Home values are so low, we can't profitably build (and other real estate desiderata)

7 charts on real estate to thrill and delight

home values cut (deep) into builder margins

construction input (tariff) mystery

bid-ask, too wide

RTO for SF

where does the people growth come from?

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. 👋👋👋Random Walk has been piloting some other initiatives and now would like to hear from broader universe of you:

(1) 🛎️ Schedule a time to chat with me. I want to know what would be valuable to you.

(2) 💡 Find out more about Random Walk Idea Dinners. High-Signal Serendipity.7 Charts on Real Estate

It’s a short week with Rosh Hashana, but behold a few assorted real estate related charts, led by the latest from the world of homebuilding.

Home values are so low, we can't profitably build

Lance Lambert over at ResiClub put together a great chartapalooza on the homebuilder Lennar’s LEN 0.00%↑ most recent report.

Random Walk has long maintained that if you want to find a price signal in the housing market, then you need to go where the action is, and all the action has been in new builds. You see, builders are in the housing-as-commodity business. Unlike homeowners, who consider their homes an asset (and not a commodity), builders don’t have the luxury of waiting until rates go down and/or incomes rise. Builders meet the market where it is.

So while existing homeowners mostly refuse to sell, builders have captured an increasingly large share of the sales volume.

And builder disclosures (and prices) have been saying a for a while now: home values are going down.

Not that it should be some great insight that home values are going down—a dramatic rise in interest rates lowers purchasing power and therefore prices, almost automatically—but when there’s an endless harangue of ‘shortage affordability crisis,’ people can get the wrong impression.

Anyways, Random Walk isn’t going to rehash the whole thing, or even rehash the victory laps that rehash the whole thing, but suffice it to say that it’s still true that there is no housing shortage, home values are going down, and it’s the interest-rates, stupid, more than anything that are driving the current bid-ask spread (incorrectly referred to as an “affordability crisis”).

Let’s let ResiClub—which really should be read in-full—and Lennar show the way.

ICYMI

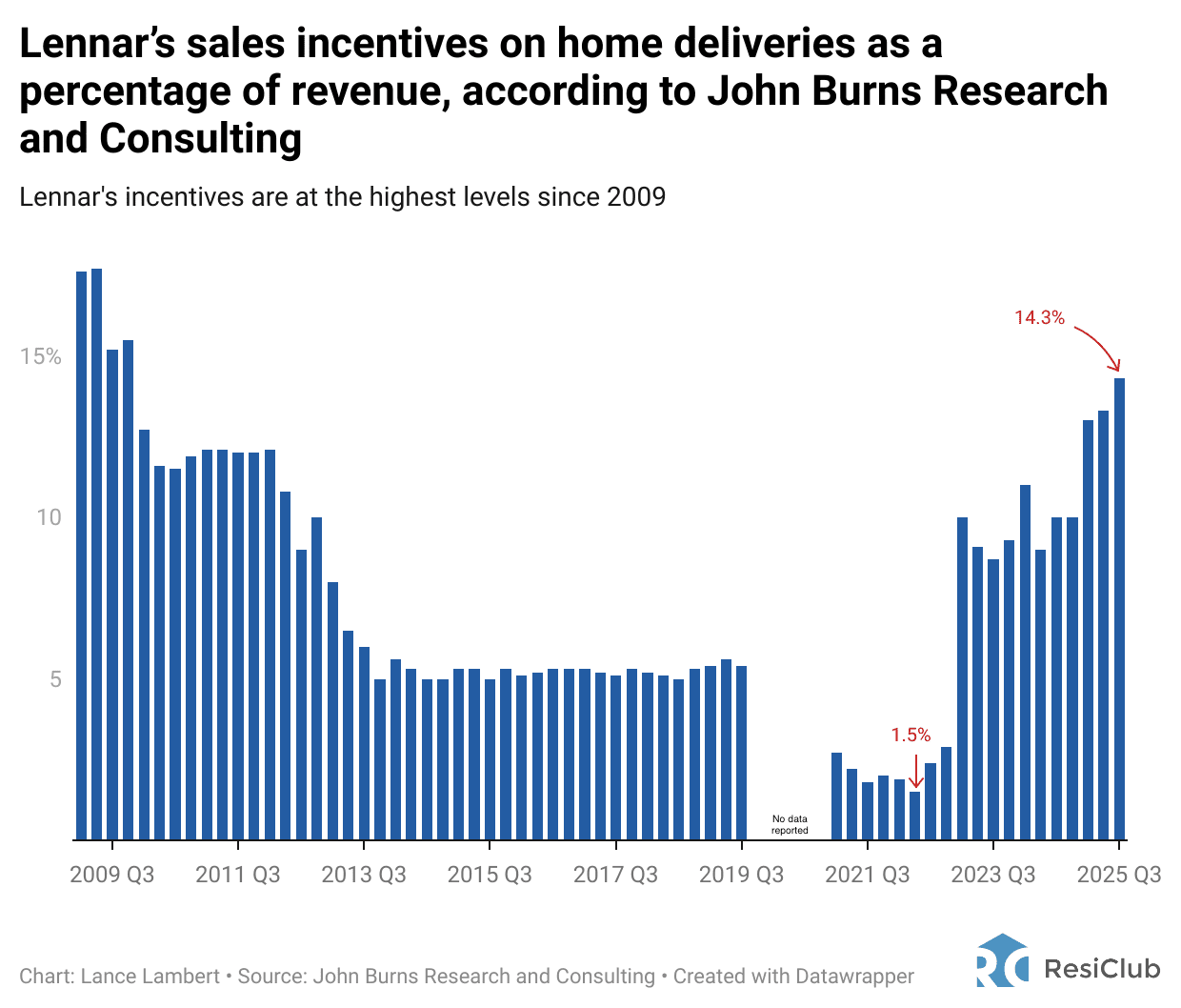

Incentives continue to skyrocket

Lennar’s incentives (by which they’ve moved inventory below sticker-price), aka “discounts” continue to scream higher:

Discounts are now higher than they’ve been since 2009.

And of course, when discounts go higher, and net prices go lower.

Selling prices below 2018

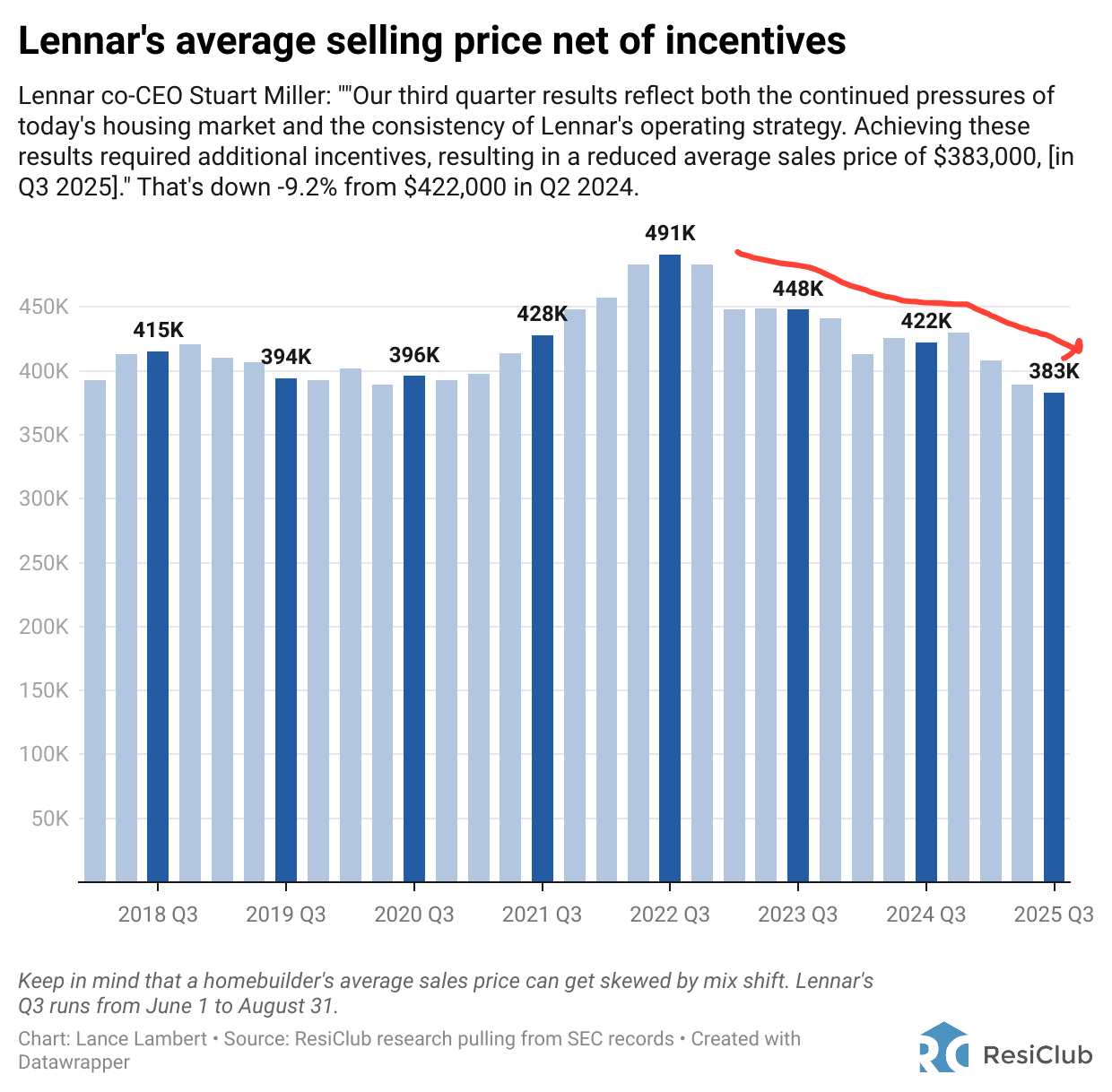

Average selling prices, net of incentives, are unsurprisingly careening lower, as well:

At $383K, the average price of a new Lennar home is below 2018 levels.

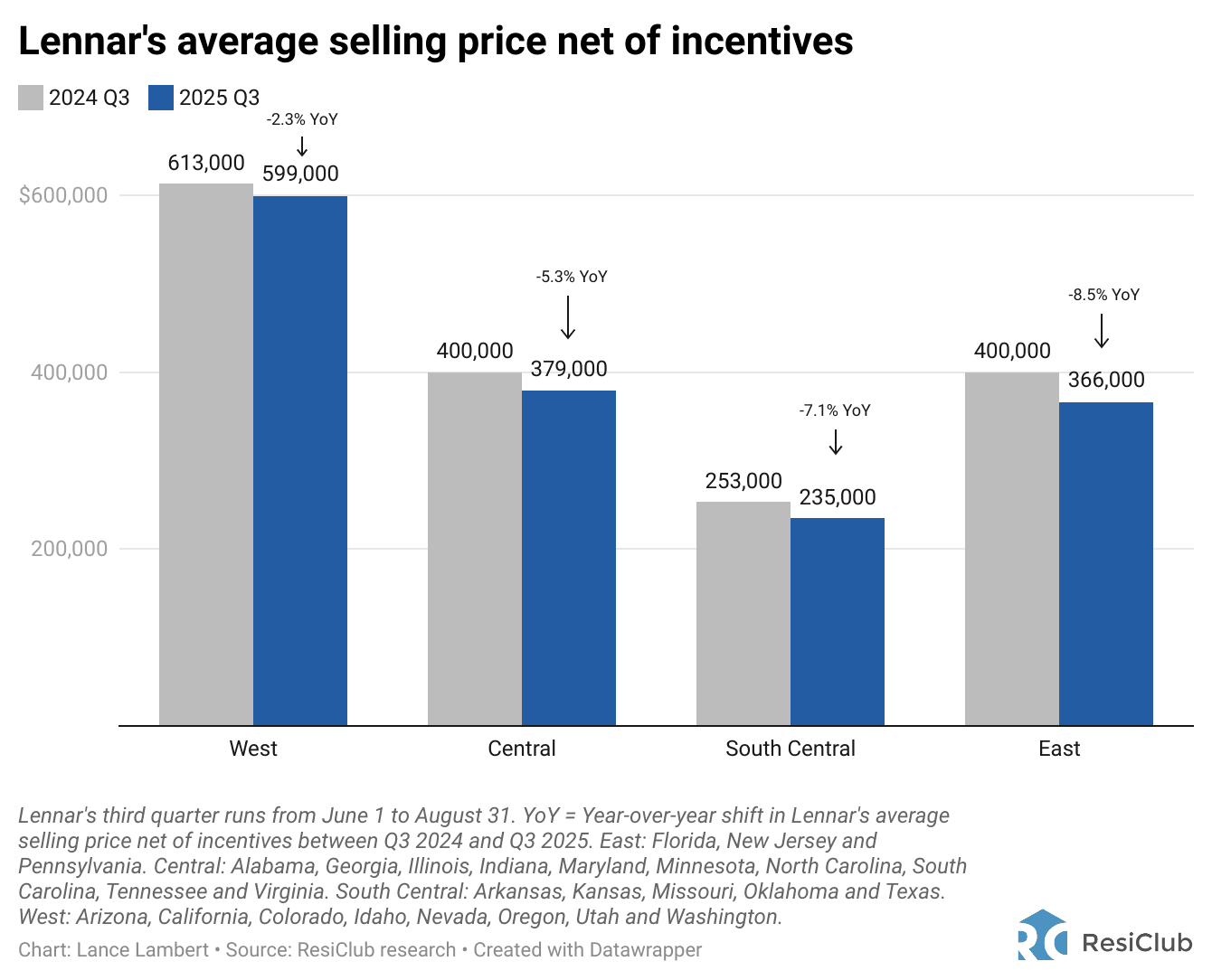

Oh, but it’s just the sunbelt, where all the over-building happened!

Nope, it’s not just the sunbelt:1

Every region has had yoy price decline, including the East, where average prices have come down ~8.5%.

Builder margins compress to the scary times

Putting it all together, Lennar’s gross margin is now at GFC levels: