It’s getting cold out there (beyond the GPUs)

A 16 chart check on the Almighty Consumer (who isn't an HVAC specialist), and where the first cut is deepest

real incomes negative for some

‘paycheck to paycheck’

travelling blues (and more reckoning for high-touch services with higher prices and deteriorating quality)

wither high earners?

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. 👋👋👋Random Walk has been piloting some other initiatives and now would like to hear from broader universe of you:

(1) 🛎️ Schedule a time to chat with me. I want to know what would be valuable to you.

(2) 💡 Find out more about Random Walk Idea Dinners. High-Signal Serendipity.It’s getting cold out there (beyond the GPUs)

It’s Nvidia week and AI is cooking, but GPUs can’t carry the entire economy, can they?

I suppose we’re about to find out. There’s not a ton of margin for error, and as of now, things are starting to look just a bit creaky (again).

Real incomes negative (for some)

It’s consensus at this point, but AI is the only pro-cyclical thing we’ve got going on, right now.

That’s really good if you’re anywhere in the broader supply chain of computational capacity, from the rarefied air of advanced lithography to the more “blue collar” (albeit complex) task of installing of gas turbines.

But what about everyone else?

Truthfully, things are a little slow:

Inflation has been running ahead of lower- and middle-income households for the better part of the year.

It’s not a great feeling when prices are rising more quickly wages, and it’s not surprising that the mood is a little edgy.

One note on feelings. Random Walk will never not take an opportunity to remind everyone, however, that “feeling” is pretty much all noise when it comes to actual behavior:

Consumer confidence has basically no relationship with actual spending.

Feelings can be indicative of other things, for sure. And when feelings correspond to actual changes in income, that’s a different story too, but in that case, it’s the incomes that matter, not the feelings.1

Anyways, on the flipside, higher-income households are doing ok. Rather than “wealth effects” (which, like ‘consumer confidence’ are probably mostly fake and besides the point), there are some good old fashioned wage-effects buoying spending at the top.

There are some caveats there too, however (more on that below).

Bigger picture, though, for ~2 years, inflation tracked lower-income wage growth pretty closely, which makes sense, given that the lower-income worker “shortage” was the primary driver of inflation. When the shortage was finally backfilled around Q1-Q2 ‘24, wage growth more or less flattened out (as did inflation), but then in January, lower-income wage growth (and to some extent middle-income wages) appears to have slowed further.

Why did lower- and middle-income wage growth slow? Pick your pet theory, I suppose.

Random Walk suspects it has something to do with the slowdown in new arrivals (and apprehension around hiring the ones already here), which has been a bit of a hit to the demand side of things (that was already normalizing to the somewhat slow status quo ante). Throw in the rising regressive tax of employer-sponsored healthcare, and general apprehension around bottom-lines (and margins), and new warm bodies are just less in demand.2 (Unless, of course, you’re in healthcare or the skilled trades, in which case, come one, come all.)

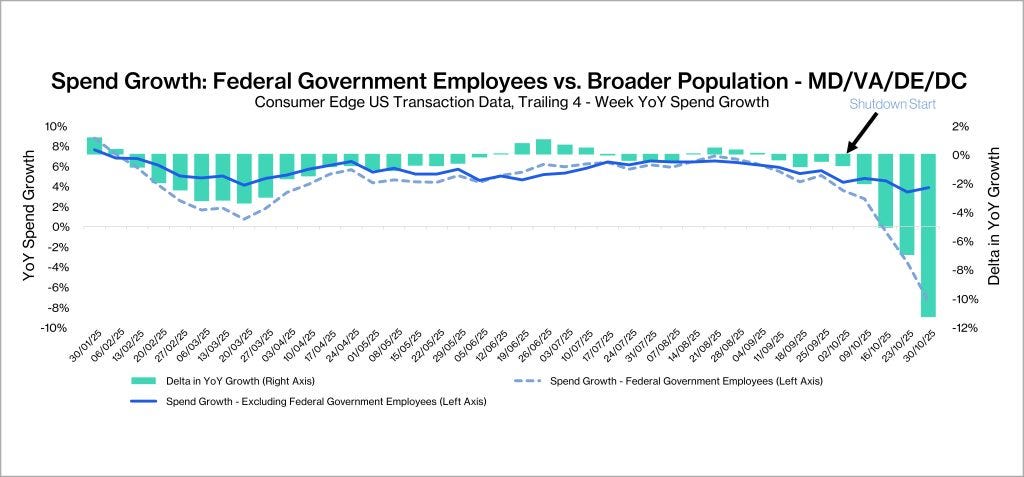

Certainly, the federal shutdown hasn’t helped, and although it’s not that big a deal in the larger scheme of things, it does make for some fine charts:

Federal employees in the DC-extended area have decelerated their spending substantially more than the rest of the population.

But regardless of the reason why, the hiring spree for lower-income workers is over, and when you add some lagging tariff-price-passthroughs, the result is that lower- and middle-income households are experiencing real wage declines, and have been for most of the year.

ICYMI

‘paycheck to paycheck’

Becoming slightly poorer naturally has some side effects.

More households are “living paycheck to paycheck,” defined as “necessity spending in excess of 95% (or 90%) of income”: