AI's bubbling (hot hot hot)

14 charts on AI ROI

earnings are in and the hyperscalers are cooking with AI gaas

senior execs are bullish on AI, with retention to die for

tech forward doctors

some catnip for the bears

the actual scariest chart in AI-land

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. 👋👋👋Random Walk has been piloting some other initiatives and now would like to hear from broader universe of you:

(1) 🛎️ Schedule a time to chat with me. I want to know what would be valuable to you.

(2) 💡 Find out more about Random Walk Idea Dinners. High-Signal Serendipity.AI’s bubbling (hot hot hot)

I know I know I know. AI is a bubble.1

Hyperscaling the cloud aka no ‘dark GPUs’ here

Well, bubble me this:

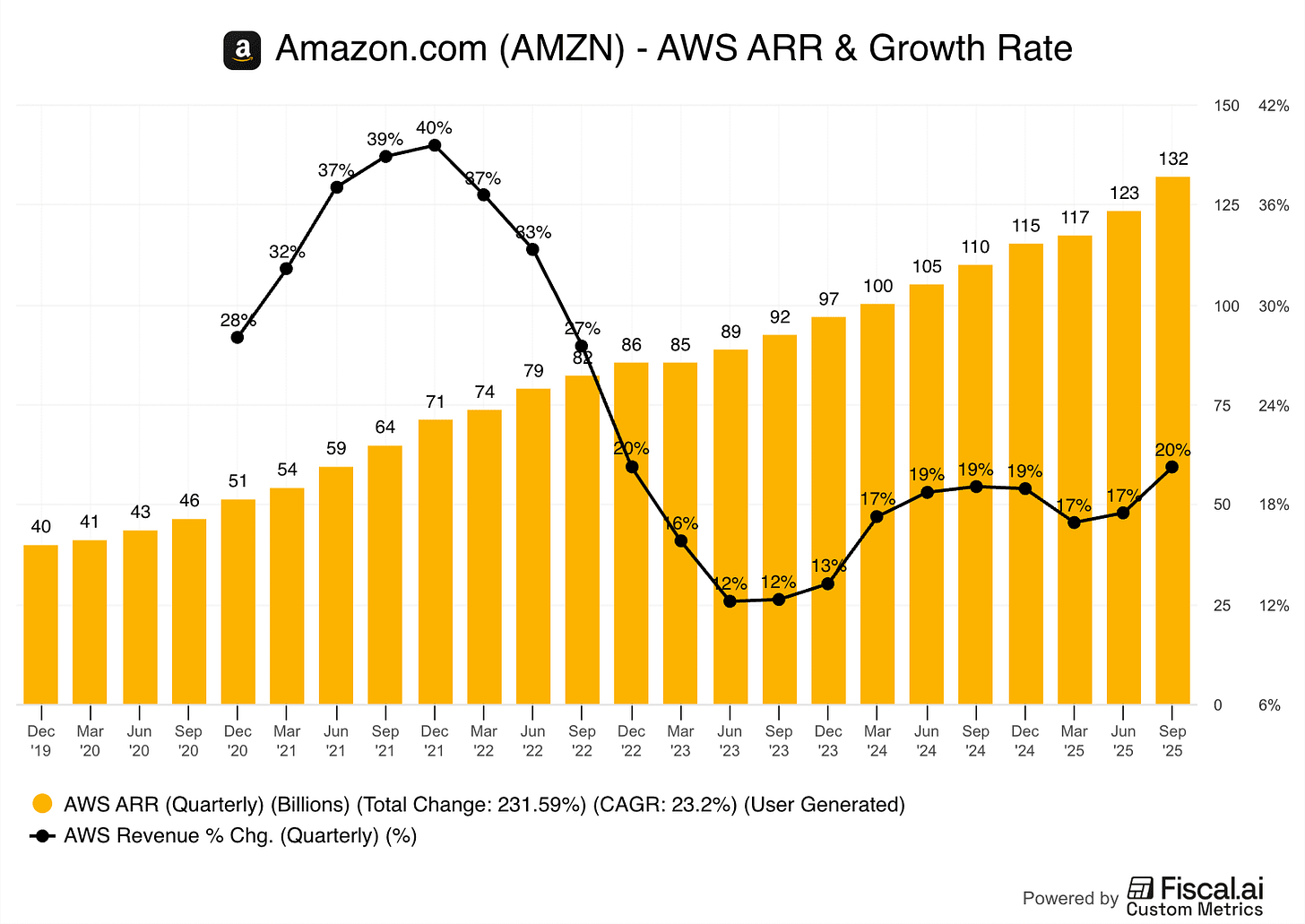

AWS cloud revenue growth is reacclerating.

And bubble me that:

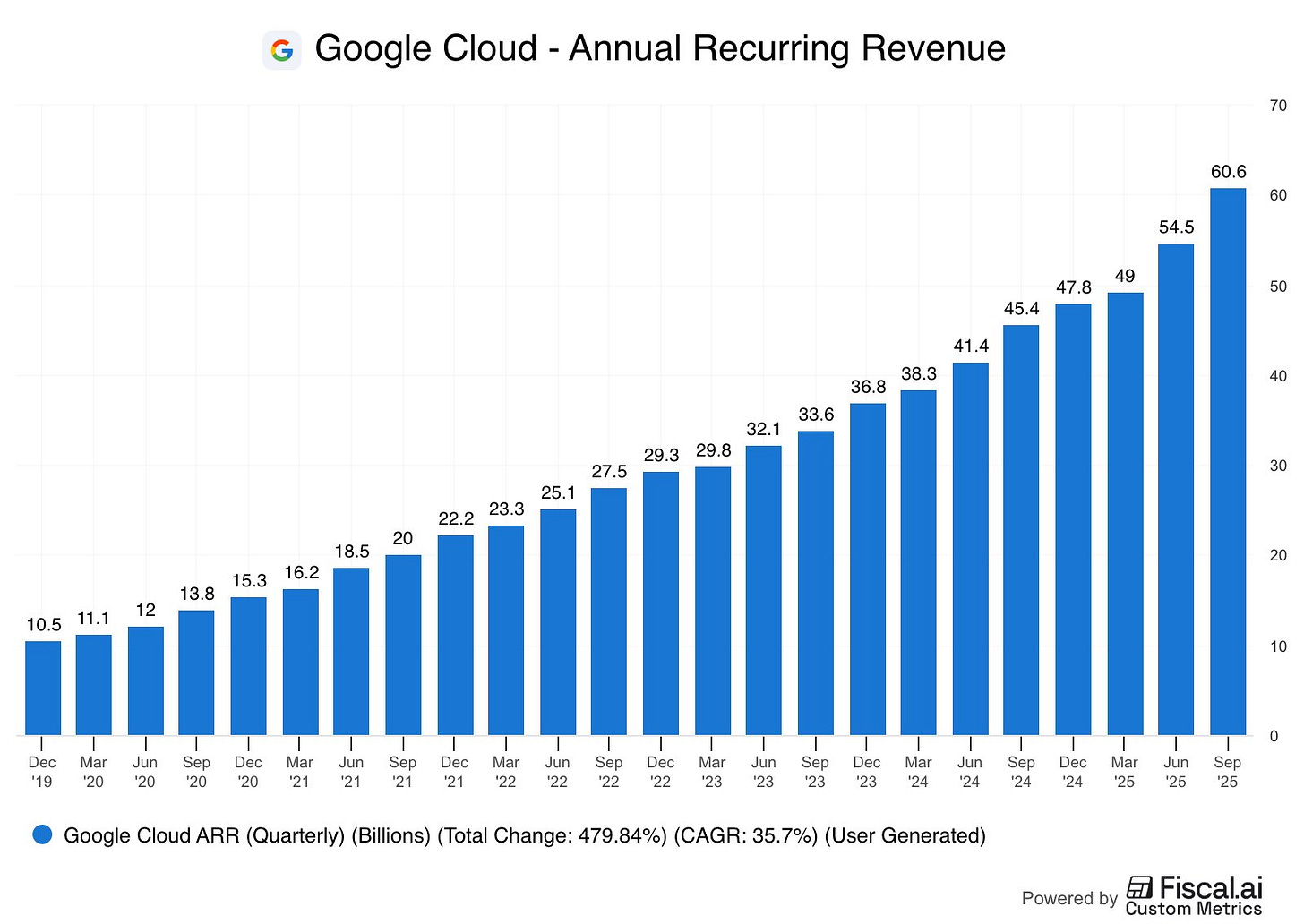

Google’s cloud revenue growth is reaccelerating too.

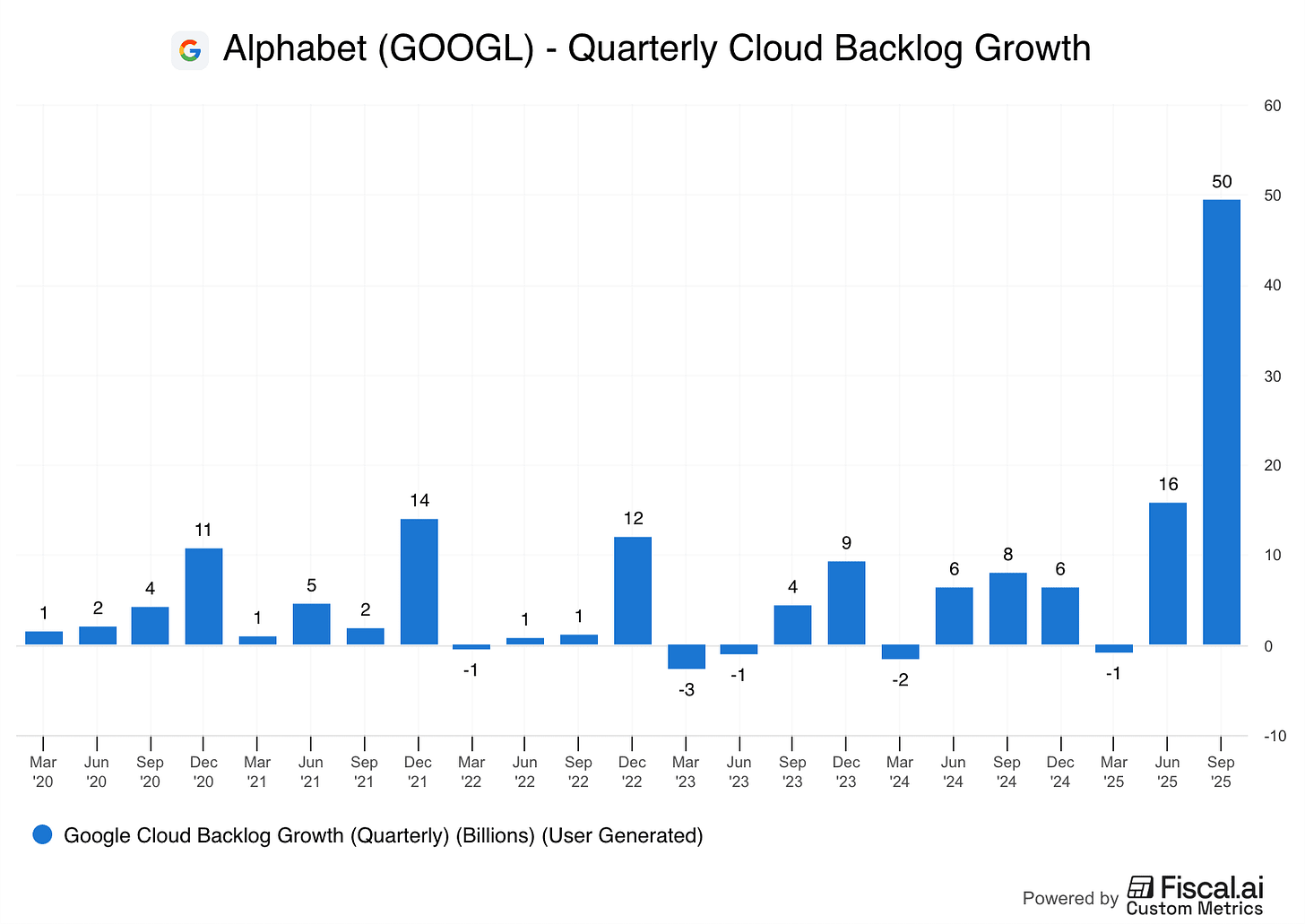

I mean, good god, look at this backlog:

That’s $50B in customer backlog for Google Cloud.

Firms are most definitely spending big dollars on AI and it is showing up in real (high margin) revenues for the hyperscalers.

When the hyperscalers say that they are building for existing demand, they are not lying. They do not have enough compute to go around.

Is some of this spending from the AI labs themselves, and the broader ecosystem of VC-backed AI startups? Sure, but more importantly, these cloud services are fully-scaled hundred-billion businesses reaccelerating revenue growth. That doesn’t happen often.

Gavin Baker of Atriedes Capital had a great line in his discussion with David George, of a16z. During the Dotcom bubble they had this thing called “dark fiber.” It sounded really sexy, but what it meant was just fiber that wasn’t in use yet, so it was literally “dark.” But, all the telecoms would happily report to the street how much “dark fiber” they had built.

Well, there are no “dark GPUs.” If anything, there are GPUs melting themselves because of all the demand for compute.

So, let your hair down and put your feet up, because the AI capexsupercycle is no speculative frenzy.

Now, there is perhaps an open question as to how enduring this utilization and revenue is. If companies are all just testing out AI, but not seeing results, eventually they will throw in the towel.

ICYMI

AI ROI

But, for now, there isn’t a whole lot of evidence of towel-throwing.

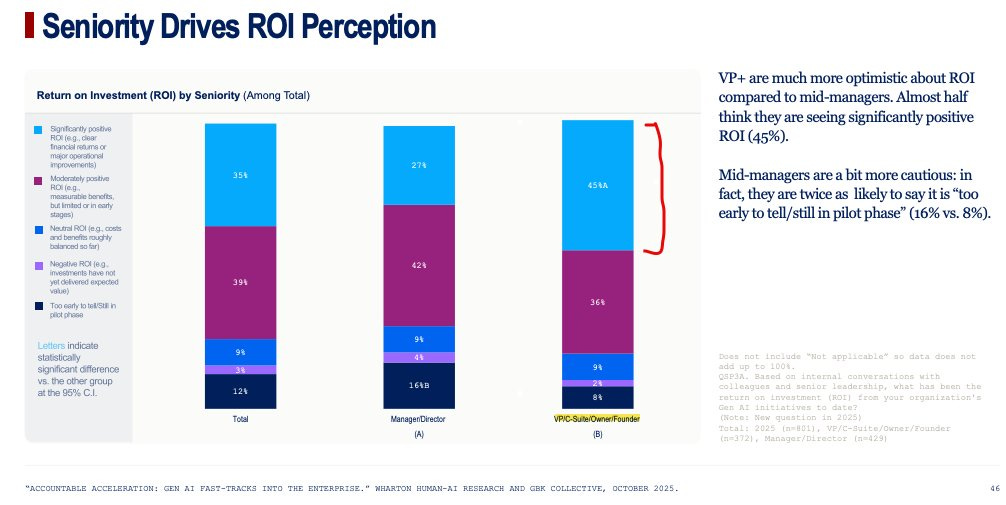

It’s hard to get evidence on this stuff, other than consumption patterns, but Penn did a big survey and the ROI looks pretty good:

Senior management is way more bullish on AI ROI than middle managers, but everyone is still pretty bullish.

Maybe senior VPs are drinking the kool-aid, or maybe middle management is worried about their jobs. And yet still, the bast majority of both are some combination of “significantly” and/or “moderately” positive about AI’s gains.

Doctors are using AI

Here’s some more sector specific evidence of AI-related “can’t live without it.”