Is retail the smart money, now?

Individual investors have a brand new bag, that they cannot kick

retail investing, a pandemic shift that stuck

leaving no powder dry

put it on margin

gimme all the options (a record-breaking amount)

Two riffs on themes

estimating the (fake) wealth effects from the AI stock boom

housing surplus, a zillow coda

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. 👋👋👋Random Walk has been piloting some other initiatives and now would like to hear from broader universe of you:

(1) 🛎️ Schedule a time to chat with me. I want to know what would be valuable to you.

(2) 💡 Find out more about Random Walk Idea Dinners. High-Signal Serendipity.Is retail the smart money now?

Random Walk has long-maintained that the Almighty Consumer is generally pretty good at spending within its means.

Or maybe credit card companies are very good at keeping them within their means.

But, either way, there’s been very little evidence that consumers have bitten off more than they can chew—quite the opposite really, in that consumers have shown a pattern of spending more when they have more to spend, and spending less when they have less. In the last check, for example, consumers still appear to have more cash on hand than they’ve generally held in the past.

Where I (and others) have had some doubts, is whether consumers are quite so good at gambling investing within their means.

Retail participation in stock trading is increasingly a big deal.

Retail flows into single-name stocks and ETFs have gone from a pre-pandemic rounding error to ~$1.5B (based on the 60-day moving average). 1

Some of that is probably driven by all the money that’s not being used as home-equity, as per above.

Other parts of it have to do with the proliferation of retail investment products, including highly levered ETFs and retail-accessible option-trading (and an accompanying increase in mass-accessible investment news and coverage).

And then, of course, is the ‘gameification’ of investing, driven by killer consumer apps, like Robinhood, where the boundaries between sports-betting and stock-picking are increasingly blurred.2

In all events, that retail might be imprudently “risk on,” fueled by a positive feedback loop of a frothy market that makes everyone feel good at investing, is surely a valid concern. Add in some leverage, in the form of options and margin-trading, and it’s a disaster waiting to happen.

Except maybe not? It’s kind of a mixed bag.

ICYMI

Keep no powder dry

I mean, it’s not a mixed bag that retail is ‘risk on.’ That’s a foregone conclusion, and I’ll lead with this fun way to further illustrate the point.

No one is leaving any cash on the sidelines in their brokerage accounts:

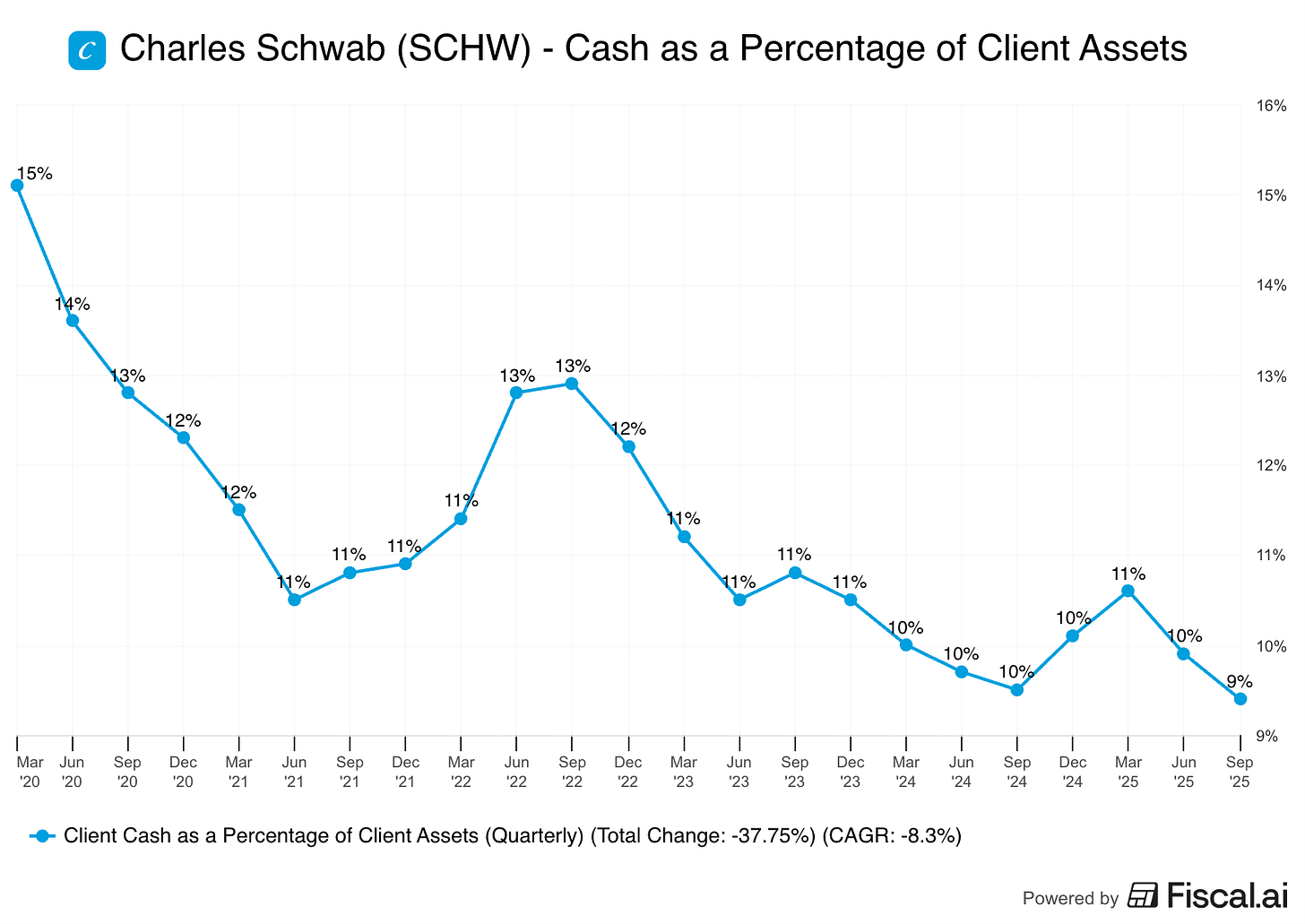

Cash a % of assets held at Schwab are the lowest they’ve been since the pandemic began.

If retail investors are keeping their powder dry waiting for a fat pitch, they’re not showing it. Whatever cash they’ve got in their brokerage accounts, they’re putting that money to work.

But what about all the scary, risk-taking, margin-trading and options, and all that?

Put it on margin

Has there been a lot of margin trading?

Well, yes, there has.

But, if we’re being honest, nothing too crazy: