5 Idea Friday: SaaS, licensing, houses, beauty, and small caps

A feast for thought, heading into the weekend

saas-attacked

licensing the licensors

when it comes to housing, it’s the interest rates, stupid

looks maxxing and other nice perks of being a thinning consumer

small cap managers are VC in disguise

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. 👋👋👋Random Walk has been piloting some other initiatives and now would like to hear from broader universe of you:

(1) 🛎️ Schedule a time to chat with me. I want to know what would be valuable to you.

(2) 💡 Find out more about Random Walk Idea Dinners. High-Signal Serendipity.5 Idea Friday

Five quick hitters on this and that for the weekend.

1. SaaS Attacked

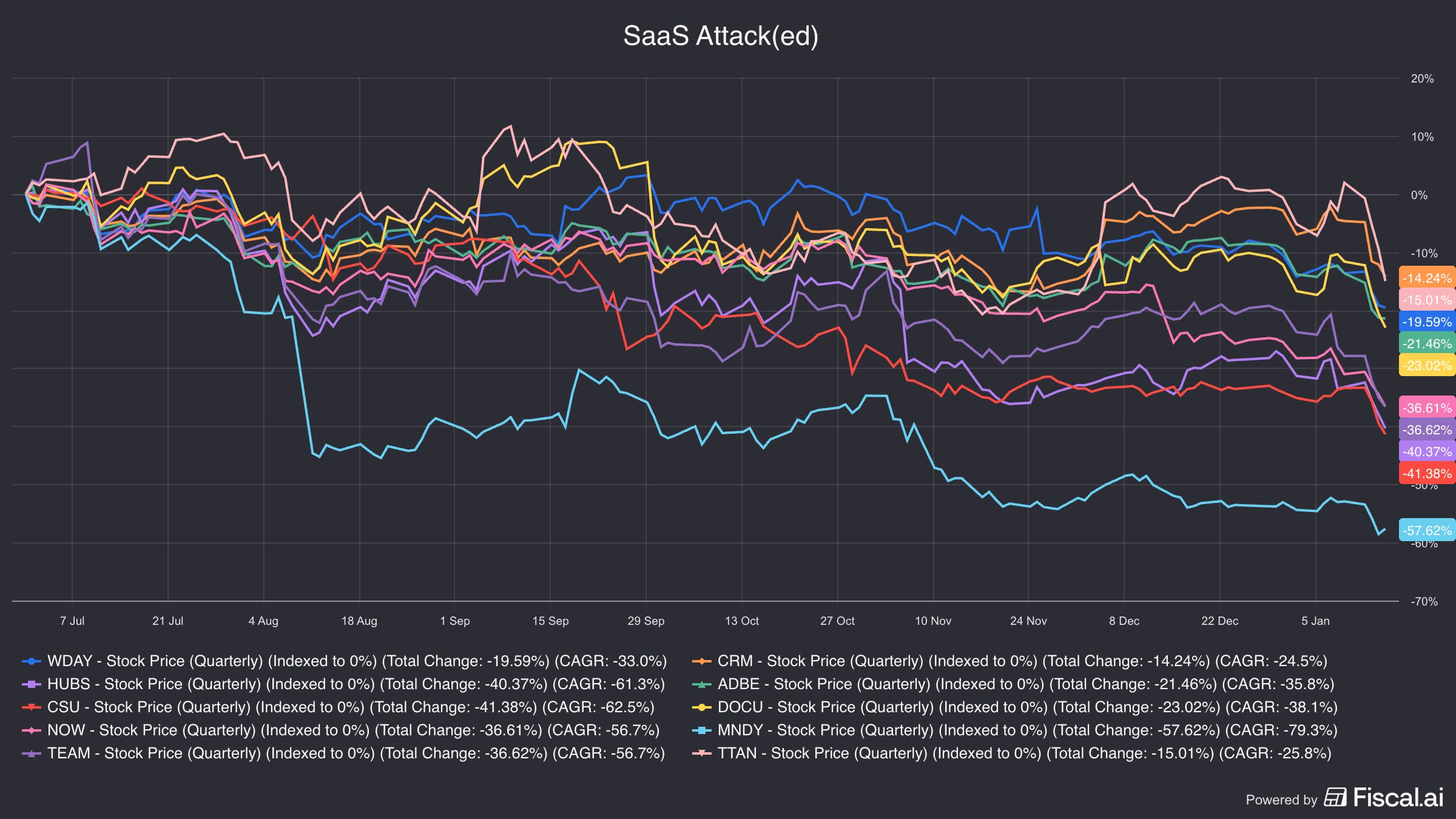

There was a big selloff yesterday, especially of SaaSCos, whose relative discount has become an area of interest for Random Walk, lately:

The recent performance of this randomish sample of ten software businesses has not been good.

It’s hard to say what precisely is driving the SaaS Selloff, and it’s never just one thing, but the general vibes point to: AI makes it too easy to create software, so these companies are dead in the water.

Plus, when “seats” aren’t growing, it’s hard to grow with a seats-based pricing model.

There’s definitely some truth to that, but it seems a bit under-specified.

Spinning up mini-apps for internal use and/or small distribution consumer fun, is far cry from enterprise grade platform technology that an entire org has to use with all kinds of permissioning, data quality, and context-dependent workflows.

Plus, AI should speed up cycle-times for the incumbents, as well, and since they’re already plugged-in at the customer level, distributing those features and products is much, much easier (not to mention building those features with company data and context already in-hand).

I’m not an expert on the entire saas ecosystem, although there are definitely some companies I’m much more familiar with than others, but the point is that this all seems a bit dramatic.

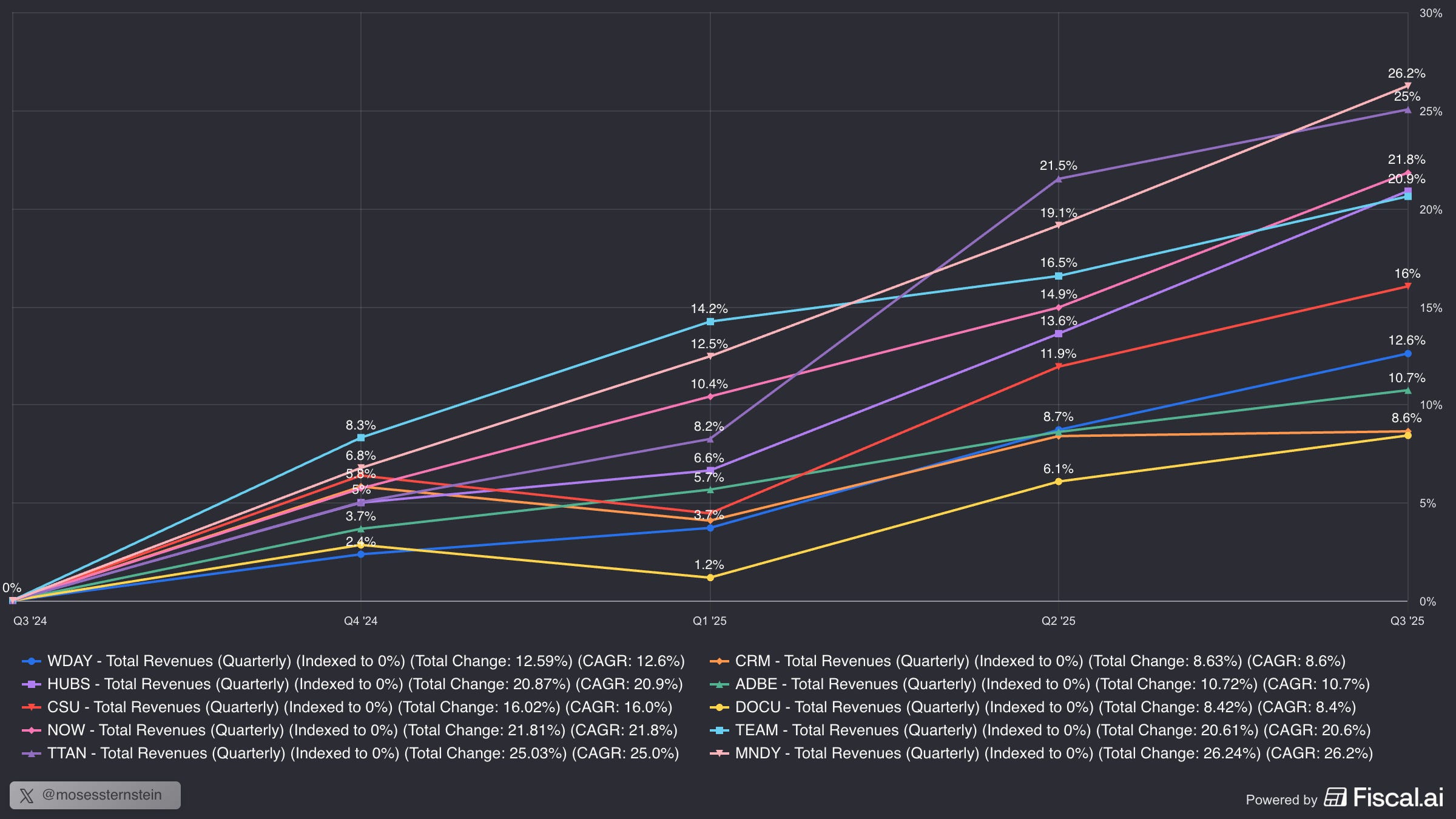

I mean, here’s another cut of those exact same companies, but this time it’s revenue indexed to a year ago:

8 out of 10 companies are growing revenue by double-digits.

You could do a lot worse than that.

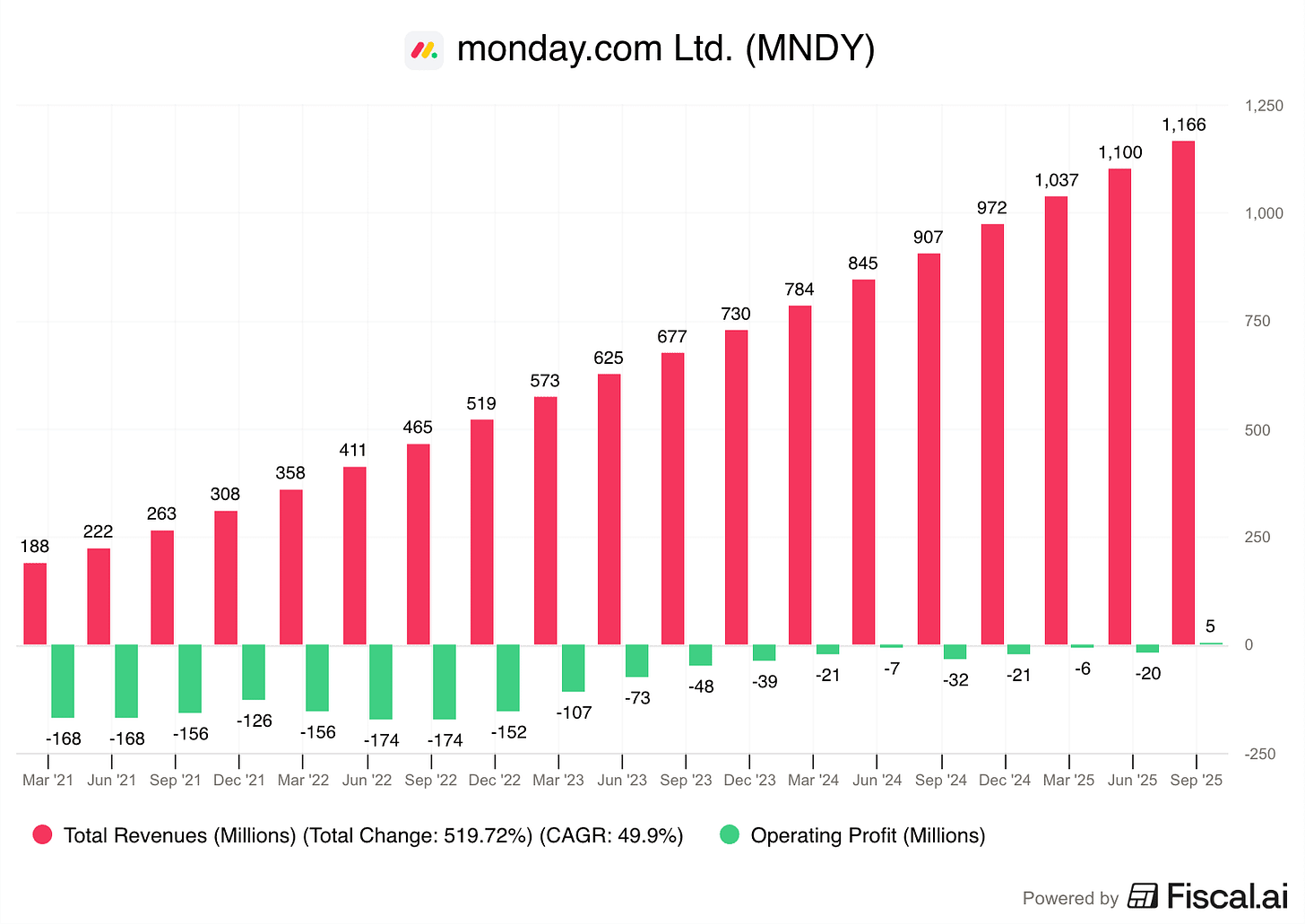

I don’t know anything about Monday.com MNDY 0.00%↑ but this doesn’t look like a company in terminal decline:

Monday finally became profitable, with revenue growth so smooth, it looks like a master mason built it.

Again, I’m sure there’s more to the story, and it’s not all a vibes-based selloff, but what % is vibes and what % is fundamentals, I’m not yet prepared to say.

Lots of people are out there quoting Soros and “reflexivity,” and all that matters is that everyone believes SaaS is dead, and blah blah blah. Those people are obviously wrong, and should be ignored. The fundamentals will carry the day.

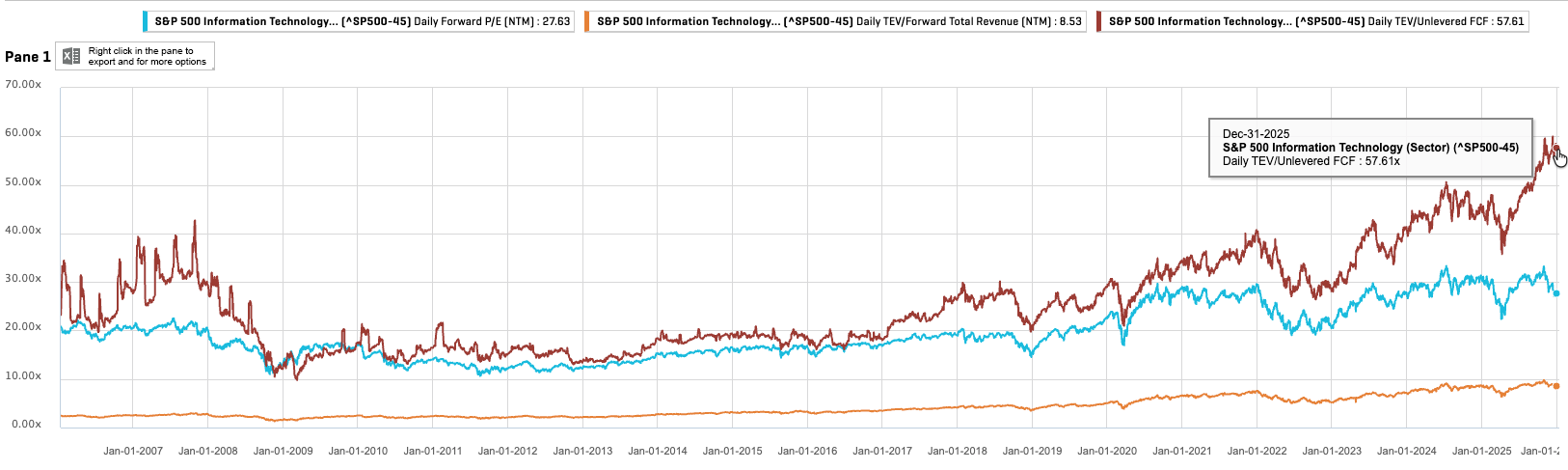

Anyways, while I continue to puzzle through this duck/rabbit universe of former high-fliers that are either on the precipice of death or the precipice of an AI-driven breakout, I did stumble upon one macro observation about the world of equities:

P/E looks pretty good, but unlevered free cashflow is starting to look pretty expensive.

Obviously, that’s a function of all the leverage that’s being added to the Capex mix.

The first leg of the AI journey has been paid for with profits, but there soon won’t be enough profits to go around, and so debt is part of the puzzle. Plus, there’s a secular demand for cash-flowing assets, which has driven a boom in credit AUM, and that money has to be put to work somewhere. It’s a match made in capital markets heaven.

Now, to be clear, none of this has any bearing on saascos (I don’t think).

It might have some bearing on a general re-rating towards a more capital intensive sort of tech ecosystem, but we’re not anywhere near that point, yet (I don’t think).

ICYMI

2. Licensing the licensors

The funny part about Random Walk’s great reveal that, in fact, there is no housing shortage, and that (fair-weather) YIMBYism is barely a solution at the margins (and reflects a deep non-understanding of the problem, which in many cases promises to do the exact wrong thing wrt demand for homes) is that I’m otherwise quite partial to YIMBYism, by default.

Healthcare YIMBYism? Now, you’re talking. Financial markets YIMBYism? Absolutely. Occupational licensing YIMBYism? Makes sense to me.

When it comes to cartelizing the services, people really lost their minds in the 70s: