Public census data says multifamily starts are picking up, while private Costar data says the opposite:

Census says multifamily starts are +18% ytd;

Costar says multifamily starts are -30% ytd

All the data can be noisy, but my guess is that census is noisier, and CoStar is closer to the truth. Builder aren’t building because supply is running into the outer limits of demand.

ICYMI

Who will lend to the lenders (reprise)?

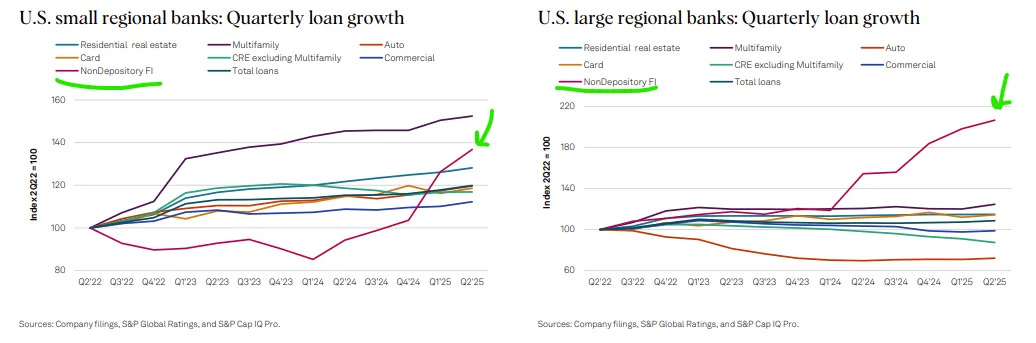

Just another chart that demonstrates some of the links between traditional banking and non-banklenders, i.e. private credit.

The shift to private credit, in part, reflects broader efforts to make banking boring.1 That is, rather than put deposits at-risk with lots of leverage, let investors (and longer-dated insurance premiums) provide the capital base to the credit markets.

It’s kind of worked that way, although banks are getting back in the game, but at least in one sense, it hasn’t.

Banks may have slowed their overall lending efforts, but nothing has grown more quickly than bank loans to non-bank lenders:

Since Q1’24, bank loans to non-depository institutions (e.g. insurance, private credit, etc.) have exploded.

These loans are still a small part of the overall picture, but risk is like water—it finds a way.

Rates go higher, and the Fed can’t do nothing about it (reprise)

Random Walk (and others) has variously speculated that lowering short-term rates won’t necessarily bring longer-term rates down.

If the net-new buyer of long-term bonds is price-sensitive, then the fact that Uncle Sam borrows more and more (with a worsening balance sheet) means that investors will simply demand higher yields, regardless of what the Fed does. Crowding out is here, it’s just not evenly distributed.

What does lower-rates-make-higher-rates look like?