Assets or software, and at what price?

There's actually some money left on the AI table, but it all comes down to price

there’s always money in the demand stand (and all signs point to go)

maybe stocks are cheap? how much value has been pulled forward?

cap-intensivity is more typical of a P:B regime, and those price differently

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. 👋👋👋Random Walk has been piloting some other initiatives and now would like to hear from broader universe of you:

(1) 🛎️ Schedule a time to chat with me. I want to know what would be valuable to you.

(2) 💡 Find out more about Random Walk Idea Dinners. High-Signal Serendipity.Assets or software, and at what price?

One little “AI is not a bubble” mental game I like to play is “AI would be so amazing if it could [xyz] (that it’s already doing), but do it [better, faster, stronger].”

And then, if there’s no technical reason that it can’t get better, faster, stronger, I pat my tum-tum and think “it’ll all be just fine.”

Sure, AI would be a lot more useful to me if interoperability between various workspace apps was better, but it’s already getting better, and there’s no reason to think it won’t continue to get better.

It’s like dial-up internet (or AI now, for that matter): think of all the possibilities, if it wasn’t so darn slow and capacity-constrained.

Right now, AI is kinda slow and capacity-constrained. The input-output process of prompting and iterating is frustrating enough, that the juice often isn’t worth the squeeze. It’s frustrating enough that I usually won’t even try to make the juice worth the squeeze, given the possibility of tinkering with something for hours, and having nothing to show for it.1

But it’s a solvable problem. And to oversimplify, it’s solvable at the compute layer.

So, when you think of it that way, it’s really not hard to understand why there’s so much investment in compute. The more and better it gets, the more and better the applications will become, leading to more and better demand for compute, and so on and so forth.

There’s always money in the demand stand

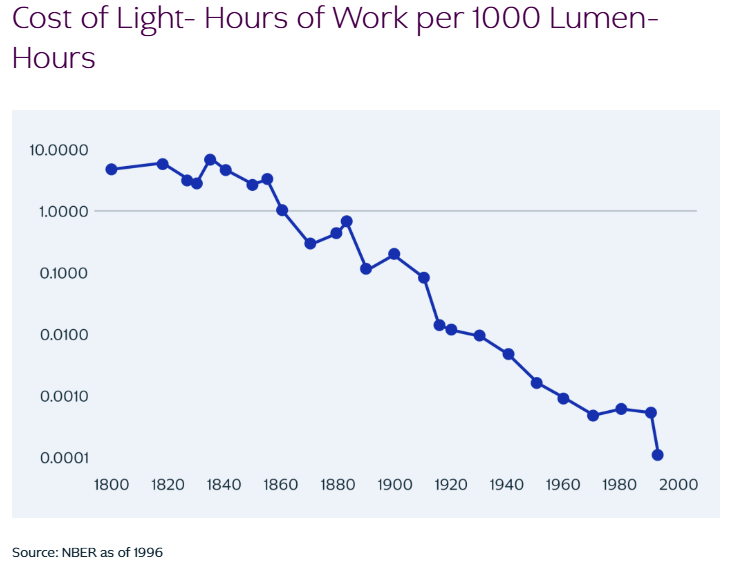

That’s Jevons Paradox.

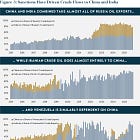

The AI Capex analogy isn’t to the shale boom, for example, where cheaper energy didn’t lead to more demand, but rather to the first “fossil fuel” revolution, when we migrated away from whale blubber and chopped wood, to petrochemicals and beyond.

Cheap, abundant energy ushered in a whole new class of use cases, professions, products, services, etc. that generation ‘burning the midnight oil’ could never have conceived of.

OK, sure, Random Walk, but when? And perhaps more importantly for my 401(k), how much of that future value has already been pulled forward into stock prices?

That’s a great question, and of course, I don’t know the answer, and neither does anyone else.

For now, I track things like this:

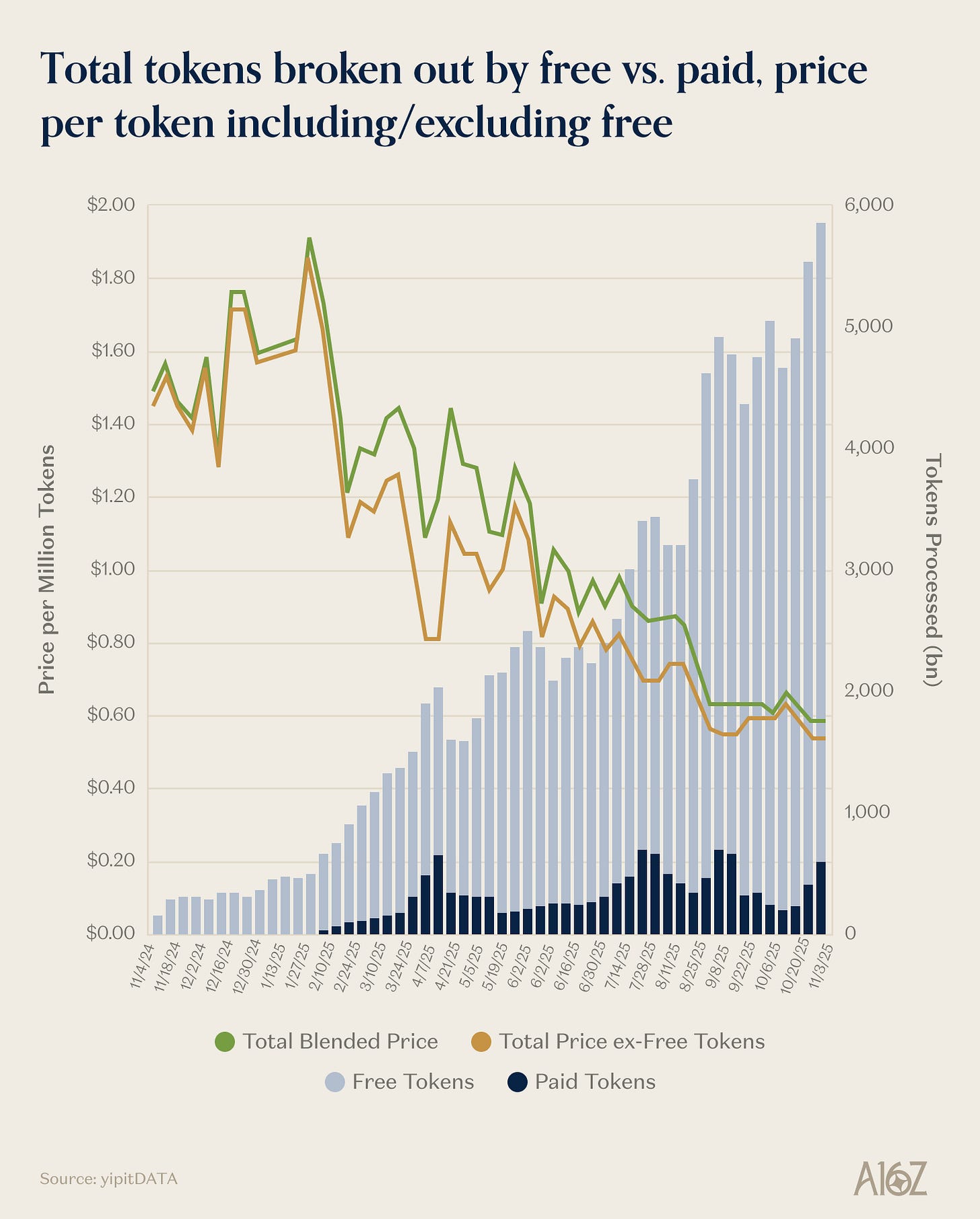

Token consumption goes up, as token prices go down.

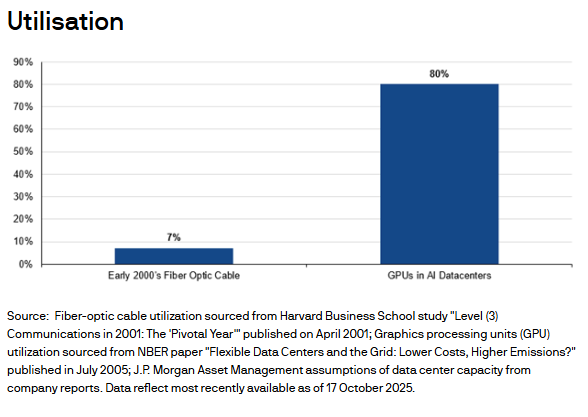

The cheaper it gets, the more people use it. That’s what you want to see for a Jevons-ish outcome. And yes, to repeat, all the hyperscalers are reporting demand for compute is in excess of supply. There is no “dark fiber” i.e. built-but-unused GPU capacity.

Some estimates put GPU utilization at ~80%:

The utilization contrast between Dotcom fiber and present-day GPUs is staggering (and comforting).2

Forget future demand. There is nothing speculative about this buildout, given demand right now.3 Will demand persist? OK, there you have to make some assumptions, but at the same time, AI bares no resemblance to some passing consumer fad.

Fine. We get it. Demand for AI is off the charts. Building more AI makes sense. Does that tell you anything about current stock valuations?

No, not really, but we’re not done with that, just yet.

ICYMI

Maybe stocks are cheap?

Goldman Sachs, for its part, did take a stab at quantifying how much residual value is still left to priced-in.

It’s napkin-math, like anything else, but it goes something like this: