The secret to PE exits

A 13-chart mid-dive on the current state of PE

mo’ money, fewer deals

GPs, doing it for themselves

private cos, pretty much ok

PE bro’s pain, is lender-bro’s gain

PIK your poison

the big dawgs are sitting pretty (i.e. returns to operational, financial, and cross-functional scale)

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. 👋👋👋Random Walk has been piloting some other initiatives and now would like to hear from broader universe of you:

(1) 🛎️ Schedule a time to chat with me. I want to know what would be valuable to you.

(2) 💡 Find out more about Random Walk Idea Dinners. High-Signal Serendipity.The secret to PE exits

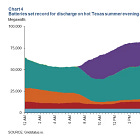

Over on the PE side, there continues to be no ‘great thaw’ of exits.

It’s not all bad, though.

There’s a secret hack for exiting PE assets, if you know what you’re doing: just have an amazing, large, profitable and growing company to sell. The best assets are selling for good prices. It’s just that everything else putters along in an ongoing can-kicking exercise (to the delight of at least some bankers and lenders).

Mo’ money, Fewer Deals

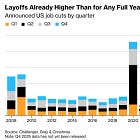

Deal volume was quite high, but it was spread across fewer deals:

Transaction volume was the highest since peak-ZIRP, but transaction count continues to ebb lower.

More money for fewer transactions means there’s a healthy market at the top—the biggest acquirers have money to deploy, and return-starved sellers are happy to divest their most valuable assets.

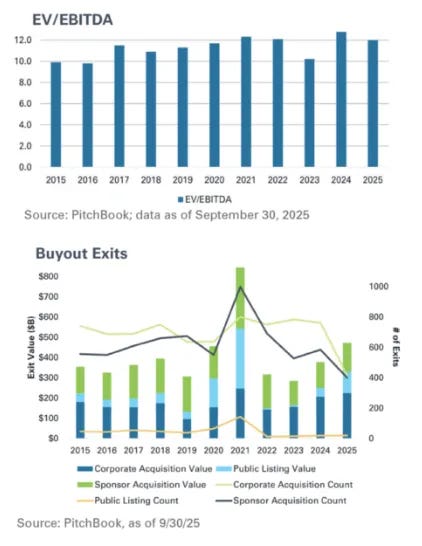

The prices look pretty good too:

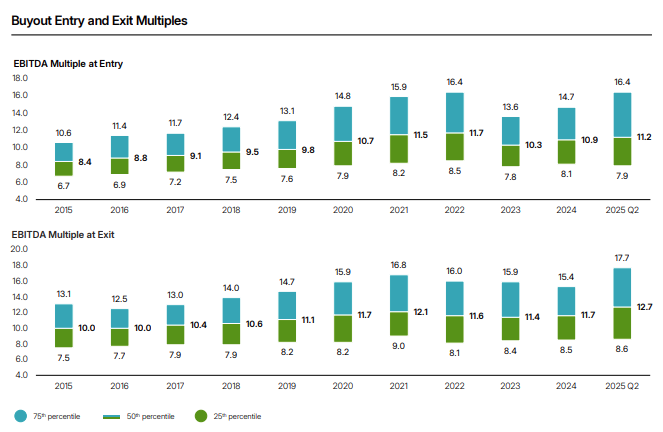

Exit multiples for buyouts are historically high, for both median and highest quartile exits (and entry multiples, ain’t bad either.

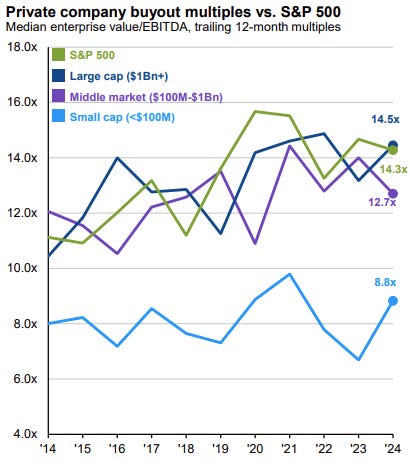

Here’s another cut of prices that’s a bit more dated, but breaks out the trend:

Median multiples are tracking towards the high-end of their range for companies of all sizes.

So exit prices are pretty, pretty good.

It’s not hard to understand what’s going on here. Fewer exits, albeit for bigger dollars and higher prices, screams “positive selection effects.”

As per above, if PE managers have got something to sell, they’re selling it. Everything else continues to ripen on the vine. It’s not really a “flight to quality,” so much as the bid-ask is (still) just too wide.

Ripening isn’t good. To be fair, the situation has improved, and it’s better than a zero, but it means that LPs aren’t getting their money back, and managers aren’t earning their carry. It also means a good chunk of the industry, especially outside of the big bluechip names, remains in something of a holding-pattern.

It’s hard to raise a new fund and acquire new assets, when you’re still managing the fund and assets that you’ve got.

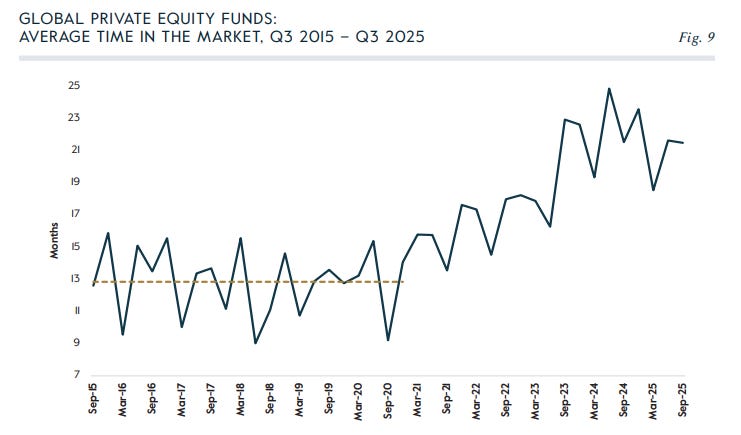

Time-to-raise a PE fund globally is lower than its peak, but is still about a third higher than before times.

The sell-or-hold incentive problem is real and obvious: sure, LPs would like GPs to sell (even at discounts), but then GPs show poor returns, and run the risk of never raising another fund. For most GPs, even a small chance at never raising another fund is far more terrifying than ongoing grumbling from LPs.

And so “hold for now, but better is right around the corner” continues to be the story:

“For much of the past two and a half years, valuation mismatches have represented the greatest obstacle to deal making,” [E&Y’s] Witte said. “As recently as last December, investors cited the valuation gap as the single largest impediment to transactions. Today that barrier has meaningfully receded.”

Two thirds of general partners that EY surveyed recently said that the gap has narrowed, “enabling buyers and sellers to find common ground and move forward with confidence,” he said.

Some 61 percent of participants said the gap has narrowed “moderately,” which Witte told Institutional Investor translates to sellers willing to offer a 5 percent to 10 percent discount on assets “to clear some of this stuff.”

He added that “the market is just getting more active, and it’s unlocking more opportunities to exit some of these companies at reasonable valuations relative to where they expected.”

At the beginning of the year, general partners said that resolving the valuation gap would be the “number one thing that unlocks the deal market. And now here we are nine months later and they say, ‘all right, well, it’s made some progress.’”

He added that GPs are well aware that they’ve been holding some companies for six or seven years and they need to invest in assets that will be “more productive.”

Sure, sure, we’re nearly there . . . just a little bit more time.

But, rest-assured, “GPs are well aware that they’ve been holding” for too long.

ICYMI

GPs doing it for themselves

So, if a fund manager can hold out hope for a better outcome, then it probably will, and so they have.

Of course, in some cases, GPs themselves are increasingly taking matters into their own hands: