Batteries set records, and other missives

Big batteries, big profits, and the K-shaped Manhattan home price shift (plus the softest markets in the country)

batteries break records

the real reason techcos aren’t hiring, in just one chart

k-shaped manhattan home values (and the softest markets in the country)

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. 👋👋👋Random Walk has been piloting some other initiatives and now would like to hear from broader universe of you:

(1) 🛎️ Schedule a time to chat with me. I want to know what would be valuable to you.

(2) 💡 Find out more about Random Walk Idea Dinners. High-Signal Serendipity.Batteries set records, and other missives

Three vignettes, written late at night.

Record-setting batteries day

Apparently, one hot summer day in Texas, batteries made a record-setting contribution to the grid:

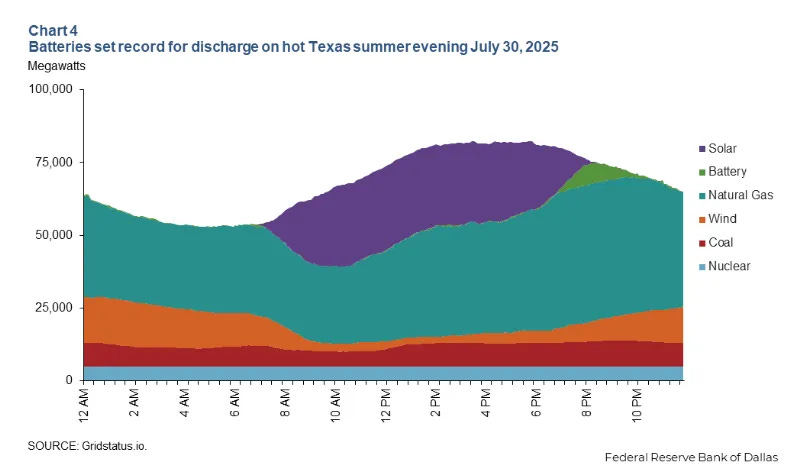

On July 30, 2025, load again peaked at around 80 gigawatts, this time in the late afternoon and early evening hours. Batteries, boosted by capacity additions in the first half of the year, set an ERCOT record (at the time) of 7.1 gigawatts of energy at 8 p.m., when net load peaked after solar disappeared for the day.

Batteries took advantage of prices around $20 per megawatt hour in the late morning hours to charge, selling at peak time prices of around $400

Hey, that’s pretty cool. Buy for $20 and sell for $400. That’ll work.

It’s a good win for batteries, and highlights their importance to overhauling the grid (and helping solve the intermittency problem of solar).

But, as you can tell by the de minimis size of the green “battery” smudge on the graph, we gotta long way to go.

Going the long way, also appears to be the plan:

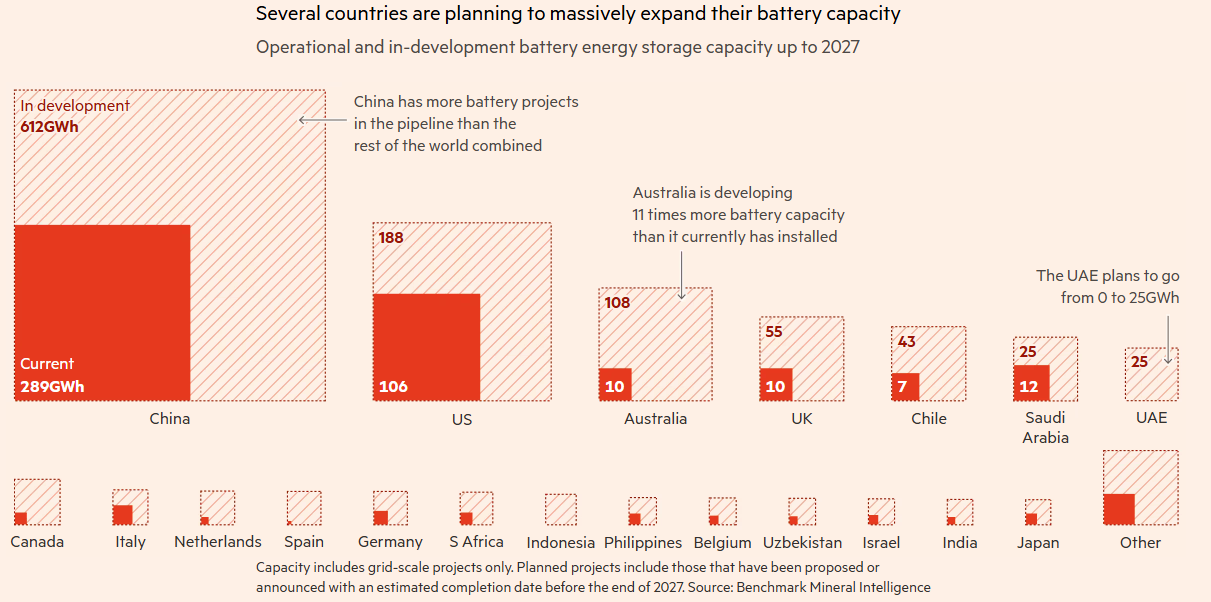

Pretty much everyone is planning to expand battery capacity, with China leading the way.

Look, it makes sense. There is a lot of solar energy, so much so, that prices go negative often enough . . . in that case, finding a way to store that energy (and get paid for it, since that what negative prices mean), and then sell it back to the grid, seems like a worthwhile endeavor.

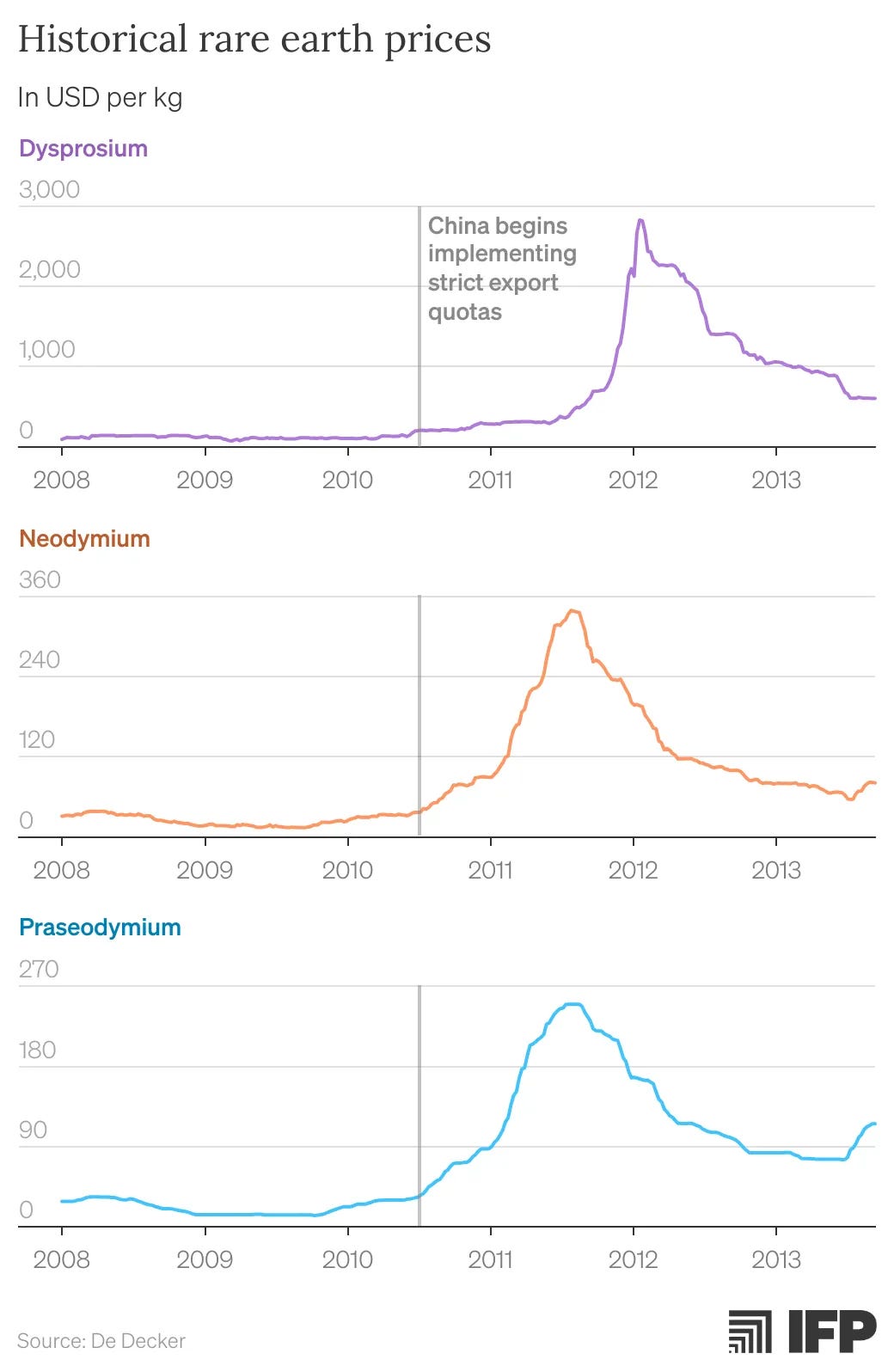

Mind the rare-earth minerals, of course.

China still has most of the key battery stuff on supply-chain lockdown.

Interestingly, as per the chart, this isn’t the first time that China has flexed its rare-earth muscles.

My understanding is that we could cultivate this stuff ourselves, but it will take some time (and money) and, perhaps worst of all, make a lot of toxic waste.

ICYMI

Profit > Growth

I think this might be the best chart to demonstrate the reasons behind the slowdown in tech hiring specifically: