AI rubber hits road, when? (cont.)

Continuing to riff on the haves and have-nots of the AI trade

forward earnings for the Mag 7 mean what exactly for the Unmag 493?

AI cloud revenues, real and spectacular

OK, but the expenses too

What are the non-AI software winners up to? Talking about AI, naturally

AI adoption is a fickle beast

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. 👋👋👋Random Walk has been piloting some other initiatives and now would like to hear from broader universe of you:

(1) 🛎️ Schedule a time to chat with me. I want to know what would be valuable to you.

(2) 💡 Find out more about Random Walk Idea Dinners. High-Signal Serendipity.AI rubber hits road, when? (cont.)

Just continuing to muse on this theme.

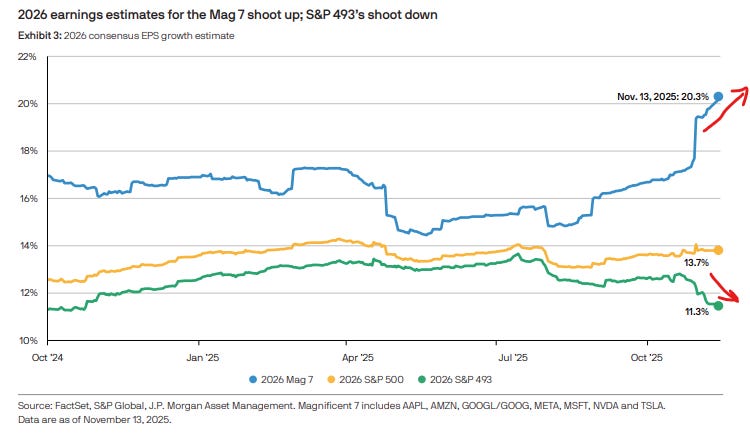

So, this is a pretty striking chart.

Earnings per share are forecast to grow ~14% in the aggregate, but all the acceleration is due to seven companies.

Earnings growth for the rest of the index isn’t expected to be bad, but it’s slower than before. But for those “Mag 7” names, earnings are expected to grow an extraordinary ~20%. That 20% reflects a substantial acceleration from the already impressive growth demonstrated by the largest profit-making companies the world has ever known.

That’s both impressive and striking in its own right, but it’s also a bit of a puzzle.

Like, how is that supposed to work?

Every other company in the world starts spending more money on cloud and advertising—presumably because of AI—which drives hyperscaler profits higher (despite their own significant CapEx).

But, at the same time, all that additional spending from the field doesn’t, in fact, translate into more profits for the field—to the contrary, profit growth slows down.

In other words, is the market expecting everyone to pay a lot more for AI compute, without realizing any benefits (or at least any benefits that flow through to the bottom line)?

I suppose that’s possible.

ICYMI

Lots of revenue

That hyperscalers are seeing substantial incremental demand for all their AI investments is almost certainly true.

Not only to do they keep saying that they have more demand than supply, but it’s showing up in the numbers.

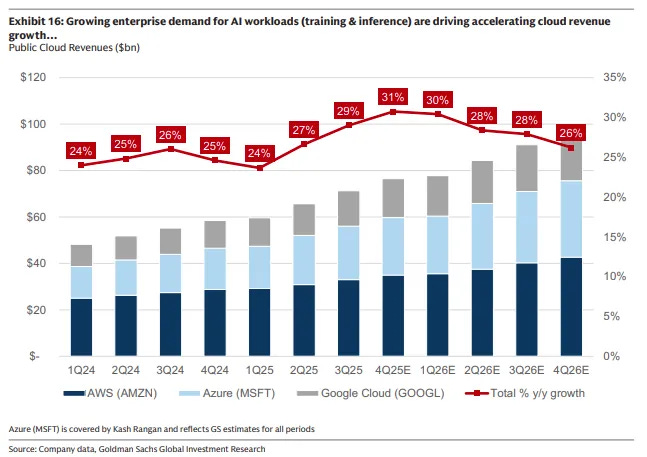

Take cloud revenues, just as an example:

Cloud growth, which was already pretty massive, reaccelerated to ~30% over the past year.1

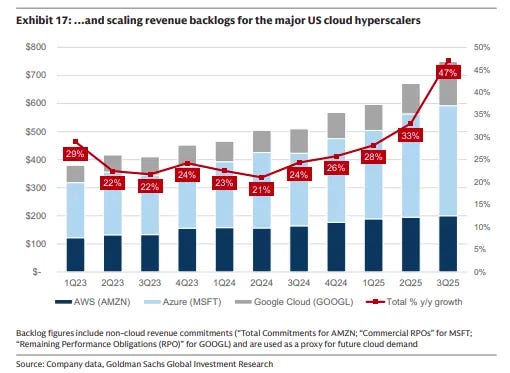

The reported “backlog” for demand has grown even more substantially:

That’s a reported $700B+ in revenue backlogs for cloud compute, representing an enormous upward inflection in growth.

Again, these businesses are already doing ~$80B per quarter, so the fact that they are accelerating their growth to over 30%—and that the backlog is almost 50% higher yoy—is basically unprecedented in the history of businesses this large.

Even Oracle ORCL 0.00%↑, the new indebted hyperscaler on the block, reported an enormous surge in future bookings: