China and the ‘Beggar Thy Neighbor’ Trade

Checking in on the apparent Chinese plan to go net-zero imports

China’s global emporium on overdrive

‘I’ll make whatever he’s having’ is a strategy

net-zero imports, and why there is no China thaw for LVMH et al

Goldman comes out and says it: it’s ‘Beggar Thy Neighbor’ time

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. 👋👋👋Random Walk has been piloting some other initiatives and now would like to hear from broader universe of you:

(1) 🛎️ Schedule a time to chat with me. I want to know what would be valuable to you.

(2) 💡 Find out more about Random Walk Idea Dinners. High-Signal Serendipity.China and the ‘Beggar Thy Neighbor’ Trade

The zeitgeist appears to be shifting towards a Random Walkian view of the world that China will “lose” a trade war (and that a trade-war is a not-crazy response to Chinese industrial policy, which is itself a not-crazy response to declining Chinese demographics).

More specifically,

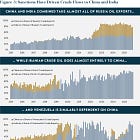

‘selling everything to everyone’ appears to be China’s growth recipe (bc what choice does it have?), and China will do everything it can to make everything for everyone, including its own domestic markets, where the ideal level of imports is 0;

there are zero-sum ‘beggar thy neighbor’ aspects to this approach that present hard questions for the rest of the world should they envision a future whereby they are not reduced to being yet another shopper in China’s global emporium of everything;

tariffs do, in fact, hit China where it hurts, because in the absence of US demand, there are no “new markets” to make up the shortfall. China’s only move is to redirect its surplus to the markets its already in, leading to further price (and profit) declines.

In other words, in the absence of growing global or domestic TAM, China’s approach is share-capture: be the only maker-of-things that anyone anywhere wants or needs.

That makes sense for China, but perhaps less-so for anyone else with aspirations of making things. It also makes China vulnerable to even incremental freeze-out, never mind a freeze-out from 300M of the wealthiest consumers the world has ever known.

But, more importantly, there’s a zero-sum(ish) element to this that warrants some kind of reflection, even if the current response leaves something to be desired.

China’s global emporium on overdrive

First, it’s important to grasp the scale of this thing, including the somewhat recent upward inflection in China’s manufacturing machine.

I’m going to borrow liberally from Brad Setser of CFR because he is on it, and makes good charts.

Consider, for a moment, China’s export surplus, and how it’s grown:

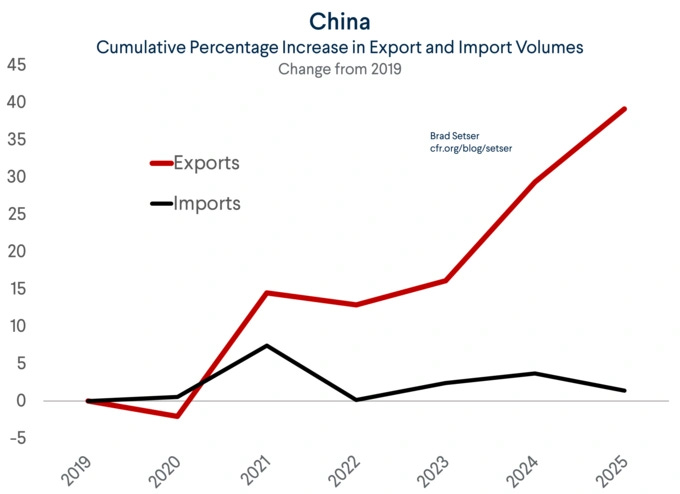

Since 2019, China’s exports have grown ~40%, while imports have grown ~1%.

That surplus, which is now ~$1.2T for all goods (after an $800B increase in just 5 years), leads to an “implied contribution of 1% to GDP” over that period.

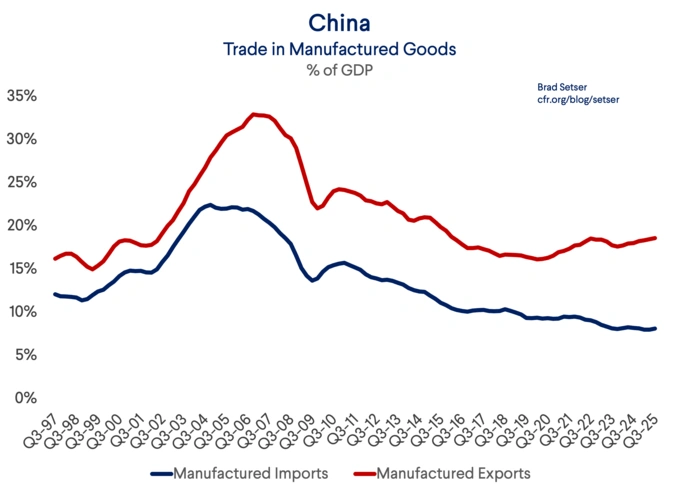

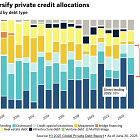

For manufactured good specifically, exports have grown, while imports have have declined slightly (as a share of GDP):

Manufactured exports have been risen ~33% since 2020, while imports have been in serial decline really since the global financial crisis.

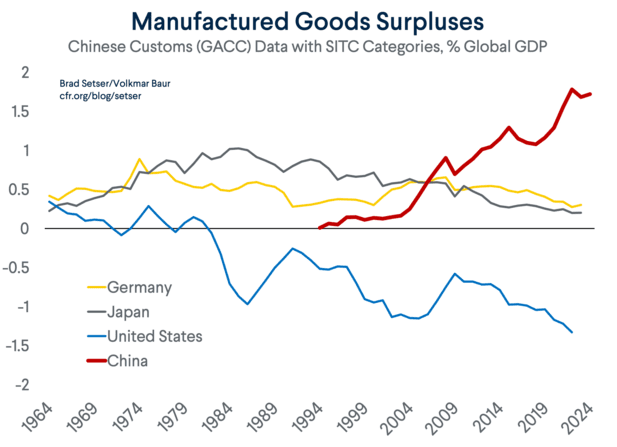

Rising exports with declining imports has blown the manufacturing surplus to an incredibly wide ~$2T:

China’s $2T surplus in manufactured goods is more than 2% of global GDP.

It also means that China’s trade surplus is larger than the combined surplus of Germany and Japan at their respective peaks.1

ICYMI

‘I’ll make whatever he’s having’ is a strategy

It’s an incredible thing to behold, and while it’s been a long-time coming, “make everything for everyone” has all the appearances of a strategic and recent acceleration, i.e. determine some critical global export, and just own it completely.

Super-charging manufactured exports in a fairly short period of time doesn’t just happen, and there are some second-order effects, to put it mildly.