If AI is taking jobs, then where are all the productivity gains?

Markets are assigning basically $0 to the field, which is weird, if the field is getting so productive with AI that it doesn't need any workers, anymore

AI is taking jobs from the youngs! (nope, try again)

AI exposed youngs hit hardest

the Olds took yer job (by winning friends and influence)

aging-in-place

At some point, would the real AI winners please stand up

assigning all the value to the builders, and $0 to the field

quantifiable AI benefits and the productivity basket, rising (but not in stock prices)

maybe the buildout is all you need?

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. 👋👋👋Random Walk has been piloting some other initiatives and now would like to hear from broader universe of you:

(1) 🛎️ Schedule a time to chat with me. I want to know what would be valuable to you.

(2) 💡 Find out more about Random Walk Idea Dinners. High-Signal Serendipity.If AI is taking jobs, then where are all the productivity gains?

Two mini-essays on the AI-job-taker (not), and the curious case of the missing AI winners.

AI is taking jobs from the young! (Nope, try again)

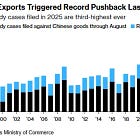

The Dallas Fed published a scary looking chart that might give you the (wrong) impression that AI is taking your job.

Well, not necessarily your job, but a young person’s job, you know, the sort of first job that youngs are having a relatively hard time getting—that’d be the one that AI is taking.

AI exposed youngs hit hardest!

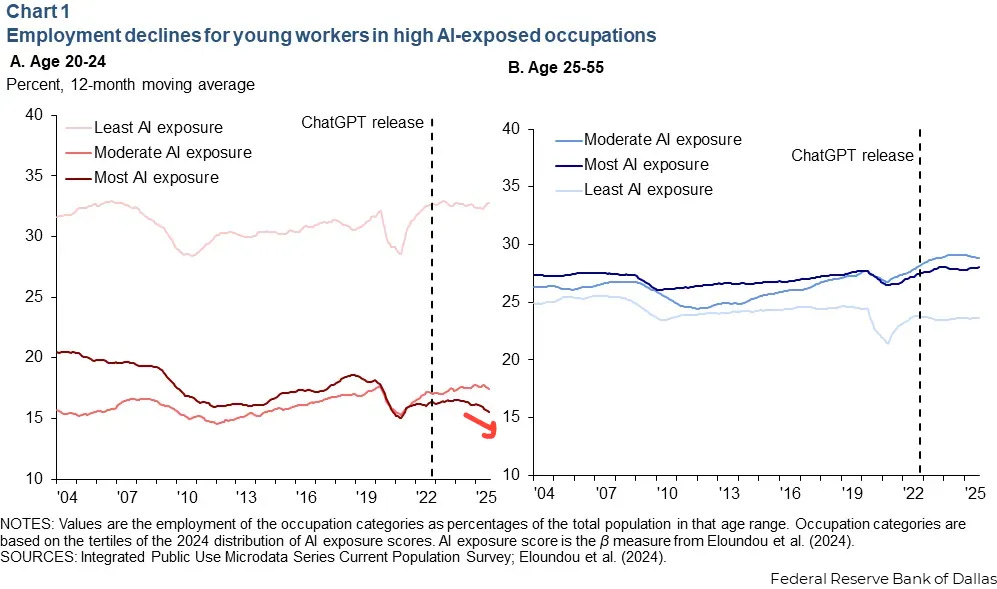

Behold, look at the employment declines for young people in “AI exposed” industries:

Employment declines for 20-24 year-olds are most pronounced in the most “AI exposed” industries.

So you see, no one is hiring junior people because AI can do the work that junior people used to do. That’s why the employment share of the youngs is tipping off a cliff, especially where AI is most applicable.

We told you Random Walk. AI is taking jobs.

Perhaps. But perhaps it’s just a low-hiring environment, which is particularly hard for new-entrants, especially when no one is quitting, either. The labor market has an absorption and/or net-new demand problem. In that case, the young share of the labor market would decline, if there are fewer net-new additions, and everyone else “ages in place.”

Put in those terms, “AI exposed” is just a proxy for the sectors that have taken a relatively tepid approach to net-new hiring, like say, white collar sectors.

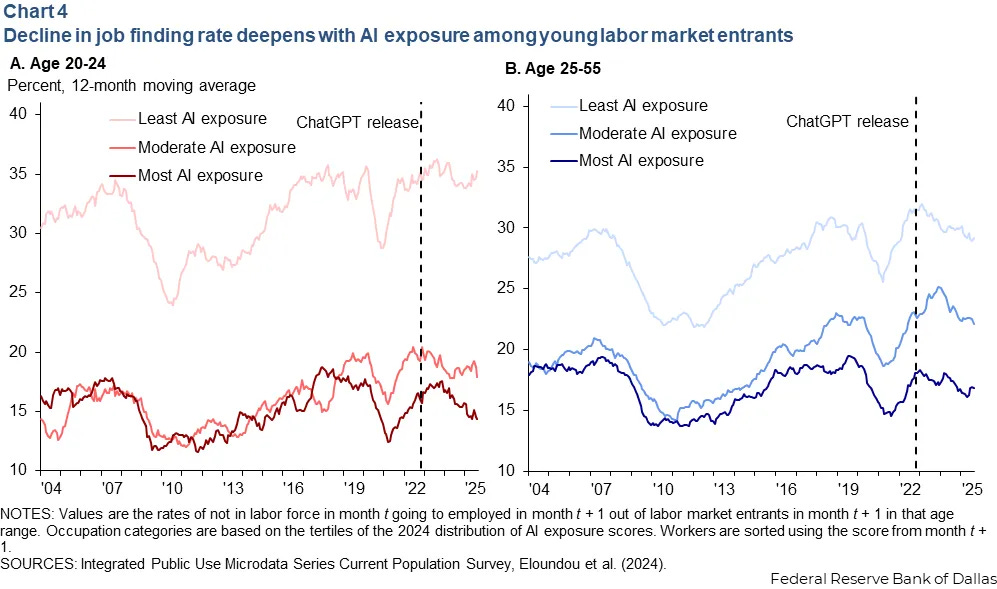

To its credit, the Dallas Fed considers (some version) of that possibility. Take a look at the “job finding rate”:

The job finding rate has declined pretty uniformly across the board, whether 20-24, 25-55, “AI exposed,” or not.

Plus, whatever divergence between “moderate” and “most” AI exposure for the 20-24 yos happened way back in 2019, so it’s not likely to have much to do with AI. Now, you could argue that the gap between “moderate” and “most” has widened recently (solely with respect to the 20-24 yos), but at that point you’re just grasping at straws (and made-up categories for “ai exposure”).

So, once again, there’s basically no evidence that AI is taking anyone’s job.

In the Dallas Fed’s words:

There appears to be lower employment for young workers in occupations with the most exposure to AI, but so far, the aggregate impacts are small and subtle. If all the decline in employment for the young, most AI-exposed workers translated into unemployment, it would be responsible for only a 0.1 percentage point rise in aggregate unemployment since November 2022.

“Aggregate impacts [of AI on jobs] are small and subtle,” which is another way of saying “basically no evidence.”

There is plenty of evidence, however, that demand for new workers is pretty soft across the board, which makes getting one (if you don’t already have one), a tough trick, especially when people are staying on for longer.

The olds took yer job

Here again, Random Walk has theorized that part of the problem is olds staying on longer than before.1

There’s now some more data on that too.

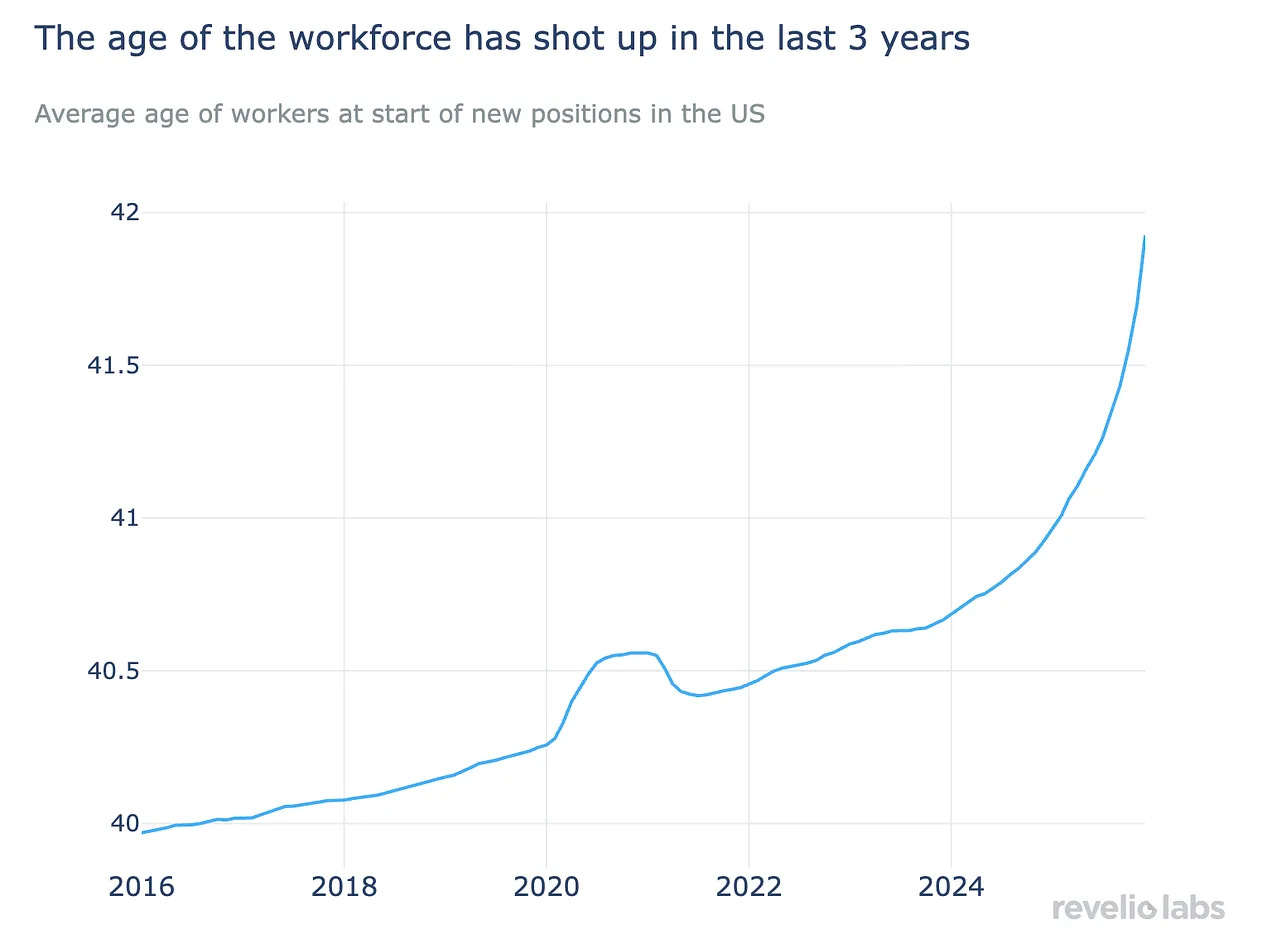

Yes, the age of the work force has gone parabolic recently (which is consistent with the smaller share of youngs flagged above):

The work force has aged by ~2 years since 2024(!)

That’s some fairly rapid aging, indeed.

And, as you can see, while the trend was heading upwards before, it went parabolic (to repeat), fairly recently. That suggests that an aging workforce isn’t just the inevitable shift of an aging population.

Aging in place

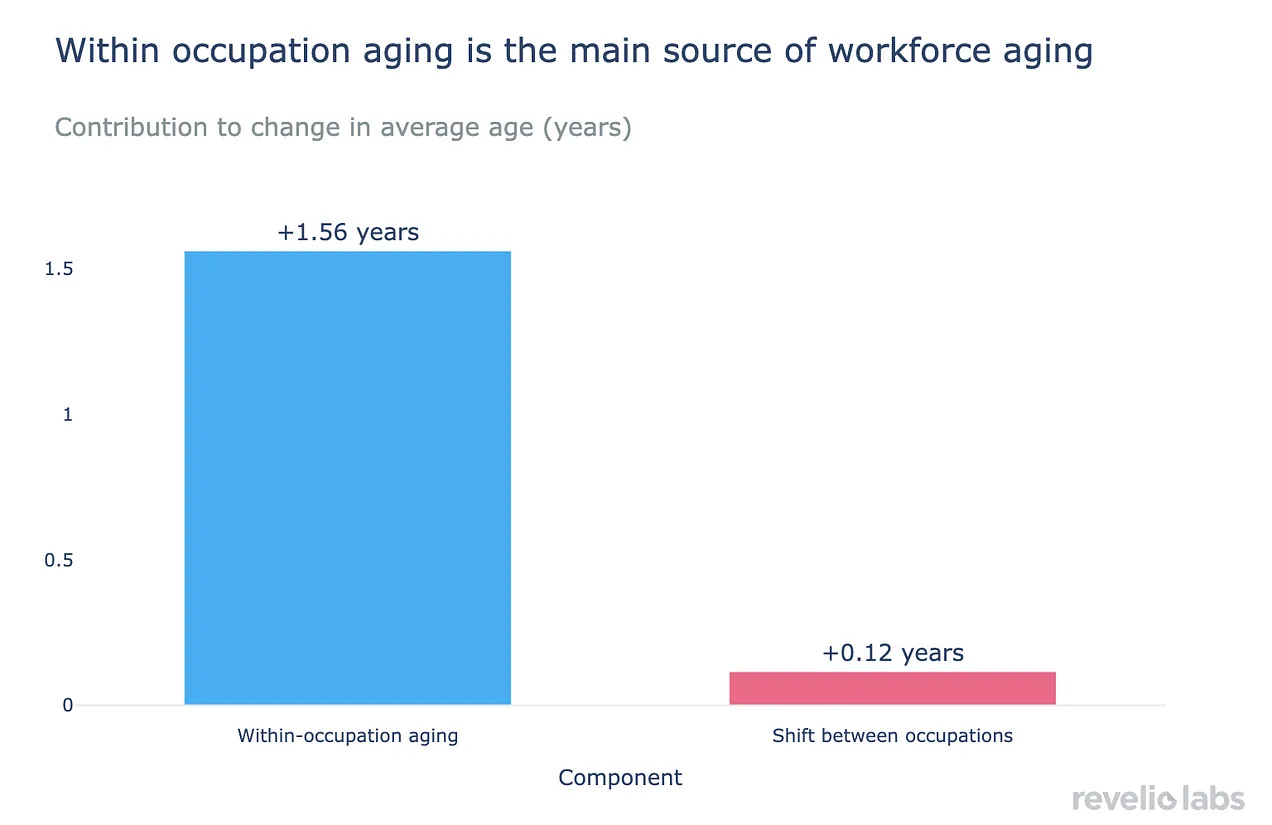

Indeed, the overwhelming majority of the contribution to aging comes from “aging in place.”

“Within occupation aging” has contributed ~1.5 years of the cumulative aging process.

People are staying in their jobs longer, and I would submit that that is making it harder for young people to find their first role.

Not only that, but youngs are competing with retirees getting back into the mix:

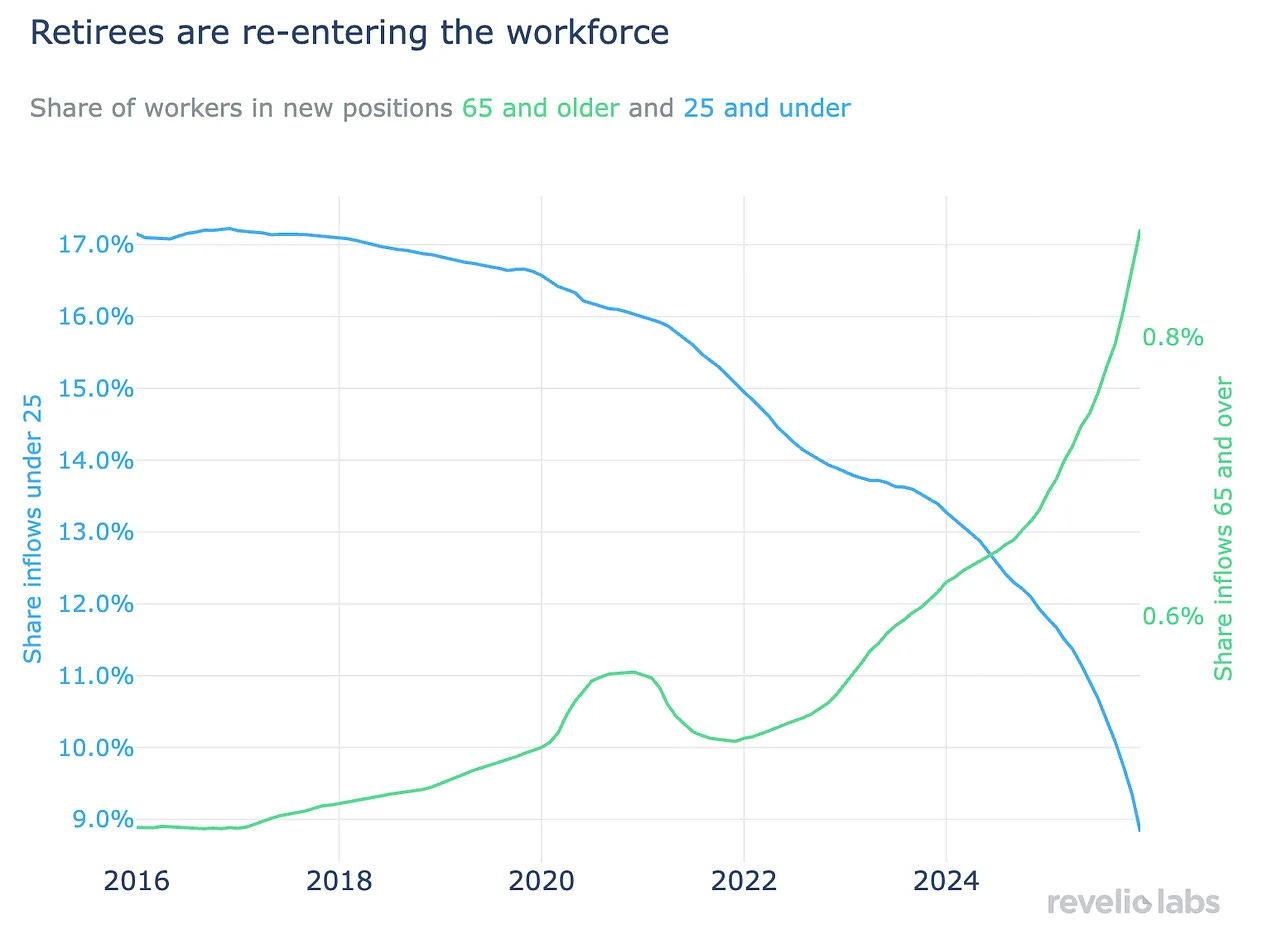

Mind the dual y-axes, but the share of seniors in “new positions” has accelerated recently, while the under-25 share has dropped by ~40% since 2020.

So, youngs are getting it on both ends. Olds are staying in their jobs longer, and they are re-entering the workforce to compete with the youngs.

It’s the friends and influence

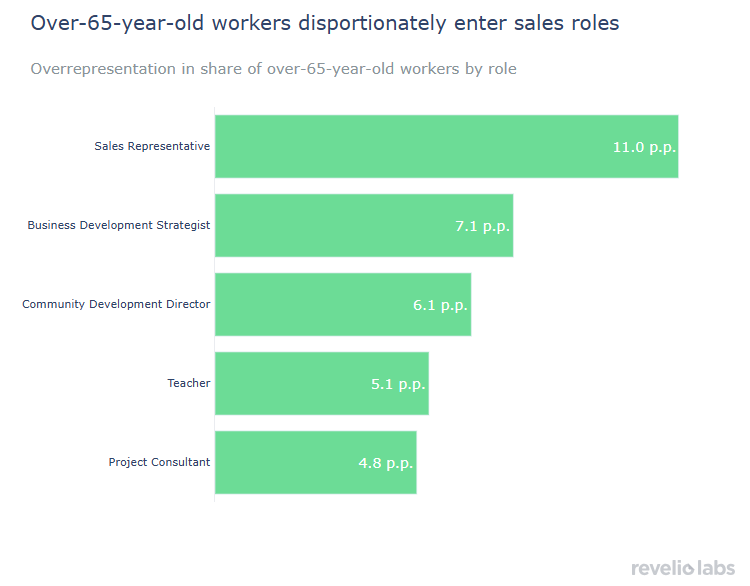

And for a certain kind of role, seniority has an edge. Consider where the olds are oldifying the workforce the most:

Service-intensive and people-facing jobs have aged the fastest since 2015. Service operations, sales representatives, claims adjusters, office assistants, and real estate agents have all seen average ages rise by close to three years. These are roles where accumulated experience, interpersonal skills, and institutional knowledge are central to productivity—and where performance does not depend on keeping up with rapidly changing technical toolkits.

People-facing roles, where people-networks are a plus, are the ones showing a bias towards older folks.

That’s most true of sales roles:

Olds have the highest share of “over-representation” in sales roles, relative to anything else.

That too makes sense.

The thing with sales roles is that they are often commission-heavy, which makes them less risky, from the employer’s standpoint. In other words, in a climate where firms are loath to hire, it’s reasonable to expect that firms would be less-loath to hire where much of the payment is on success, only. And if you were going to take a swing on a someone for a salesguy, why not take a swing on a retiree who has a preexisting professional network?

Will it work? Who knows, but there’s not much risk in finding out.

The oldification of people-facing roles stands in contrast to more technical, screen-facing roles:

By contrast, more technical and analytics-driven roles have aged far less. The average age of data analysts has declined, and systems analysts have only seen modest increases in average age, reflecting the continued importance of formal training pipelines and early-career hiring in these fields.

Data analysts have gotten younger.

If AI was taking jobs, that’s pretty much the opposite sort of thing you’d expect to see. Fortunately, AI is not taking jobs, it would seem.

ICYMI

At some point, the real AI winners will stand up

On the subject of AI taking jobs, the underlying premise is that AI is taking jobs because AI is making firms more productive (and that firms have nothing better to do with that suddenly slack labor resource).

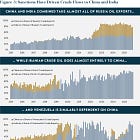

It bears repeating, therefore, that until now, basically all the (easily measurable) “AI gains” have gone to (and are expected to go to) the AI build-out. And not to firms using AI.

Assigning all the value to the builders, and $0 to the field

In other words, however much job-taking-productivity-making AI is supposedly doing, it’s not really showing up in, e.g. margin- or revenue-growth, at least not for anyone that isn’t in the business of making AI and AI-related stuff.2

And (somewhat curiously), investors aren’t even expecting much accelerated revenue- or margin-growth for the rest of the field: