Almighty consumer, bnpl edition

BNPLers are built different. But we knew that.

Some charts and thoughts on the ‘black box’ consumer credit product that contains multitudes

bnpl to terrify and delight, a refresher

drafting on ecomm—still got it—but if Germans mean anything, then there’s room to run

bnplers are built different, and yes, that includes some bad habits

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. 👋👋👋Random Walk has been piloting some other initiatives and now would like to hear from broader universe of you:

(1) 🛎️ Schedule a time to chat with me. I want to know what would be valuable to you.

(2) 💡 Find out more about Random Walk Idea Dinners. High-Signal Serendipity.Almighty consumer, bnpl edition

Longer-term Random Walk readers know that I’m generally bullish BNPL.

Or at least the best form of it (i.e. AFRM 0.00%↑).

Not only does it sit squarely at the intersection of various Random Walkian secular tailwinds, but most of the skepticism sounds in “it’s scary, new and different” (without understanding the basic constraints around extending credit to parts unknown that bnpl has unlocked).

Plus, there’s a healthy dose of regulatory heads-I-win-tails-you-lose because bnpl is inevitably either insufficiently inclusive or far too predatory, depending on how the chips fall.

And there’s something exciting about a ‘black box’ of consumer credit risk that’s a fertile playground for whatever paranoid speculation about the health of the almighty consumer one might wish to indulge.

Finally, the rise of private credit has created demand for scalable, asset-backed yield, precisely the kind of thing that bnpl can provide, driving costs of capital down.1

More simply, if you think people are going to increasingly shop online for an increasingly wide variety of things, and they’ve never used credit before not because there’s no credit risk worth taking, but because distribution and underwriting of traditional consumer credit products made the squeezing more costly than the juice, but now the mix of financial and technological engineering have created a win-win-win for consumers, lenders and merchants alike, then you might like BNPL.

Or not. Was that simple? idk.

Anyways, I’ve been right and the critics have been wrong, at least thus far.

And, with holiday season upon us, and a BNPL IPO inbound, what better time to curate some bnpl- and bnpl-adjacent charts.

ICYMI

More ecomm, more bnpl

One question with BNPL is, of course, how much more room is there to go?

Is it a niche credit offering, or is it closed-network fintech innovation providing value to merchants and consumers in a way that credit cards cannot replicate (easily)?

I’m inclined more towards the latter—once you use an Affirm product, it’s sort of a no-brainer not to keep using them, plus as e-comm grows (as it does), so too does BNPL. (To be fair, I’m also surprised by how many people still only use debit cards, when credit cards give you basically free float and points, to boot, so no-brainers are not as simple as they seem.)2

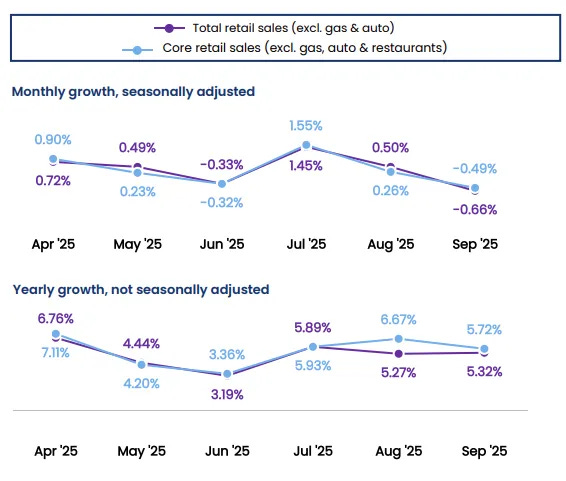

First more data to confirm what we already knew, consumer spending is still growing:

NRF’s data shows ~5.5% yoy growth (with slight monthly contraction).

People are still employed, so people are still spending. Many such cases.3

Basically all the data shows some version of the same thing: the Almighty Consumer continues to be fine. Not great, not terrible, still cautious, but fine. Some pressure at the lower-end for sure, but overall, just fine.

But what about BNPL, specifically?